In all this excitement, no one seems to remember that the President unilaterally refused to play the Bush tax cut card back in June. At least in public. I suspect strongly that the deals are being made behind the scenes, and much of what passes in public is for show, and political diversions.

The tax cuts expire in 2012. They offered an excellent bargaining chip, and one of the key drivers, along with the two unfunded discretionary wars and the out of control financial sector, of the current financial crisis that took the US from surplus to crisis in roughly ten years. If you were going to use that chip, the time to have done it was now, and not in an election year. And in a budget crisis not using it looks to be highly ideological if not mildly insane.

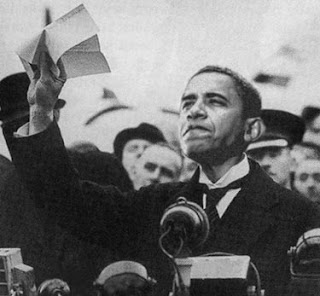

Obama is either a well-prepared Manchurian candidate for the monied interests, something I am not dismissing, or playing chess on a multi-dimensional board that I still do not quite understand, something which I am also not willing to dismiss completely just yet, but it does not look very likely. He could also be a haplessly inept idiot at the mercy of his advisors, but I doubt that very much now.

Bush was easy to read, as was Clinton, at least after the few two years. Obama is a bit harder, but perhaps that is by intent. Good or ill, I cannot yet tell. He keeps getting the benefit of the doubt, but as I said on his 100th day in the Presidency, that time is over and done.

No matter the motives, actions speak louder than words, and at the end of the day, he is a disaster, a betrayer to his supporters, a decidedly ineffective and uninspiring leader, a faux reformer, and likely to go down in history as one of the great unrealized moments in greatness, like Jimmy Carter or even worse, Andrew Johnson. And that is a shame, because it was entirely avoidable.

But for all those smug "I told you so's" out there, Obama is still probably better than having the Alaskan reality show star a shaky heartbeat away from the presidency, a truly frightening prospect that most people forget. McCain flamed out and sold out before his moment came, and I suspect it was because he had no other choice in a crony corporatist party that rules its members by threat and decree. Lack of dissent does not always imply a unanimity of thinking.

The door may be open for a viable third party movement in 2012. I would even welcome a primary challenger from the Democrats, in the manner of Robert Kennedy and Lyndon Johnson. But where is there any US politicians of that character, that level of leadership?

You may also wish to read The Weirdness of the Ten Year Deficit Reduction Discussion by James Kwak.

The Baseline Scenario

Two Can Play

By James Kwak

26 July 2011

Quick, what was the greatest conservative accomplishment of the George W. Bush presidency? It wasn’t Medicare Part D: that was a clever way to steal a Democratic issue and pass it in a form that was friendly to the pharmaceutical industry. It wasn’t Roberts and Alito: yes, they are young and conservative, but the majority is still only 5-4. It wasn’t Social Security privatization: that didn’t happen. Iraq? Getting political support to invade Iraq was a major coup, but everything went downhill from there.

The answer is obvious: the tax cuts of 2001 and 2003. Together, they were a wish list of conservative tax policy: a reduction in the top marginal income tax rate from 39.1 percent to 35 percent; a reduction in the top rates for capital gains and dividends to 15 percent; much higher contribution limits for tax-preferred retirement accounts (meaning that if you have enough money to save, you can shield more of it from taxes); and eventual elimination of the estate tax. In total, when fully phased in, the Bush-era tax cuts sliced almost 3 percent of GDP out of federal government revenues.*

And most of that money stayed in the pockets of the wealthy. According to the Tax Policy Center, 65 percent of the dollar value of the tax cuts (in 2010, once the 2001 and 2003 tax cuts were phased in) went to the top income quintile, and a staggering 20 percent — that’s tens of billions of dollars — went to the top 0.1 percent. Even if you look at the impact in percentage terms, the rich still took home more than their share: after-tax income went up by 0.7 percent for the bottom quintile, 2.5-2.6 percent for the middle three quintiles, 4.0 percent for the top quintile, and 8.2 percent for the top 0.1 percent.

Everyone knows all that already. Who cares? The point today is that President Obama can make this epic conservative victory vanish by snapping his fingers. He can say, “I promise to veto any bill that extends any of the tax cuts.” (Or, if he prefers, he can say, “I promise to veto any bill that extends any of the tax cuts, except the income tax rate reductions for the ‘middle class.’”)

Why would he do such a thing? Think about where the debt ceiling negotiations are today. The House Republicans are effectively holding the financial system and the economy hostage, demanding a massive, spending-cuts-only deficit reduction package. What makes this a smart move (where “smart” is defined solely in terms of likelihood of winning, not the risk being taken) is that if they can force Obama to choose between (a) raising the debt ceiling on their terms and (b) not raising it at all, he is going to choose (a). Even if he would be better off politically letting the government default and blaming it on the Republicans, no one thinks he would actually let it happen.**

Well, Obama has a hostage, too, if he wants to use it: the Bush tax cuts. From the Republicans’ position, just thinking about themselves and what they want (not about the country as a whole), are a few trillion in spending cuts over ten years — averaging something like 1.5 percent of GDP — worth giving up the greatest accomplishment of the entire conservative revolution?

Now, I’m not enough of a political strategist to know exactly how this would play out. For Obama to use the threat, he has to be willing to go through with it. That means mutual assured destruction: the Republicans insist on $3 trillion in spending cuts as the price to pay for raising the debt ceiling; Obama agrees in order to prevent default; and then Obama lets $3-4 trillion in tax cuts expire. Politically, it means being willing to argue in 2012 that letting the tax cuts expire was the right thing for the country. But that’s not an impossible case. Back in 2001, every aspect of the tax cuts was unpopular, other than the fact that they were tax cuts. (See Hacker and Pierson, Off Center, pp. 50-51.) Alternatively, Obama could propose a bill that extends just the “middle class” tax cuts on a take-it-or-leave-it basis.

As I said, I can’t tell you what the political percentages are. But it seems to me there has to be some leverage here that Obama can use — if he wants to.

* In the January 2007 Budget and Economic Outlook, the total 2017 cost of extending all the tax cuts, in addition to but not including patching the AMT, was projected to be $616 billion (Table 1-5), or 2.9 percent of GDP. I chose the 2007 projection because (a) it goes out to 2017, which is when some tax cuts were scheduled to expire and (b) it is before 2008, when the tax cuts to stimulate the economy began.

** What makes it a somewhat less smart move is that, with the Senate in the hands of the Democrats, the Republicans have no clear way of forcing Obama to sign or veto their deficit reduction bill. If the two houses can’t agree on a plan, Obama can avoid having to make the choice (and the end of the world will be Congress’s fault).

Obama Gives in to GOP on Bush Tax Cuts, and More

By Thomas Hartmann

Tuesday 28 June 2011

Yesterday – Senator Bernie Sander wrote a letter to President Obama telling him not to give in to Republican demands in the debt limit negotiations – and to fight for “shared sacrifice” by taxing millionaires and billionaires along with any new spending cuts. Unfortunately – the President didn’t get the message and the White House stated yesterday that the President is taking repealing the Bush tax cuts for millionaires and billionaires off the table. Which leaves mostly spending cuts targeting working families still on the table. Looks like America's oligarchs - and the Republican Party they own - win again."

The corporatist strategy has been to give generous tax cuts to the wealthy, spend money like drunken sailors on things that benefit the monied interests, and then declare a budget crisis and take the difference out of the hides of the middle class, the weak, and the elderly. So far Obama is following the same playbook, with a little dusting of compassionate sounding hoo-hah.