skip to main |

skip to sidebar

Non-Farm Payrolls for March tomorrow.

Its the kind of report where they will be adjusting the raw numbers DOWN for seasonality, so there is plenty of room to fudge the numbers.

Unemployment claims came in higher than expected today.

This has every appearance of a phony, desperate recovery. But that does not mean that they cannot go on trying to 'muddle through' this to the next election.

The overhead resistance levels are around 1450 and 38 respectively, and are being strongly defended by the paper bulls and bullion bears.

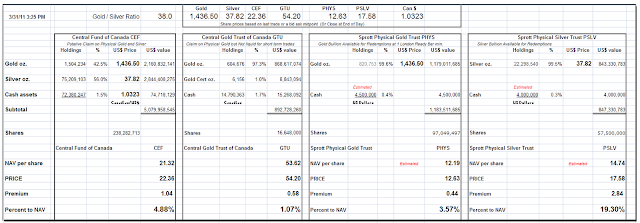

The price of the Central Fund of Canada is likely to remain a bit depressed relative to its NAV and historical averages until their recent additional unit offering is absorbed and the bullion is added to the trust's holdings. The price at which the underwriters obtained their additional shares may act as a short term 'magnet' for the price.

TORONTO, Ontario (March 29, 2011) – Central Fund of Canada Limited (“Central Fund”) of Calgary, Alberta announced today that it plans to offer Class A Shares of Central Fund to the public in Canada (except Québec) and in the United States under its existing U.S.$1,000,000,000 base shelf prospectus dated September 8, 2009 and filed with the securities commissions in each of the provinces and territories of Canada, except Québec, and under the multijurisdictional disclosure system in the United States pursuant to a proposed underwritten offering by CIBC. Central Fund will only proceed with the offering if it is non-dilutive to the net asset value of the Class A Shares owned by the existing Shareholders of Central Fund.

The remaining amount of approximately U.S.$394,295,000 of the original U.S.$1,000,000,000 provided for in the base shelf prospectus is available for this offering. Substantially all of the net proceeds of the offering will be used for gold and silver bullion purchases, in keeping with the asset allocation policies established by the Board of Directors of Central Fund. Any additional capital raised by this offering is expected to assist in reducing the annual expense ratio in favour of the Shareholders of Central Fund...

TORONTO, Ontario (March 30, 2011) - The Central Fund of Canada Limited (“Central Fund”) is pleased to announce that a syndicate of underwriters (the “Underwriters”) led by CIBC have exercised their right to purchase an additional 1,800,000 Class A Shares at a price of U.S.$22.30 per Class A Share, for additional gross proceeds of approximately U.S.$40,000,000 to Central Fund. The Underwriters agreed earlier this morning to purchase 14,350,000 Class A Shares for gross proceeds of approximately U.S.$320,005,000.

The purchase price of U.S.$22.30 per Class A Share is non-dilutive and accretive for the existing Shareholders of Central Fund. The additional net proceeds have been committed to purchase gold and silver bullion for settlement at closing, in keeping with the asset allocation policies established by the Board of Directors of Central Fund. This offering is expected to assist in reducing the annual expense ratio in favour of the Shareholders of Central Fund."

"There is a place. Like no place on Earth. A land full of wonder, mystery, and danger! Some say to survive it: You need to be as mad as a hatter."

End of quarter antics, and of course Obama went before the nation and put forward his plan for US oil independence.

Although he said he wanted to reduce the use of foreign oil by 1/3, he was a bit sketchy on details. Annexing Libya and Iraq?

Natural gas companies caught a bid, and they are getting the oil drilling rigs fitted out for tundra and wetlands.

Blythe threw her best stuff at silver today, to little avail. It looks ready to take another leg up again unless equities fall apart.

If gold breaks through the big neckline this could be impressive.

Non-farm Payrolls on Friday. ADP came in pretty much as expected today.

Given that it was the end of quarter, and the bonuses of the wiseguys are heavily dependent on making their targets, I doubt anything short of Tokyo melting into the Marianas Trench could have stopped a stock market rally today.

And gold and silver must go down to make Ben and Timmy look good, if just for a day.

Speaking of a pliantly available pig belly, I am still trying to regain my equilibrium after reading Greenspan's Op-Ed in the Financial Times on the danger of financial reform and too much banking regulation. It is as if there was a seminar on customer service and proper hair cutting techniques for the trade being given by Sweeney Todd, the demon barber of Fleet Street. Are these people really that tone deaf or just that arrogant? What next, a personal financial advice column by Bernie Madoff?

At long last, Mr. Greenspan, have you no decency, no sense of shame?

And end of quarter rally on light volumes. How unusual -- not.

See the gold and silver post above for general market commentary.

There must have been enough calls taken up yesterday to make it worth the wiseguy's trouble to hit the metals with another bear raid again today. Again, it did not stick as bullion seems to be held in strong hands.

I hate to say this, but the metals are often hit around a Non-Farm Payrolls report, as the Fed and its dealers wish to discourage any flight to safety or inflation hedge thoughts as they print their way to prosperity, mostly theirs.

Very low volumes, and the end of quarter tape painting continues.

Tomorrow we will get the ADP employment report, consensus +210K, and the markets will be eyeing it for some hints about the Non-Farm Payrolls report for March which will be out at the end of the week. Consensus for the NFP is currently +203k for private sector jobs and +185k overall.

I will take a look at the specifics and the seasonals tomorrow.

Stocks are jamming up into this resistance.

This is what is commonly known as an 'intimidation' tactic, a fishing expedition. No need for explanations or probable cause. All perfectly legal. Nice.

The Republican Party of Wisconsin has made an open records request for the emails of a University of Wisconsin professor of history, geography and environmental studies in an apparent response to a blog post the professor wrote about a group called the American Legislative Exchange Council (ALEC).

Professor William J. Cronon, who is the president-elect of the American Historical Association, said in an interview on Friday that the party asked for emails starting Jan. 1.

The request was made by Stephan Thompson of the Republican Party of Wisconsin. In his request, Thompson asked for emails of Cronon's state email account which "reference any of the following terms: Republican, Scott Walker, recall, collective bargaining, AFSCME, WEAC, rally, union, Alberta Darling, Randy Hopper, Dan Kapanke, Rob Cowles, Scott Fitzgerald, Sheila Harsdorf, Luther Olsen, Glenn Grothman, Mary Lazich, Jeff Fitzgerald, Marty Beil, or Mary Bell."

Most of the names are Republican legislators. Marty Beil is the head of the Wisconsin State Employees Union and Mary Bell is the head of the Wisconsin Education Association Council.

Thompson was not immediately available for comment.

Bloggers Beware (If You Work at a State University in Wisconsin)

Dirty stuff really, but considering some of the advice these guys have come up with recently about false flag operations, dirty tricks, and physical violence as public policy it is not all that surprising. They could also have the State Police search his car each day as he leaves the parking lot to make sure he has not taken any state property, such as pencils or pads of paper. Who knows what they might find along the way?

Even if nothing ever turns up, there is potential upside. A former Wisconsin Republican made a great national career out of using this sort of political tactic, and endless investigations into anyone he deemed worthy of suspicion, who disagreed with him, capturing the atteniton of the public for a quite a few years: Joe McCarthy.

"Have you no sense of decency?" No they don't.

On the other hand, this *could* set up an interesting precedent and become a trend. The possibilities are almost endless.

I am wondering if we can put forward a Freedom of Information Request for the emails of high level SEC employees that contain any of the following words: "teen" "horny" "nude" "epic" "erotic" "babe" "MILF" "VIP" "consultant" "interview" "signing bonus" and "Blankfein."

It might be several terabytes of data, but it could be a good read on a cold winter's night.

And I shiver in anticipation of a broad search on the emails of the CFTC: "silver" "gold" "position limit" "JPM" "Summers" "GATA" and "Blythe"

We could have an eBay type auction or a British style betting pool for the most popular search words for Obama's emails to help raise funds for Social Security. I predict a bull market in 'birth certificate,' 'oil,' and 'Hillary.'

Bread and circuses. And Ben and Timmy are the clowns. But two guesses on who is going to clean up after the elephants.

Good night, and good luck.

"We have enjoyed so much freedom for so long that we are perhaps in danger of forgetting how much blood it cost to establish the Bill of Rights." Justice Felix Frankfurter

"Skillful accumulation is what my observation has been telling me as well. this market is trading just like I used to try and trade illiquid junk bond names that I was trying to buy - hit the market's bid side for a bit and try to shake out sellers and fill in with your own bid...feels like that's what's happening out there right now."

Denver Dave

It was option expiration on the Comex today and they hit the metals again hard, but earlier than usual.

My friend Dave made that comment above early this morning, and I thought he was right. This was not so much a real bear raid as a chance to skin the naive amongst the options traders and holders of miners and funds, and then cover shorts and get a little long.

They keep hitting the miners, probably taking gains there in addition to what they can wring out of the metal itself.

If you have to ask how and if I traded this today, then you have not been following the action. Buy strength, sell weakness, while the trend remains intact. I did add shorts on the stock indices near the top of the day at resistance as insurance, as I was picking up a few miners and higher volatility things in addition to bullion. I have an open mind on the stocks, but think it will take a 'trigger event' to really bring them down in a serious correction.

I liked the early hit, as it gave me time to go out and buy some fresh vegetables and fish. My wife usually does all the shopping but she is not feeling so well. She does scrutinize all my purchases carefully however, especially the prices paid. And if I have paid too much, oi yoi!

I do not now how many calls actually translated into new futures positions, but if there are enough it is traditional for Blythe and crew to give them at least one more 'gut check' before letting the markets return to their natural trend, whatever that might be.

As a reminder, the US will report its Non-Farm Payrolls for March on Friday April 1. The metals are typically hit on such occasion as well. We are also ending the first quarter. It could be an interesting week with quite a few cross currents.

I had an interview with Chris Martenson and it is now available here.

Weak buying from the technical trade caused stocks to rise most of the day, but a definite lack of legitimate retail and institutional buyers, indicated by low volumes, caused equities to sell off into the close, as the momentum players went flat and hit the exits.

Nothing is really broken yet support wise, but the news from Japan and the Middle East remains a drag on the stock optimists.

Europe is troubling, and although it seems to be largely in la-la land, the States are probably heading for a long, hot summer.

Timmy and Ben are under this market. Whether that will be enough is hard to say. It depends on what happens.

There is some thought that if the correction does not materialize by the end of the second quarter in June, that there will be a summer rally as fund managers sitting on the sidelines scramble to catch up.

It might be more likely that they will be sucked in first, and then taken for a ride by the hellhounds of Wall Street. The market will let us know which scenario unfolds.

The Wall Street Journal has a story that points out the dangers of ownership of the industry which they are charged to regulate.

TOKYO—Japan's nuclear regulator has amassed power while growing closer to the industry it regulates, according to former regulators and industry critics who blame the trend for lapses that may have contributed to the Fukushima Daiichi accident.

Bucking the global standard, Japan's Ministry of Economy, Trade and Industry has two distinct and often competing roles: regulating the nuclear power industry, and promoting Japanese nuclear technology at home and abroad.

The setup recalls U.S. regulation of offshore drilling before last year's oil spill in the Gulf of Mexico, in which the same agency regulated the industry and promoted offshore oil-and- gas development.

Nuclear Regulator Tied to Industry

In the States, the most powerful banking regulator is the the Fed, which is essentially OWNED by the industry which it purports to regulate. And the last time I looked, the WSJ was part of the choir singing the praises of self regulation of the various segments of the financial sector, taking every opportunity to undermine independent regulation.

And they probably do not get it. You just have to laugh at this kind of irony.

Well, derivatives are a bit like radiation, something resembling a neutron bomb. They kill off the life in a society, while leaving the buildings intact.

Speaking of the extended analogy, Radioactivity 100,000 Times Normal at Fukushima Reactor 2. The good news is that it is not 10 million times normal as reported by TEPCO earlier today.

Reminds one of the recent report on the US banks by the Fed.

There will be a sustainable recovery in the US when the median wage recovers in relation to inflation and consumer necessities, and the employment-population ratio rises to some reasonable equilibrium.

A rising employment-population ratio itself is no sign of recovery, if consumers must continue to rely on debt to finance their basic necessities. Conservsely, a falling employment-population ratio can be constructive if it is driven by a vibrant median wage, increasing industrial productivity, and excess income as savings, allowing for retirements and more people devoted to non formal employment such as charitable activities, parenting, artistic expression, and elder care, for example. The point is that these measure are not one-dimensional.

As shown by the median wage below, the 'recovery' engineered by the Fed in the aftermath of the tech bubble they created was artificial and totally supported by credit creation and a bubble in housing, with enormous amounts siphoned off the top in the form of financial fraud and corruption.

The basic economic problem in the US economy is related to international trade, currency manipulation, public policy and wage arbitrage by multinational corporations. 'Free trade' interacts with public standards of health, worker compensation, environmental, child labor, and the entire structure of public standards.

Therefore the solution is not amenable to straightforward Keynesian stimulus. This is no cyclical contraction.

It has its roots in the conflict between 'free trade' amongst nations with different standards towards their workers, and various forms of governance. A democratic republic and a autocratic dictatorship do not have the same public policies and attitudes towards the individual and their rights vis a vis the state. How then can free trade reconcile fair wages with what is by comparison virtual slavery? These are the economics of 'the camps' and the plantations, a familiar attraction for the monied interests who have an abiding love of monopolies and oligarchies.

And of course the unspoken problem in the US is the pervasive corruption in and overweighting of the financial sector in relation to the productive economy even today after so-called reforms.

On another note, there is renewed discussion of 'Modern Monetary Theory,' and some have asked me again to address this, as I have done previously. I have only this to add.

I see no inherent problem with the direct issuance of non-debt backed currency as there is sufficient evidence that it can 'work.' Indeed, my own Jacksonian bias toward central banking would suggest that.

I think the notion that the Fed is some objective judge of what is best for the public welfare without effective oversight or restraint is anti-democratic and probably un-Constitutional, at least in spirit, as it has been implemented. And this notion that the FED and the discipline of the interest markets could reliably emulate an external restraint on excessive money creation is deeply flawed.

The problem becomes then how to implement a fiat currency without the discipline of issuing debt through private markets.

This is the important point that most MMT adherents seem to ignore, but it is their greatest area of strength.

One cannot print money at will. The limitation is always and everywhere the willingness of the markets to accept it in exchange for labor and real goods without coercion. To make counter claims is to undermine your own position.

It is a tautology to say that a state that controls its own fiat currency cannot become insolvent in that currency, since they can never lack that which they can create from nothing. The state does not run out of its currency, rather, it runs out of people who will accept it at the official face value.

I would stipulate that central currency issuers can attempt to set arbitrary values, and to enforce them through things like official valuation and wage and price controls. Indeed, practical experience seems to indeed they inevitably must and will become increasingly draconian in their central planning. Dictatorships generally embrace fiat monetary systems without external discipline as policy, but rarely is this a sign of a vibrant economy or a government that respects the individual's rights to just recompense for goods and labor.

The problem with limitless issuance would first appear with necessities that the state must acquire externally, that is, outside their direct sphere of political control. In the case of the United States, for example, oil comes to mind.

I am not suggesting a retur to a gold or silver monetary standard, for that too has its weaknesses and is no panacea. But rather, I am addressing the particular overstatements being made by those who promote the Fed, and those who promote the Treasury, as infallible arbiters of monetary value.

Transparency, oversight, checks and balances are the inherent genius of of the Constitution, and anything that weakens those pillers undermines the democratic Republic.

Most fiat currencies inevitably fail, without regard to their particular mechanisms, because of the weakness and corruption of the people who manage them. This the hard truth that no amount of accounting gimmicks and Utopian central planning can overcome. Such schemes spawn tyranny from their nature, since like a Ponzi scheme they require an ever expanding sphere of absolute control over the daily transactions of the public.

If the inherent evil contained in the concentration of power in a few hands in your concern, then Modern Monetary Theory does not seem to be a viable solution, replacing the Fed with the Treasury, and potentially one form of monetary tyranny with another.

Someone brought this to my attention, as I had not heard of it. It is not so much what they are doing, but why now?

With recovery supposedly at hand, and the financial crisis over thanks to Ben and Timmy, I wonder why they would enact unlimited FDIC coverage for what sounds like checking accounts and commercial clearing accounts.

The only thing that occurred to me was that in the event of a bank run, it might be intended to prevent another short term credit seizure such as was experienced in the financial crisis.

But why now? And why use FDIC to do take on this unlimited liability, far in excess of what it was intended to do? I doubt very much that this is designed to protect individuals per se, given the exclusions.

Curious. Perhaps I am missing something here.

Temporary Unlimited Coverage for Noninterest-bearing Transaction Accounts - FDIC

From December 31, 2010 through December 31, 2012, all noninterest-bearing transaction accounts are fully insured, regardless of the balance of the account and the ownership capacity of the funds. This coverage is available to all depositors, including consumers, businesses, and government entities. The unlimited coverage is separate from, and in addition to, the insurance coverage provided for a depositor’s other accounts held at an FDIC-insured bank.

A noninterest-bearing transaction account is a deposit account where:

interest is neither accrued nor paid;

depositors are permitted to make an unlimited number of transfers and withdrawals; and

the bank does not reserve the right to require advance notice of an intended withdrawal.

Note: Money Market Deposit Accounts (MMDAs) and Negotiable Order of Withdrawal (NOW) accounts are not eligible for this temporary unlimited insurance coverage, regardless of the interest rate, even if no interest is paid. (lol)

Later - here is an old description that probably fits the bill:

"The FDIC's action is one aspect of its Temporary Liquidity Guarantee Program (TLGP). The full account coverage is aimed primarily at business accounts that need to keep larger balances for covering payrolls and meeting other business needs, but it extends to all non-interest-bearing transaction accounts, whether they are held by businesses or by individuals and households. The FDIC's goal is to help depository institutions retain such accounts, giving small and medium size businesses a reason to keep their balances with their current financial institutions. That would help the institutions maintain their liquidity, and thus enhance their ability to make loans."

Unlimited FDIC Coverage for Checking Accounts - Banking Questions

So it is a measure to prevent another seizure in the credit system in the event of a major bank failure triggering a financial crisis. Do you think it covered JPM's $22 billion bridge loan to AT&T for its purchase of T-Mobile?

Do you think Goldman has a program to sweep all of their funds and their partners' personal money into accounts such as this at the first sign of trouble? Just as GE pays no taxes, expect Wall Street to take no pain, in the very troubles which they have caused.

As an aside, I would have used the FDIC and the government to backstop 100% of all customer money in the banking crisis, and let the banks themselves go through a debt reorganization, taking the executives, bondholders and shareholders to the woodshed, in the manner in which Sweden had dealt with its banking troubles. In the US, UK, and Ireland we saw the opposite approach: save the banks, and the people be damned.

But then again, I am not a major contributor to the campaign coffers of Washington, nor a member of the old boy network, and chances are, neither are you. So there you are.

As bad as this has been, if you think the worst is over you are probably just being wishful, maybe a little naive. There is still some meat on your bones, and the wolves are insatiable.

AGI News

IMF TO SET UP 580 BILLION DOLLAR ANTICRISIS FUND

Chiudi 09:45 25 MAR 2011

(AGI) Washington - The International Monetary Fund will set up, next week, a 580 billion Dollar anticrisis fund. "The greatest concern is the risk of contagion from Portugal," says a well informed source. IMF's top officer, Dominique Strauss-Kahn, will issue the fund, on the basis of the ratification announced on March 11 by the Nab (New Arrangement to Borrow). Last year, the Nab increased 10 times its initial 53 billion Dollars, thanks to the 13 new member countries.

"As it was in the days of Noah, so shall it be with the coming of the Son of man. In the days before the flood, they were eating and drinking, marrying and being given in marriage, even to that very day in which Noah entered into the ark. They did not suspect what was happening until the flood came and swept them all away. So shall the coming of the Son of man also be...Watch therefore, because you do not know at what hour your Lord will come." Matt 24:37-42

"For our struggle is not against flesh and blood, but against the rulers, against the authorities, against the powers of this dark world and against the spiritual forces of evil in the heavenly realms. Therefore put on the full armor of God, so that when the day of evil comes, you may be able to stand your ground, and after you have done everything, to stand." Eph 6:12-13

"Surely, there is at this day a confederacy of evil, marshalling its hosts from all parts of the world, organizing itself, taking its measures, enclosing the Church of Christ as in a net, and preparing the way for a general Apostasy from it. Whether this very Apostasy is to give birth to Antichrist, or whether he is still to be delayed, as he has already been delayed so long, we cannot know; but at any rate this Apostasy, and all its tokens and instruments, are of the Evil One, and savour of death.

Far be it from any of us to be of those simple ones who are taken in that snare which is circling around us! Far be it from us to be seduced with the fair promises in which Satan is sure to hide his poison!

Do you think he is so unskilful in his craft, as to ask you openly and plainly to join him in his warfare against the Truth? No; he offers you baits to tempt you. He promises you civil liberty; he promises you equality; he promises you trade and wealth; he promises you a remission of taxes; he promises you reform.

This is the way in which he conceals from you the kind of work to which he is putting you; he tempts you to rail against your rulers and superiors; he does so himself, and induces you to imitate him; or he promises you illumination, he offers you knowledge, science, philosophy, enlargement of mind.

He scoffs at times gone by; he scoffs at every institution which reveres them. He prompts you what to say, and then listens to you, and praises you, and encourages you. He bids you mount aloft. He shows you how to become as gods.

Then he laughs and jokes with you, and gets intimate with you; he takes your hand, and gets his fingers between yours, and grasps them, and then you are his."

J.H.Newman, The Times of AntiChrist, 1890

March 24, 2011-- "There is only one certainty regarding paper money -- the longer you hold it, the less it will buy in terms of real goods or real money -- gold." Richard Russell.

A late day raid on price, again after Europe went home for dinner. It happened at roughly the same time as it did yesterday, but it really did not do so much, and actually failed rather badly in silver.

Next week should be interesting. I do not know what it is going to take to move gold over that neckline in the big inverse head and shoulders formation, or how long it might take. But I suspect strongly that when it does break out we will see another fast move higher, because so many in the markets are not positioned for it. After at least one serious 'gut check' on the longs, gold will most likely move fairly quickly to 1590.

Depending on what happens, I will not be surprised to see gold hitting $2,000 by year end. What concerns me is the potential for a deflationary event this year with another stock market collapse. This will not be a true deflation, but a liquidation panic, that will set up the next round of monetization and a further deterioration of the social fabric.

There is an obvious push from some of the developed countries to enlarge the wars in the Middle East and Asia, from Libya to Afghanistan. This is all about oil, and Keynesian militarism which is the last refuge of corruption in a failing empire.

Stocks opened brightly on the slightly 'better than expected' US GDP revision of the fourth quarter to 3.1%, but it really is moot at this point at the end of the first quarter.

Fukushima weighed on the markets, as it now unfolds that the situation is worse than TEPCO and the government had allowed, with a probable reactor breach unleashing more dangerous radioactive fallout over a wider area.

More later...

I do not seem to be hearing this same level of detailed information on the financial news networks anymore. I do not watch network televised news at all, so it could be covered there.

Apparently I am not the only one who feels this way.

Lack of Data from Japan Distresses Nuclear Experts - LA Times

The stock touts on bubblevision are busily promoting blue skies and rainbows ahead of the weekend. Nothing to see here, move along. Just send in your money, and we can have endless prosperity. Or at least some can.

As in the US, the public will be paying for the mess created by corporate greed and negligence: Cleanup Costs To Be Born By Japan Taxpayers

New Scientist

Fukushima radioactive fallout nears Chernobyl levels

By Debora MacKenzie

24 March 2011

Japan's damaged nuclear plant in Fukushima has been emitting radioactive iodine and caesium at levels approaching those seen in the aftermath of the Chernobyl accident in 1986. Austrian researchers have used a worldwide network of radiation detectors – designed to spot clandestine nuclear bomb tests – to show that iodine-131 is being released at daily levels 73 per cent of those seen after the 1986 disaster. The daily amount of caesium-137 released from Fukushima Daiichi is around 60 per cent of the amount released from Chernobyl.

The difference between this accident and Chernobyl, they say, is that at Chernobyl a huge fire released large amounts of many radioactive materials, including fuel particles, in smoke. At Fukushima Daiichi, only the volatile elements, such as iodine and caesium, are bubbling off the damaged fuel. But these substances could nevertheless pose a significant health risk outside the plant.

The organisation set up to verify the Comprehensive Nuclear-Test-Ban Treaty (CTBT) has a global network of air samplers that monitor and trace the origin of around a dozen radionuclides, the radioactive elements released by atomic bomb blasts – and nuclear accidents. These measurements can be combined with wind observations to track where the radionuclides come from, and how much was released.

The level of radionuclides leaking from Fukushima Daiichi has been unclear, but the CTBT air samplers can shed some light, says Gerhard Wotawa of Austria's Central Institute for Meteorology and Geodynamics in Vienna.

For the first two days after the accident, the wind blew east from Fukushima towards monitoring stations on the US west coast; on the third day it blew south-west over the Japanese monitoring station at Takasaki, then swung east again. Each day, readings for iodine-131 at Sacramento in California, or at Takasaki, both suggested the same amount of iodine was coming out of Fukushima, says Wotawa: 1.2 to 1.3 × 1017 becquerels per day.

The agreement between the two "makes us confident that this is accurate", he says. So do similar readings at CTBT stations in Alaska, Hawaii and Montreal, Canada – readings at the latter, at least, show that the emissions have continued.

In the 10 days it burned, Chernobyl put out 1.76 × 1018 becquerels of iodine-131, which amounts to only 50 per cent more per day than has been calculated for Fukushima Daiichi. It is not yet clear how long emissions from the Japanese plant will continue.

Similarly, says Wotawa, caesium-137 emissions are on the same order of magnitude as at Chernobyl. The Sacramento readings suggest it has emitted 5 × 1015 becquerels of caesium-137 per day; Chernobyl put out 8.5 × 1016 in total – around 70 per cent more per day.

"This is not surprising," says Wotawa. "When the fuel is damaged there is no reason for the volatile elements not to escape," and the measured caesium and iodine are in the right ratios for the fuel used by the Fukushima Daiichi reactors. Also, the Fukushima plant has around 1760 tonnes of fresh and used nuclear fuel on site, and an unknown amount has been damaged. The Chernobyl reactor had only 180 tonnes.

The amounts being released, he says, are "entirely consistent" with the relatively low amounts of caesium and iodine being measured in soil, plants and water in Japan, because so much has blown out to sea. The amounts crossing the Pacific to places like Sacramento are vanishingly small – they were detected there because the CTBT network is designed to sniff out the tiniest traces.

Dangerous isotopes

The Chernobyl accident emitted much more radioactivity and a wider diversity of radioactive elements than Fukushima Daiichi has so far, but it was iodine and caesium that caused most of the health risk – especially outside the immediate area of the Chernobyl plant, says Malcolm Crick, secretary of a United Nations body that has just reviewed the health effects of Chernobyl. Unlike other elements, he says, they were carried far and wide by the wind.

Moreover the human body absorbs iodine and caesium readily. "Essentially all the iodine or caesium inhaled or swallowed crosses into the blood," says Keith Baverstock, former head of radiation protection for the World Health Organization's European office, who has studied Chernobyl's health effects.

Iodine is rapidly absorbed by the thyroid, and leaves only as it decays radioactively, with a half-life of eight days. Caesium is absorbed by muscles, where its half-life of 30 years means that it remains until it is excreted by the body. It takes between 10 and 100 days to excrete half of what has been consumed.

While in the body the isotopes' radioactive emissions can do significant damage, mainly to DNA. Children who ingest iodine-131 can develop thyroid cancer 10 or more years later; adults seem relatively resistant. A study published in the US last week found that iodine-131 from Chernobyl is still causing new cases of thyroid cancer to appear at an undiminished rate in the most heavily affected regions of Ukraine, Belarus and Russia.

Caesium-137 lingers in the environment because of its long half-life. Researchers are divided over how much damage environmental exposure to low doses has done since Chernobyl. Some researchers think it could still cause thousands of new cases of cancer across Europe.

On Tuesday I wrote:

"Since option expiry is on Monday the 28th, I would expect Blythe to throw some cards on the table and at least take a run at this rally. If it comes it will be in thin trading and likely into the weekend."

Yesterday in an intraday commentary I said:

"Gold is right up against the big inverse head and shoulders neckline around 1440. I am struggling to see a breakout here, but it is possible. The last big neckline breakout took place around a failed option expiration gambit... I take profits, holding bullion but trading paper, and retire to the kitchen for the evening trade."

So gold and silver ran higher today, and then suffered a savage bear raid in the late trade in New York, before Asia wakens, and while the European are eating their dinners. The CME announced they would be raising margin requirements again on Friday.

Let's see if Blythe can follow through with this tomorrow. I was a little surprised that they made their move today, especially with the news from Portugal, and especially so blatant an intervention. But the financial and political communities in the US are riding high, in the euphoria that comes with self-serving schemes going well, just before their downfall.

"I have no spur

To prick the sides of my intent, but only

Vaulting ambition, which o'erleaps itself,

And falls on th'other. . . ."

Macbeth Act 1, scene 7. 25–28

It seems to be this way, doesn't it, this pride just before a fall? One has to wonder if it is merely bravado, or if supposedly educated people can be that willfully arrogant and ignorant of the consequences of their actions. And then faced with failure, pride takes the next step, madness is unleashed, and tragedy begins.

"We can never be gods, after all. But we can become something less than human with frightening ease."

N.K. Jemisin

I did come back into the market near the end of the US trading day, buying gold and silver and shorting broad equities in a paired trade, but lightly for now. I want to see what Blythe has left for Act II of this opera buffa.

Blythe Calls Forth Hell's Fire and Vengance on the Silver Bulls

Der Hölle Rache kocht in meinem Herzen,

Tod und Verzweiflung flammet um mich her!

fühlt nicht durch dich Sarastro Todesschmerzen,

so bist du meine Tochter nimmermehr.

Verstoßen sei auf ewig,

verlassen sei auf ewig,

zertrümmert sei'n auf ewig

alle Bande der Natur

wenn nicht durch dich Sarastro wird erblassen!

Hört, Rachegötter, hört der Mutter Schwur!

W.A. Mozart, Die Zauberflöte

When the Wall Street liquidity addicts get their daily fix from Bernanke, they can ignore the news from Portugal on sovereign debt default, and the other ominous warning signs in the financial and political systems.

It's a cynical game, in the vein of the financial fraud that has replaced an efficient capital allocation system in the US.

You will not hear economists talk about this problem, just as they did not discuss the pervasive fraud in the mortgage backed securities market before it caused a financial collapse. It is safer to explain what just happened after it is completely obvious to everyone, over and done. And yet they still call for the same old remedies, of either stimulus or tax cuts for trickle down effects, both pointless options when the system is broken.

The Fed and the Treasury think they can support the economy by keeping the stock market up. The wiseguys on Wall Street will continue to encourage and take advantage this policy error, transferring the wealth generated by debasing the public money into their own pockets, while the regulators are paid to look the other way. It is very remniscent of the failing Soviet empire and the rise of the oligarchs.

That is what is happening now. This is why gold and silver continue to rise despite the best efforts of the financial engineers to halt this 'alarm system.'

There is a day coming in the not too distant future when many will realize the situation as it really is, and then there will be a panic.

I think there is a good chance of a 15 to 20% correction in US equities sometime between now and the end of July. I am not at all sure of the timing, in part because the Fed is adding enormous amounts of liquidity which seeks out beta, AND the volumes remain light, so this liquidity can do its work in a relatively straightfoward manner.

But as with all sugar high bubbles, this one is going to pop. We are in bubble territory, so a trigger event is able to quickly deflate the stock indices. The higher stocks go, the less of a trigger event will be required. It could also come as a series of event that together bear enough weight to shake the Fed's policy errors back to some more realistic base level.

Most of the economic discussion I read is either complete book-talking puffery, or naively pedantic. I wonder how many bubbles it will take before this Ancien Régime of crony capitalism is overthrown, and how difficult this transition might be.

Gold and silver moved higher today, and are both up against overhead resistance.

Intraday commentary here.

I seem to recall saying that the Yen intervention by the G7 was not so much for the Japanese and their rebuilding as it was for the benefit of the financial global carry trade. Et, la voila.

Yen action sets scene for return of carry trade - FT

Gold is right up against the big inverse head and shoulders neckline around 1440.

I am struggling to see a breakout here, but it is possible. The last big neckline breakout took place around a failed option expiration gambit.

Maybe Jamie is too preoccupied with the largest unsecured, non-syndicated bank loan every (to AT&T as a bridge loan to buy T-Mobile) to worry about Blythe's capital needs.

I think this AT&T acquisition, and its very rich price, is indicative of what is wrong with the US economy. Money is being generated and held by fewer hands who continue to use it to consolidate their economic and political power.

But these things ebb and flow. The mighty sow their own destruction in their excesses and their overreach. The reign godless as if triumphant, until they fall back upon their knees. It can be a curse or a blessing, to see the true face of that which you serve.

I take profits, holding bullion but trading paper, and retire to the kitchen for the evening trade.

The appetites and customers seem unchanging, but there is always something a little different on the menu if you look carefully. And over long periods of time, tastes and fashions will change back and forth, but the basic ingredients remain the same.

"Money is gold, and nothing else." J. Pierpont Morgan

Since option expiry is on Monday the 28th, I would expect Blythe to throw some cards on the table and at least take a run at this rally. If it comes it will be in thin trading and likely into the weekend.

The gold/silver ratio is cracking 40 again. It could eventually go back to 16:1 which has historical precedent.

Keeping the Shell Game Going Department

JPM Becomes a Self-Licensed Vault/WeighMaster/Assayer For the NYMEX/COMEX

Makes it easier to move the bullion between the COMEX and SLV? lol

Good one, Baba Yaga.

Adobe came out after the close and cut forecasts in light of slumping sales, which they attribute to Japan.

"In a way, the worldview of the Party imposed itself most successfully on people incapable of understanding it. They could be made to accept the most flagrant violations of reality, because they never fully grasped the enormity of what was demanded of them, and were not sufficiently interested in public events to notice what was happening.

By lack of understanding they remained sane. They simply swallowed everything, and what they swallowed did them no harm, because it left no residue behind, just as a grain of corn will pass undigested through the body of a bird."

George Orwell (1984)

The US dollar is approaching some key support levels, and gold is pushing up towards a potential neckline on a big inverse H&S formation.

Silver is a juggernaut while the markets are climbing on Fed provided liquidity and the global carry trades.

So, we either correct soon, or Benny takes us to the next level of debasement.

It would be nice to see gold finally hit that 1455 level I called out so long ago before it had broken out.

Option expiration at the Comex on Monday the 28th as shown on the calendar below, although any serious bear raids are likely to be at the end of this trading week. They have not even sorted out the March deliveries yet in silver. It is hard to imagine them losing control of price, although some day they most likely will. Let's see how the metals fare, under the attack of Blythe Baba Yaga, the Silver Witch.