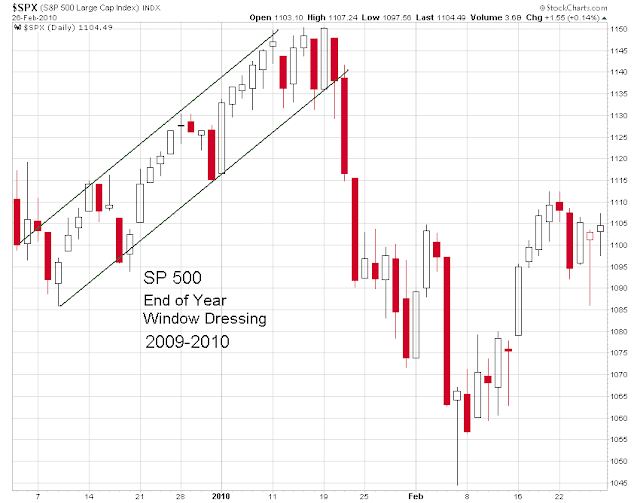

I am keeping an open mind on this year's window dressing cycle as to the extent and the timing.

Wall Street desperately wishes to hand off this bubble to mom and pop and foreign hands, but so far the target victims are reluctant to buy in. The standard script is to keep running it higher while protecting your own risks with derivatives. If your derivatives counterparty fails then you obtain public funds to bail out of your losses. The objective is always the same: the public loses.

The Fed and Wall Street *could* conceivably keep this going as they did in the early cycle of housing bubble, or the tech bubble. Never underestimate the recklessness of desperate men caught up in a fraud of their own design. When the suckers start to question the game, double down and act even more resolutely and boldly. The average person will believe because they do not think people are capable of such obvious and blatant deception, since they are not so free of scruples and conscience. And of course greed is a marvellously effective prescription for silence, rationalization, and self-deception.

They may feign ignorance in Washington, New York and London, but they know, and it serves their purpose. This is a classic fraud, not even elegant or complex, but merely clumsy, an obvious abuse of trust and power. It is as noble and productive as running a protection racket on the neighborhood candy store, and robbing little old ladies for their pension checks.

The only thing that is surprising about Wall Street and the US financial frauds is, as Eliot Spitzer famously observed, their scams and schemes are so simple and so obvious when one can pry back the veil of secrecy and see what is actually being done. Old frauds never go way; they come back endlessly with minor variations and different shades of lipstick.

How obvious and bold can they be? How about this obvious and bold?

Setting Your Watch by the Silver Manipulation - WT

It is called 'running the stops' held by the small specs. It is an old and treasured fraud on the Street, like running up the prices of stocks and then selling them to the public at the top while you quietly exit with your profits and fees.

On the bright side the metals manipulation seems to be faltering, with silver soaring to new highs as the lack of physical metal for delivery impedes the ability for a few banks to endlessly run their paper ponzi scheme of naked shorting and leverage.

All Ponzi schemes end badly, but timing is everything. While there are overleveraged spec shorts to squeeze and pensions to plunder the money printing and tape painting can continue. You will run out of real wealth, assets and freedom before they will run out of ink.