"Hobbes had argued the need for a despot because men were like beasts; Townsend insisted that they were actually beasts and that, precisely for that reason, only a minimum of government was required.

From this novel point of view, a free society could be regarded as consisting of two races: property owners and laborers. The number of the latter was limited by the amount of food; and as long as property was safe, hunger would drive them to work. No magistrates were necessary as hunger was a better disciplinarian than the magistrate...

The biological nature of man appeared as the given foundation of a society that was not of a political order. Thus it came to pass that economists presently relinquished Adam Smith's humanistic foundations, and incorporated those of Townsend...Economic society had emerged as distinct from the political state."

Karl Polanyi, The Great Transformation, 1944

Plus ça change, plus c'est la même chose. Only the percentages and the methods of sorting seem to matter to a certain type of

ubermensch mentality. And of course force and fraud are indispensable to the accumulation and protection of their wealth.

I have spent the last day or two reading Karl Polanyi's landmark work of economic history,

The Great Transformation: The Political and Economic Origins of Our Time.

Polanyi's history is particularly good because he describes in some detail how the predominant economic thought changes and adapts itself to its cultural context, the changing attitudes and philosophies of people and particular historical developments. And how it even begins to shape history as a branch of political philosophy. What are people, and what is their relationship to society as a whole? What is power? What is moral?

It is a grave mistake to treat economics as a physical science like chemistry. Chemistry seeks to quantify and explain an essentially unchanging physical world in substance if not in incidentals. There are real

laws. Theory becomes verifiable fact, and new facts build to new theories. Chemistry

evolves, in that it changes with a remarkably evident progression of one thing on another which can be seen against some objective standard.

Economics reflects the changing attitudes of politics and the other social sciences to the relationship among the individual, society, and nature. That is not to say that there is no

learning in a social science. There is plenty of learning, but also a strong tendency to have to re-learn the same hard lessons over and over again.

If someone in astrophysics were to say that the sun revolves around the earth they would be laughed off the podium and booted out of their positions. But if an economist says even now that markets are naturally self-regulating and efficient if left alone, they might be given a large grant and the chairmanship of an economics department, even though this theory has been found wanting, or as some might phrase it, a

howler.

There is a remarkably poignant paragraph in Polanyi where he says that since self-regulating markets have been proven to be nonsense "we are witnessing a development under which the economic system ceases to lay down the law to society and the primacy of society over that system is secured." As John Kenneth Galbraith put it, there are no new financial frauds, just variations on the old familiar themes.

Keep in mind that there is a difference between monetary theory, which is more akin to finance, and macroeconomics, which operates more generally in the realm of broad relationships and what is essentially morals or public policy. It is well said that a little learning is a dangerous thing, because one does not understand the scope of the field and their own limitations.

A certain school of economics can, and often did as shown in this history, coolly observe that profits will be maximized if a large percentage of the workers are maintained on the verge of starvation and insecurity without any support or interference from society, in the service of a superior few. We can clearly see the descendants of that particular moral philosophy in the world today.

It should be understood that by 'liberal economics' is meant 'self-regulating,' or essentially unregulated markets, and not progressivism as we might think of it today. Polanyi goes to some lengths to show that there are no self-regulated markets that are fair and efficient. Mostly those markets that are called self-regulated are set up with a bias that favors the insiders that control them. Or as I said the other day, naturally occurring self-regulated markets are as common as seals reciting Shakespeare.

It is a long book. I will almost certainly read it again in more leisure. I tend to read quickly online, and more carefully when holding an actual book. But it was enjoyable and those inclined might read it with some benefit. It gave me a framework on which to hang quite of bit of independent thought and learning, providing some additional coherence. I think I understand

why certain things have happened in the way that they have.

Bear in mind that Polanyi is a man of his time. I disagreed with many of his thoughts on the gold standard for example, even though I am not even in favor of it today as I have said, for some of the same reasons he cites. I have seen another 60 or more years of history without a gold standard, and know that what he saw was not so much attributable to the gold standard but the inflexibility of a

single currency system, much as we are seeing with a euro currency and a multiplicity of fiscal regimes in the euro zone today. And for the dollar reserve currency in the world which is in a similar process of failing for similar reasons. I still wonder at who conceived these monstrosities and what they were really thinking, except for an expedient solution that became institutionalized with a powerful set of adherents and beneficiaries, and so long outlived its usefulness.

I include here only key passages, by no means exhaustive or complete. I have left out whole sections of his thought on land for example. But the major progression of his thought is here.

A Utopian system leads to an impasse between the adherents attempting to sustain the unsustainable and those who are obliged to endure its conflicts with reality. Much in the manner of the Wall Street financialisation cartel and the real productive economy today. The system might function well during a spectacular growth period, but when some return to normal growth occurs the system fails and a standoff occurs.

Unless resolved by organic reform that impasse can lead to 'reform by other means,' or an extreme solution and with it a general unhappiness. This is in fact his thesis, that the failure of neoliberal economics and its unwillingness to relieve the deadlock in which it held the real world economy led to the rise of the extreme solutions of fascism, communism, and the second great war. He makes an interesting case.

Enjoy.

"A market economy is an economic system controlled, regulated, and directed by markets alone; order in the production and distribution of goods is entrusted to this self-regulating mechanism. An economy of this kind derives from the expectation that human beings behave in such a way as to achieve maximum money gains. It assumes markets in which the supply of goods (including services) available at a definite price will equal the demand at that price. It assumes the presence of money, which functions as purchasing power in the hands of its owners.

Production will then be controlled by prices, for the profits of those who direct production will depend upon them; the distribution of the goods also will depend upon prices, for prices form incomes, and it is with the help of these incomes that the goods produced are distributed amongst the members of society. Under these assumptions order in the production and distribution of goods is ensured by prices alone...

Nothing must be allowed to inhibit the formation of markets, nor must incomes be permitted to be formed otherwise than through sales. Neither must there be any interference with the adjustment of prices to changed market conditions—whether the prices are those of goods, labor, land, or money. Hence there must not only be markets for all elements of industry, but no measure or policy must be countenanced that would influence the action of these markets. Neither price, nor supply, nor demand must be fixed or regulated; only such policies and measures are in order which help to ensure the self-regulation of the market by creating conditions which make the market the only organizing power in the economic sphere...

A self-regulating market demands nothing less than the institutional separation of society into an economic and political sphere. Such a dichotomy is, in effect, merely the restatement, from the point of view of society as a whole, of the existence of a self-regulating market...

A market economy must comprise all elements of industry, including labor, land, and money. (In a market economy the last also is an essential element of industrial life and its inclusion in the market mechanism has, as we will see, far-reaching institutional consequences.) But labor and land are no other than the human beings themselves of which every society consists and the natural surroundings in which it exists. To include them (people) in the market mechanism means to subordinate the substance of society itself to the laws of the market...

To allow the market mechanism to be sole director of the fate of human beings and their natural environment, indeed, even of the amount and use of purchasing power, would result in the demolition of society. For the alleged commodity "labor power" cannot be shoved about, used indiscriminately, or even left unused, without affecting also the human individual who happens to be the bearer of this peculiar commodity. In disposing of a man's labor power the system would, incidentally, dispose of the physical, psychological, and moral entity "man" attached to that tag. Robbed of the protective covering of cultural institutions, human beings would perish from the effects of social exposure; they would die as the victims of acute social dislocation through vice, perversion, crime, and starvation.

Nature would be reduced to its elements, neighborhoods and landscapes defiled, rivers polluted, military safety jeopardized, the power to produce food and raw materials destroyed. Finally, the market administration of purchasing power would periodically liquidate business enterprise, for shortages and surfeits of money would prove as disastrous to business as floods and droughts in primitive society...But no society could stand the effects of such a system of crude fictions even for the shortest stretch of time unless its human and natural substance as well as its business organization was protected against the ravages of this satanic mill...

But on the island of Juan Fernandez (an economic analogy described earlier) there was neither government nor law; and yet there was balance between goats and dogs. That balance was maintained by the difficulty the dogs found in devouring the goats which fled into the rocky part of the island, and the inconveniences the goats had to face when moving to safety from the dogs. No government was needed to maintain this balance; it was restored by the pangs of hunger on the one hand, the scarcity of food on the other. (This is the law of predator and prey).

Hobbes had argued the need for a despot because men were like beasts; Townsend insisted that they (people) were actually beasts and that, precisely for that reason, only a minimum of government was required. From this novel point of view, a free society could be regarded as consisting of two races: property owners and laborers. The number of the latter was limited by the amount of food; and as long as property was safe, hunger would drive them to work. No magistrates were necessary, for hunger was a better disciplinarian than the magistrate...

The paradigm of the goats and the dogs seemed to offer an answer. The biological nature of man appeared as the given foundation of a society that was not of a political order. Thus it came to pass that economists presently relinquished Adam Smith's humanistic foundations, and incorporated those of Townsend...Economic society had emerged as distinct from the political state...

To the politician and administrator laissez-faire was simply a principle of the insurance of law and order, with the minimum cost and effort. Let the market be given charge of the poor, and things will look after themselves...

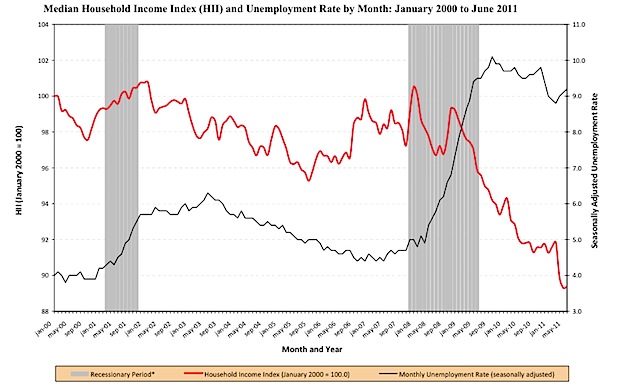

What induced orthodox economics to seek its foundations in naturalism was the otherwise inexplicable misery of the great mass of the producers which, as we know today, could never have been deduced from the laws of the old market. But the facts as they appeared to contemporaries were roughly these: in times past the laboring people had habitually lived on the brink of indigence (at least, if one accounted for changing levels of customary standards); since the coming of the machine they had certainly never risen above subsistence level; and now that the economic society was finally taking shape, it was an indubitable fact that decade after decade the material level of existence of the laboring poor was not improving a jot, if, indeed, it was not becoming worse... (trickle down theory had not worked, mystifying economists. The old canards are the best).

The acceptance of near-indigency of the mass of the citizens (roughly 47 to 99 percent apparently) as the price to be paid for the highest stage of prosperity was accompanied by very different human attitudes. Townsend righted his emotional balance by indulging in prejudice and sentimentalism. The improvidence (lacking personal responsibility) of the poor was a law of nature, for servile, sordid, and ignoble work would otherwise not be done. (born to be vile?) Also what would become of the fatherland unless we could rely on the poor? "For what is it but distress and poverty which can prevail upon the lower classes of the people to encounter all the horrors which await them on the tempestuous ocean or on the field of battle?"...

Robert Owen, in 1817, described the course on which Western man had entered and his words summed up the problem of the coming century...The organization of the whole of society on the principle of gain and profit must have far-reaching results. He formulated these results in terms of human character. For the most obvious effect of the new institutional system was the destruction of the traditional character of settled populations and their transmutation into a new type of people, migratory, nomadic, lacking in self-respect and discipline—crude, callous beings...

He proceeded to the generalization that the principle involved was unfavorable to individual and social happiness. Grave evils would be produced in this fashion unless the tendencies inherent in market institutions were checked by conscious social direction made effective through legislation...The Industrial Revolution was causing a social dislocation of stupendous proportions, and the problem of poverty was merely the economic aspect of this event. Owen justly pronounced that unless legislative interference and direction counteracted these devastating forces, great and permanent evils would follow...

The trading classes had no organ to sense the dangers involved in the exploitation of the physical strength of the worker, the destruction of family life, the devastation of neighborhoods, the denudation of forests, the pollution of rivers, the deterioration of craft standards, the disruption of folkways, and the general degradation of existence including housing and arts, as well as the innumerable forms of private and public life that do not affect profits...

Two vital functions of society, the political and the economic, were being used and abused as weapons in a struggle for sectional interests. It was out of such a perilous deadlock that in the twentieth century the fascist crisis sprang...

Economic liberalism (liberal in the sense of laissez-faire) was the organizing principle of a society engaged in creating a market system. Born as a mere penchant for non-bureaucratic methods, it evolved into a veritable faith in man's secular salvation through a self-regulating market. Such fanaticism was the result of the sudden aggravation of the task it found itself committed to: the magnitude of the sufferings that were to be inflicted on innocent persons as well as the vast scope of the interlocking changes involved in the establishment of the new order...

The global sweep of economic liberalism can now be taken in at a glance. Nothing less than a self-regulating market on a world scale could ensure the functioning of this stupendous mechanism. (one world government) ...No wonder that economic liberalism turned into a secular religion once the great perils of this venture were evident. There was nothing natural about laissez-faire; free markets could never have come into being merely by allowing things to take their course...The road to the free market was opened and kept open by an enormous increase in continuous, centrally organized and controlled interventionism... (At the end of the economic continuum, both extreme laissez-faire and communism meet, becoming almost indistinguishable in their destruction of the individual and their particular social institutions which inhibit centralized control).

Stabilization of currencies became the focal point in the political thought of peoples and governments; the restoration of the gold standard became the supreme aim of all organized effort in the economic field. The repayment of foreign loans and the return to stable currencies were recognized as the touchstones of rationality in politics; and no private suffering, no infringement of sovereignty, was deemed too great a sacrifice for the recovery of monetary integrity. (austerity anyone?)

The privations of the unemployed made jobless by deflation; the destitution of public servants dismissed without a pittance; even the relinquishment of national rights and the loss of constitutional liberties were judged a fair price to pay for the fulfillment of the requirement of sound budgets and sound currencies, these a priori of economic liberalism...

The root of all evil, the liberal insists, was precisely this interference with the freedom of employment, trade and currencies practiced by the various schools of social, national, and monopolistic protectionism since the third quarter of the nineteenth century; but for the unholy alliance of trade unions and labor parties with monopolistic manufacturers and agrarian interests, which in their shortsighted greed joined forces to frustrate economic liberty, the world would be enjoying today the fruits of an almost automatic system of creating material welfare.

Liberal leaders never weary of repeating that the tragedy of the nineteenth century sprang from the incapacity of man to remain faithful to the inspiration of the early liberals; that the generous initiative of our ancestors was frustrated by the passions of nationalism and class war, vested interests, and monopolists, and above all, by the blindness of the working people to the ultimate beneficence of unrestricted economic freedom to all human interests, including their own.

A great intellectual and moral advance was thus, it is claimed, frustrated by the intellectual and moral weaknesses of the mass of the people; what the spirit of Enlightenment had achieved was put to nought by the forces of selfishness In a nutshell, this is the economic liberal's defense. Unless it is refuted, he will continue to hold the floor in the contest of arguments...

To separate labor from other activities of life and to subject it to the laws of the market was to annihilate all organic forms of existence and to replace them by a different type of organization, an atomistic and individualistic one. (a vision of Orwell's 1984).

This effect of the establishment of a labor market is conspicuously apparent in colonial regions today. The natives are to be forced to make a living by selling their labor. To this end their traditional institutions must be destroyed, and prevented from re-forming, since, as a rule, the individual in primitive society is not threatened by starvation unless the community as a whole is in a like predicament...

Now, what the white man may still occasionally practice in remote regions today, namely, the smashing up of social structures in order to extract the element of labor from them, was done in the eighteenth century to white populations by white men for similar purposes... (the economic hitmen come home again).

Mankind was in the grip, not of new motives, but of new mechanisms., Briefly, the strain sprang from the zone of the market; from there it spread to the political sphere, thus comprising the whole of society. But within the single nations the tension remained latent as long as world economy continued to function...

Eventually, the moment would come when both the economic and the political systems were threatened by complete paralysis. Fear would grip the people, and leadership would be thrust upon those who offered an easy way out at whatever ultimate price. The time was ripe for the fascist solution.

The fascist solution of the impasse reached by liberal capitalism can be described as a reform of market economy achieved at the price of the extirpation of all democratic institutions, both in the industrial and in the political realm. The economic system which was in peril of disruption would thus be revitalized, while the people themselves were subjected to a re-education designed to denaturalize the individual and make him unable to function as the responsible unit of the body politic.

This re-education, comprising the tenets of a: political religion that denied the idea of the brotherhood of man in all its forms, was achieved through an act of mass conversion enforced against recalcitrants by scientific methods of torture.

The appearance of such a movement in the industrial countries of the globe, and even in a number of only slightly industrialized ones, should never have been ascribed to local causes, national mentalities, or historical backgrounds as was so consistently done by contemporaries...

In fact, there was no type of background— of religious, cultural, or national tradition—that made a country immune to fascism, once the conditions for its emergence were given. Moreover, there was a striking lack of relationship between its material and numerical strength and its political effectiveness. The very term "movement" was misleading since it implied some kind of enrollment or personal participation of large numbers. If anything was characteristic of fascism it was its independence of such popular manifestations. Though usually aiming at a mass following, its potential strength was reckoned not by the numbers of its adherents but by the influence of the persons in high position whose good will the fascist leaders possessed, and whose influence in the community could be counted upon to shelter them from the consequences of an abortive revolt, thus taking the risks out of revolution.

A country approaching the fascist phase showed symptoms among which the existence of a fascist movement proper was not necessarily one. At least as important signs were the spread of irrationalistic philosophies, racialist aesthetics, anticapitalistic demagogy, (and procapitalist demagogy for that matter) heterodox currency views, criticism of the party system, widespread disparagement of the "regime," or whatever was the name given to the existing democratic set-up...

What we termed, for short, "fascist situation" was no other than the typical occasion of easy and complete fascist victories. All at once, the tremendous industrial and political organizations of labor and of other devoted upholders of constitutional freedom would melt away, and minute fascist forces would brush aside what seemed until then the overwhelming strength of democratic governments, parties, trade unions.

If a "revolutionary situation" is characterized by the psychological and moral disintegration of all forces of resistance to the point where a handful of scantily armed rebels were enabled to storm the supposedly impregnable strongholds of reaction, then the "fascist situation" was its complete parallel except for the fact that here the bulwarks of democracy and constitutional liberties were stormed and their defenses found wanting in the same spectacular fashion... (or as Orwell put it, a revolution is the kicking in of a rotten door - Jesse)

Fascism, like socialism, was rooted in a market society that refused to function. Hence, it was world-wide, catholic in scope, universal in application; the issues transcended the economic sphere and begot a general transformation of a distinctively social kind. It radiated into almost every field of human activity whether political or economic, cultural, philosophic, artistic, or religious. And up to a point it coalesced with local and topical tendencies. No understanding of the history of the period is possible unless we distinguish between the underlying fascist move and the ephemeral tendencies with which that move fused in different countries."

Karl Polanyi, The Great Transformation, 1944