This is not so much anything new, but a concrete reminder of the breadth of systemic banking risks inherent in the Anglo-American banking structure in which depositor money is intermingled with the Bank's speculative interests.

The repeal of Glass-Steagall stripped the average person of important and time-tested safeguards against loss. Things are different now.

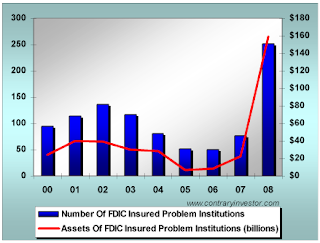

Any deposits you have at a bank in excess of 'insurance guarantees' are at risk in case of another financial crisis.

This exposure may include wealth you think that you own, but do not know exactly where and how it is being held. This may include 401k's and IRA's, pension plans, health insurance deposits, life insurance and annuities, and so forth.

MF Global was very instructive on how even cash deposits and physical assets backed by a certificate of ownership may be fair game for the banking system in the event of a crisis.

Nothing is perfect and foolproof, but there are degrees of safety.

And you may wish to consider that the next time something like Occupy Wall Street starts up and demands reform, don't stand by on the sidelines and join in with the orchestrated jeering from the one percent's water bearers.

Simplify, streamline, organize.

Demand serious, meaningful, and genuine reform and transparency in the banking and political system.

"The goal is to produce resolution strategies that could be implemented for the failure of one or more of the largest financial institutions with extensive activities in our respective jurisdictions. These resolution strategies should maintain systemically important operations and contain threats to financial stability.

They should also assign losses to shareholders and unsecured creditors in the group, thereby avoiding the need for a bailout by taxpayers. These strategies should be sufficiently robust to manage the challenges of cross-border implementation and to the operational challenges of execution...

But insofar as a bail-in provides for continuity in operations and preserves value, losses to a deposit guarantee scheme in a bail-in should be much lower than in liquidation. Insured depositors themselves would remain unaffected.

Uninsured deposits would be treated in line with other similarly ranked liabilities in the resolution process, with the expectation that they might be written down."

Bank of England and Federal Reserve Joint Statement on Resolving Globally Active, Systemically Important, Financial Institutions.

Related:

A Message From the Banking and Brokerage System

Lawmakers Must Heed the Wisdom of the 1930's

Why Has the Financial System Failed and What Are We Going To Do About It?

A Brilliant Warning on Robert Rubin's Proposal to Deregulate the Banks in 1995