“On top of the world,

Or in the depths of despair—

Happy alone is the soul that loves."

Johann Wolfgang von Goethe, Klärchens Lied, aus Egmont

Stocks were on a wild tear higher.

Let's chalk this one up to the words of Fed Chair Jay Powell who sees a strong economy permitting more interest rate increases.

Gold and silver were taken out to the woodshed and beaten lower, with the Dollar slightly higher.

Stocks are putting in another blow off top. Don't try and get in front of them, but this one will end up like the rest.

Our defining character is fraud in the service of Mammon.

And the Deep State is howling a hurricane.

Trumpolini is fortunate in his opposition. Which is too bad, because he brings out the worst in his followers. And unfortunately the opposition tries to answer in kind. Too bad. Darkness cannot defeat darkness.

Little Dolly has been sitting in my lap, shivering with fear, since a cold front bringing thunderstorms has started rolling through.

As a reminder, there will be a stock options expiration at the end of this week.

And a Comex precious metals option expiration next week on Thursday, the 26th.

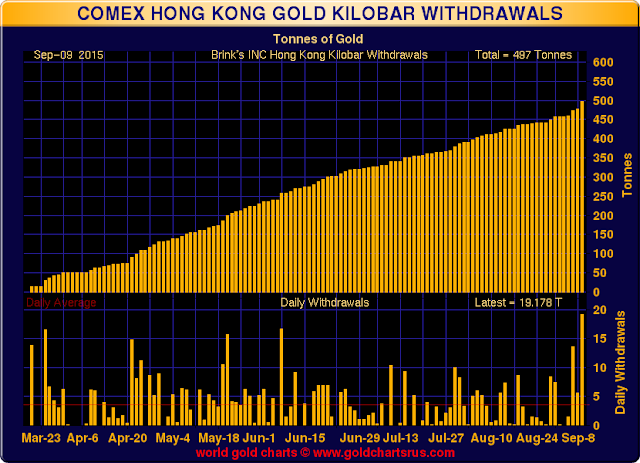

The struggle to cover the physical gold withdrawals from the Hong Kong Comex listed warehouses continues. Not to mention the less visible, like Singapore.

There is certainly nothing happening with the gold warehouses in New York. It is locked down tight, like a morgue.

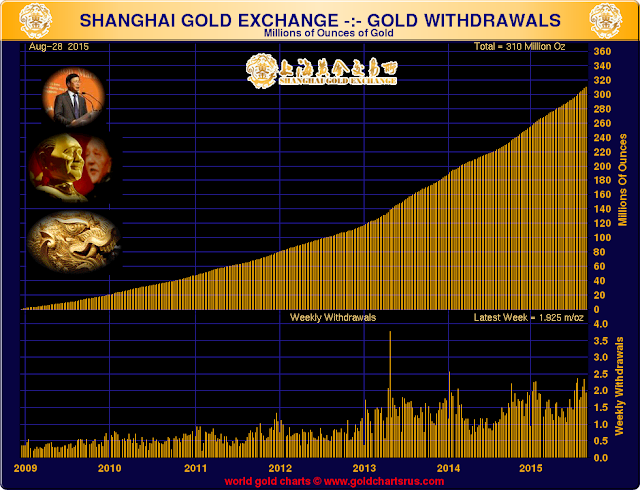

Gold is flowing from West to East. It is the most striking phenomenon of modern monetary developments. And yet so few see it, and fewer remark on it.

Smells like teen spirit. Or is that desperation? The price action tells us something. What is it?

This is quite a wild party being thrown for us by the elite— a bonfire of the vanities, we suspect. Part three, le dénouement.

And they all fall down.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.