Check out the Treasuries in the second chart, particularly the 30 Year Bond.

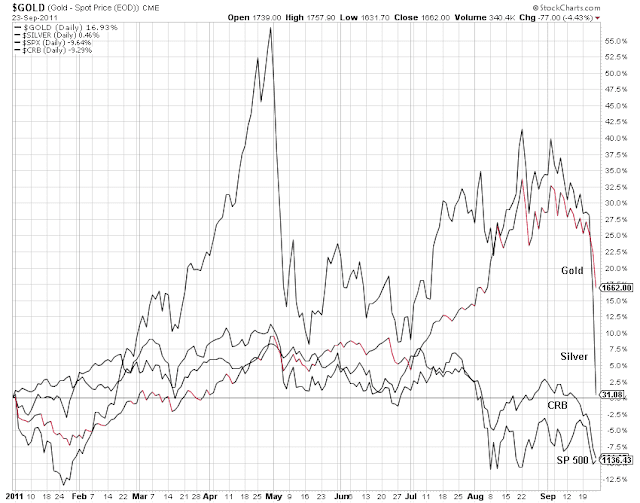

If the Fed had not been targeting assets to create some of these price moves it would be the best case for deflation which I have seen thus far.

I think this might be a case in which Fed does something with the right hand, which the audience is watching, while it does something very different with its left hand, using the misdirection of the markets to distract the viewers from its true purposes.

Whatever that may be, the performance is what it is. It shows no recovery in the real economy and an expansion of the 'financing sector.'