There was a very obvious hit on the precious metals market today. You could not miss it if you were watching the tape intraday.

I have posted some commentary on that here and here.

The Non-Farm Payrolls Report is on Friday. The ADP report came in light today, and ISM Services missed as well.

There were a couple of surprises today in that things which we have seen are now starting to penetrate the mainstream consciousness.

Jim Chanos observed that the moral hazard is now so bad that 'cheating is a fiduciary responsibility.' Nice tone that the governments are setting in Washington and London.

Even nations are getting in on the action as Venezuela is allowing the financiers to front run its devaluations.

"Unlike the first devaluation however, the second was done behind closed doors with local financial interests placing bids on dollar exchange transactions ahead of the country’s citizenry...Additionally, the CBC seems to have confirmed that Canada is concerned about bank failures and is adopting the Cyprus model for their own bailout plans.

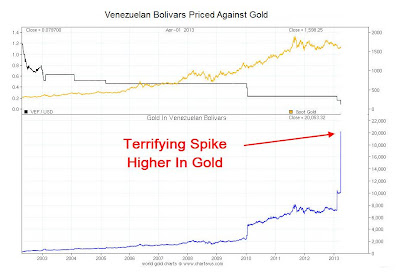

The chart shows that when measured against gold, the Venezuelan Bolivar has “collapsed” from Bs. 860 in 2005, to what appears to be over Bs. 20,000 today. This represents an over 23-fold move (2300%) in gold over the last eight years.

It seems a bit dodgy that both NZ and Canada have taken these steps, while reassuring everyone, rather smugly, that their banks cannot fail.

Are you kidding me? In the event of a major global derivatives event, I would imagine that nothing in the banking system is safe.

And lastly, I hear from Bloomberg that American Banks with European money market funds intend to deal with their negative returns by quietly 'breaking the buck.' Bail-in, everybody.

If the above does not give you a sense of foreboding then you may wish to check your pulse.

And with the gold and silver action we are seeing, and the dissembling about the safety of the banking systems and the economy, it is as if the local authorities are trying to keep people on the beach, generating commercial activity by spending money and saving paper currency, while they themselves make their own provisions for an incoming tsunami of financial disaster.

Right. I'll send you a postcard from higher ground, eh?

Have a pleasant evening.