There should be no doubt in anyone's mind that the fundamentals for world gold supply and demand have changed dramatically over the past ten years at least.

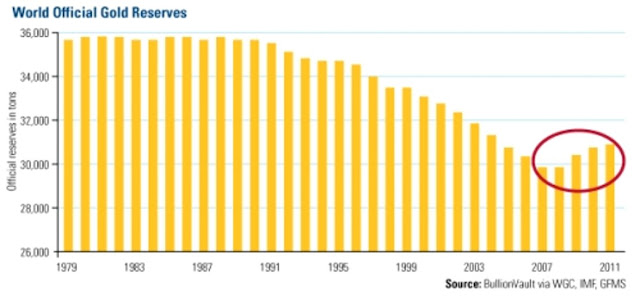

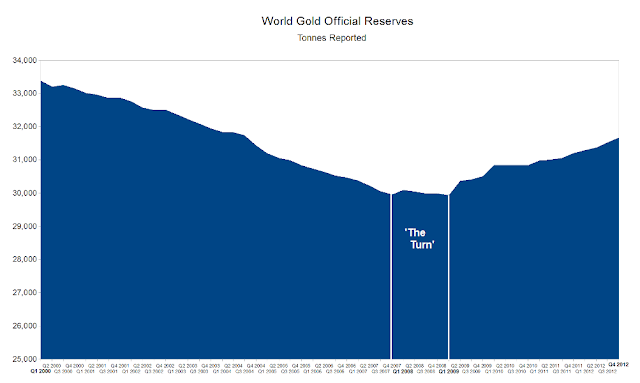

The world's central banks, most significantly in the West, had been selling bullion from their central bank reserves since 1989. The first chart below shows the long decline in the official gold reserves of the central banks through the long bear market from 1979 through 2000, and even in the beginning of the bull market.

There was an explicit public arrangement called the Washington Agreement struck in 1999 to regulate that official selling after a particular central bank had disrupted the market.

"Under the agreement, the European Central Bank (ECB), the 11 national central banks of nations then participating in the new European currency, plus those of Sweden, Switzerland and the United Kingdom, agreed that gold should remain an important element of global monetary reserves and to limit their sales to no more than 400 tonnes (12.9 million oz) annually over the five years September 1999 to September 2004, being 2,000 tonnes (64.5 million oz) in all.

The agreement came in response to concerns in the gold market after the United Kingdom treasury announced that it was proposing to sell 58% of UK gold reserves through Bank of England auctions (aka Brown's Bottom), coupled with the prospect of significant sales by the Swiss National Bank and the possibility of on-going sales by Austria and the Netherlands, plus proposals of sales by the IMF. The UK announcement, in particular, had greatly unsettled the market because, unlike most other European sales by central banks in recent years, it was announced in advance. Sales by such countries as Belgium and the Netherlands had always been discreet and announced after the event. So the Washington/European Agreement was at least perceived as putting a cap on European sales."

There is some speculation as to the reason why the UK's Brown decided to engage in that rather extraordinary action, against the counsel of his own advisors, but that does not concern us here.

This outright selling in gold by central banks is different from the leasing of gold by central banks, which is generally not transparent and openly announced. In this leasing operation, bullion banks pay a small lease rate to the central bank for the right to use that gold as collateral and for sale, with the promise to replace it after a period of time with a fee. It is a subject of controversy how much of the existing stock of central banks has been committed to the market through leasing arrangements. The number is not insubstantial. The gold is likely to have been sold or otherwise committed, and must be repurchased to be returned.

There is a very high likelihood that gold collateral has been rehypothecated, or used many times with a number of parties holding claim to it. This is a common practice and is referred to as fractional gold reserves. These most often take the form of 'unallocated bullion' which is when a certificate of ownership is issued, but no particular bars have been identified. And as we saw in the failure of MF Global, even allocated bullion ownership, in which specific bars are committed and paid for, ownership can be a rather philosophical concept in which possession is nine-tenths of the law.

The second chart shows the period from 2000 to 2012, with emphasis on 'the Turn' which is when central banks turned from net sellers to net buyers of gold. I cannot stress enough how important this is to the fundamental outlook.

Economists, pundits and investment managers can say whatever they like, but the proven fact remains that the world's central banks, on the whole, do not agree with them that gold is not an important store of value, and likely to become more important in the future. It is somewhat ironic that these same fellows would uphold the power of the central bank on one hand, and say things like

Don't fight the Fed, or

Bernanke says what the market is, but then will turn around and suggest you ignore what the central banks of the world are doing on the whole. It is hard to imagine that this is not someone woefully ignorant of current trends or with some other agenda who would take such an obtuse position.

And of course we also have the statement and opinions of those who say,

personally I think gold is barbaric and useless, but then will say,

money is based on consensus, and so fiat money is sound. Again, the clear consensus of the central banks is that gold is an important facet of their reserves, and the importance to their future plans is growing, for whatever reasons they have not yet disclosed.

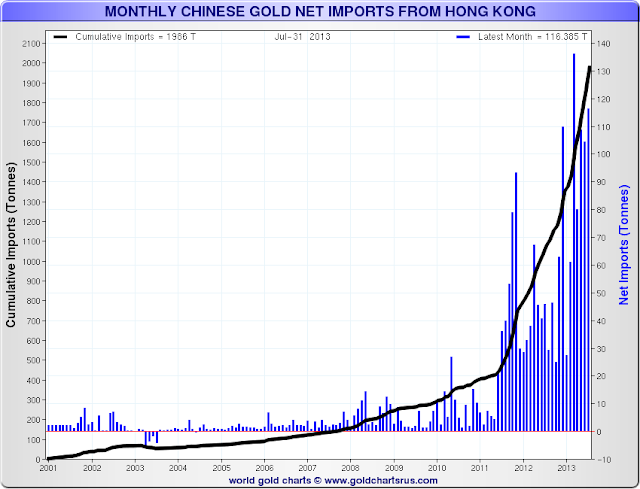

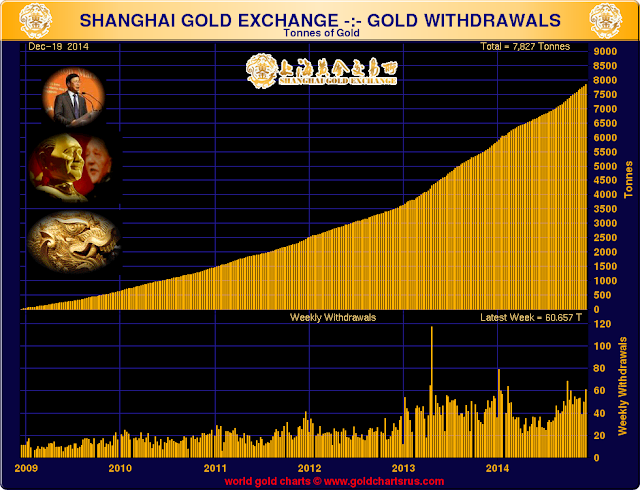

The third chart demonstrates the significant increase in gold bullion acquired by the Chinese. This is both private and official purchases. A large producer in their own right, China exports little of their domestic production, and is a large net importer. Several other countries are following the same pattern, the common thread being that they are the high growth countries who have the need to increase their reserves, or whose people have new wealth they wish to deploy.

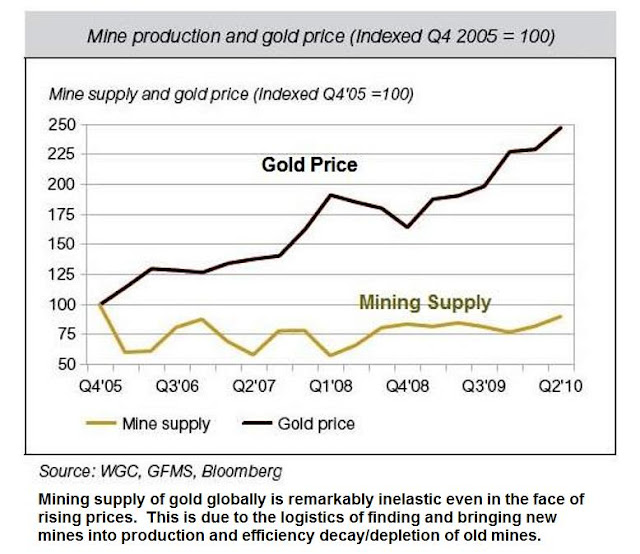

The fourth chart shows the well established fact that the increase in the gold supply through mining is relatively inelastic with regard to price. It takes significant effort and capital to create new mining operations, and there is a natural decay in the productivity of existing mines as with most natural resources. The estimate is that the gold supply can increase through mining at roughly 2% per year. This is one of the features that has long made gold attractive as a form of money.

As demand increases therefore, the price of gold must rise. If someone wishes to hold the price steady, new supplies of gold must be found, and they will not be discovered in mines.

There is a fairly well established 'scrap market' in which old jewelry and other gold objects can be purchased and melted down for bullion. But this market again is not robustly elastic although it can respond to higher prices more readily than mining operations.

So for ready access to gold to meet market demands, other sources of gold must be found.

This is where we get into the concept of 'fractional reserve gold' and 'paper gold' in which ownership is more of a financial concept than a hard reality. This includes both the leasing of official reserves, and the use of unallocated reserves that would be discovered in purchasing programs and perhaps even some well known funds.

One would hope that highly transparent audits of such things would exist from impeccable sources, but sadly that does not seem to be the case.

Leverage and rehypothecation are two of the largest factors in the recent financial crises, in addition to the mispricing of risk and fraudulent representations.

I think one of the more remarkable features of the current situation is the storage of official bullion in custody in New York and London. Venezuela was one of the first countries to demand that their gold be repatriated from New York, and this has happened despite much scoffing and derision by the usual pundits.

But then in response to domestic requests and changing circumstances, the German central bank requested that some portion of their gold be returned from out of country.

The German gold had been stored out of country in response to concerns that the gold was not safe, given the divided nature of the country and fears of a Soviet incursion. Obviously with their country reunited and at peace, it would make sense to return things to normal.

They had already received much of their gold back from London, in large part because it was incurring significant storage fees. They are also requesting their gold back from France.

By 2020, the Bundesbank intends to store half of Germany’s gold reserves in its own vaults in Germany. The other half will remain in storage at its partner central banks in New York and London. With this new storage plan, the Bundesbank is focusing on the two primary functions of the gold reserves: to build trust and confidence domestically, and the ability to exchange gold for foreign currencies at gold trading centres abroad within a short space of time.

The following table shows the current and the envisaged future allocation of Germany’s gold reserves across the various storage locations:

| 31 December 2012 | 31 December 2020 |

|---|

| Frankfurt am Main | 31 % | 50 % |

| New York | 45 % | 37 % |

| London | 13 % | 13 % |

| Paris | 11 % | 0 % |

To this end, the Bundesbank is planning a phased relocation of 300 tonnes of gold from New York to Frankfurt as well as an additional 374 tonnes from Paris to Frankfurt by 2020.

What is so remarkable is the response from New York. The Fed is agreeing to return a portion of Germany's gold in SEVEN YEARS.

Until the fundamentals change, the offtake of gold will continue to deplete supply, until the price moves to strike an equilibrium.

And as I have attempted to show at some length and detail on this site, the recent sell off in the price of gold was largely motivated by speculation in paper gold on western markets, specifically London and New York, that resulted not in a decrease in demand but an increase in demand that led quickly to spot shortages, delays, and premiums over the paper price for actual bullion.

I do not know the future. It is patently obvious that China and Russia and a few other countries, are making a concerted effort to increase their gold reserves for some reason. There is significant speculation that the nations will be changing to a new form of reserve currency for trade that will be backed at least partially by gold. In addition, several countries are said to be making plans to back their national currencies by gold in some manner as the devaluations of world currencies obtain momentum. I think these all these plans are under serious discussion today. There is no doubt that international discussion have been going on for some time.

I am aware that there are other, more specialized and sophisticated, studies out there about the gold and silver markets. Much of them are with regard to the shorter term for traders. But there are a few extraordinary efforts conducted by groups like GATA, data compilers like the World Gold Council, and individuals such as Eric Sprott, who has done a remarkable job of attempting to derive the demand and supply data for gold over a longer period of time.

My goal here is to present what I like to think of as the bigger picture. My own analysis of the global economy started in 1992 in a brief return to academics, and a natural interest as someone involved in international business.

Starting with the Asia currency crisis of the 1990's and the collapse of the rouble, my thinking led me to assume that there was going to have to be a significant change in the structure of the global trading arrangements with regard to currencies. Up to that point in 1999 I had no interest in gold whatsoever. I discovered gold and silver in my process of thinking about other things, and everything I had anticipated seems to have been unfolding, with variations of course.

There is the little detail that the second credit bubble tied to housing has collapsed, and the powers that be will not take the banks down, but are going to try and reflate the financial paper, particularly bonds and equities, by devaluing the major developed currencies. They are doing fairly well of hiding its effects, but at some point it is going to bite. A lot of the shenanigans going around now are trying to position the public, weakest segments first, into picking up the tab.

Make of this what you will, but I think the facts are sound. I suggest you look at this, and then come to their own conclusions. It may provide a framework with which to interpret events as they continue to unfold.

This is the final blow for the ones who still couldn’t comprehend, after all evidence presented, the amount of Chinese non-government gold demand in 2013. At the LBMA forum in Singapore June 25, 2014, one of the keynote speakers was chairman of the Shanghai Gold Exchange (SGE) Xu Luode. In his speech he made a few very candid statements about Chinese consumer gold demand, that according to Xu reached 2,000 tonnes in 2013.

This is the final blow for the ones who still couldn’t comprehend, after all evidence presented, the amount of Chinese non-government gold demand in 2013. At the LBMA forum in Singapore June 25, 2014, one of the keynote speakers was chairman of the Shanghai Gold Exchange (SGE) Xu Luode. In his speech he made a few very candid statements about Chinese consumer gold demand, that according to Xu reached 2,000 tonnes in 2013.