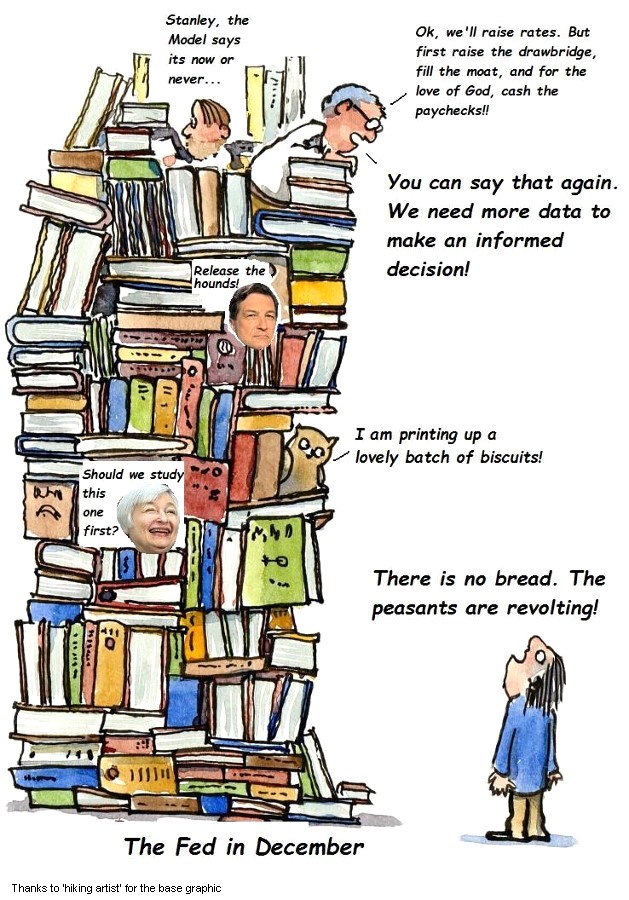

"The Federal Reserve, as one writer put it after the recent increase in the discount rate, is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

Uncle Jay and his Monetary Moonshine

William McChesney Martin, Speech to Investment Bankers Association of New York, October 1955

"We're not even thinking about thinking about the consequences of our actions."

Jerome Powell, Chairman, Federal Reserve

"Jukebox and sawdust floor

Sumpin' like I ain't never seen

And I'm just going on fifteen

But with the help of my finaglin' uncle I get snuck in

For my first taste of sin

I said "Lemme have a big old sip"

Brrrrr-bbbb, done a double back flip

Chug-a-lug, chug-a-lug

Make you want to holler hi-de-ho

Burns your tummy, don'tcha know

Chug-a-lug, chug-a-lug."

Roger Miller, Chug-a-lug

The spokesmodels were gushing with excitement as the SP500 snugged its beer goggles and managed to reach its pre-crash high.

The NDX is already in some alternate universe.

Thanks for the hot money for the recovery, Uncle Jay.

Great success.

Gold and silver responded to the call, as the Dollar continued to slide lower.

The commentary about the precious metals on financial TV is so shallow and badly informed that I think the metals may have quite a bit further to go.

The time to sell will be when even the most purblind Wall Street lounge lizards 'get it.'

Stock market will have its August stock option expiration on Friday.

Chug-a-lug, chug-a-lug.

Have a pleasant evening.