"Central banks have the power to create economic, political and social change. This is how they do it."

02 December 2014

Princes of the Yen: Central Banks and the Transformation of an Economy

19 February 2013

Prime Minister Abe's Radical Plan for Japan's Constitution

Here is a notice of an upcoming talk at the Foreign Correspondents Club of Japan that I found to be of interest.

I am sure there is some political hyperbole here, and there are also some big 'ifs.' But this sort of thing does seem to be the general trend amongst the developed nations.

Democracy was an innovation imposed on Japan in the aftermath of the second World War. Most westerners do not realize that for the majority of its political life, the postwar government of Japan has been a government dominated by a single party, the LDP in partnership with their corporate combinations, or keiretsus.

And this 'Japan Model' of concentrated political power in a partnership between government and their corporations is responsible for the lack of reform that led to Japan's 'lost decade.'

The Constitution and its integrity takes on an added importance to those devoted to the democractic freedoms and individual protections for this reason.

The Foreign Correspondents Club of Japan

Shinzo Abe's Radical Plan to Change Japan's Constitution

Lawrence Repeta, Professor, Meiji University School of Law

Masako Kamiya, Professor, Gakushuin University Faculty of Law

Yoichi Kitamura, Representative Director, the Japan Civil Liberties Union

12:00-14:00 Thursday, February 21, 2013

Japan's Liberal Democratic Party has made no secret of its plan to comprehensively reform the Constitution, which it says was 'imposed' on the country after World War 2. On April 28, 2012, it revealed what these plans are. The date was chosen to commemorate the sixtieth anniversary of the San Francisco Peace Treaty.

In Diet interpellations on January 30, Prime Minister Shinzo Abe declared that the party would move forward with these plans under his leadership. For many years, debate over constitutional amendment has focused on the war-renouncing Article 9 but the LDP reform plan is far more radical.

If successful, the party would delete Article 97, the Constitution's most powerful declaration of human rights, and make several other far-reaching changes, including elevating maintenance of "public order" over all individual rights; adding a new requirement that citizens "respect" the kimi ga yo hymn and the hinomaru flag; eliminating free speech protection for activities "with the purpose of damaging the public interest or public order, or associating with others for such purposes"; and reducing parliamentary majorities required for constitutional amendments.

If the party achieves these goals, it will create a Constitution that mandates citizen obligations to the state rather than the other way around. This would effectively mean a rejection of popular sovereignty and a return to Japan's prewar order. The LDP and its allies secured more than two-thirds of the House of Representatives in December elections. If they can achieve the same level in the House of Councilors, the door will be open to a new Constitution to match Mr. Abe's vision.

A panel of experts has agreed to come to the FCCJ and explain the significance of these enormously important proposals. Lawrence Repeta is a professor at Meiji University Faculty of Law. Masako Kamiya is a Professor of Law at Gakushuin University and representative director of the Japan Civil Liberties Union. Yoichi Kitamura is a representative director of the same union and a co-counsel in many noteworthy cases, including litigation that led to the historic 2005 Supreme Court decision that found the Diet in violation of the Constitution for failing to adopt adequate voting procedures for Japanese who reside abroad.

Please reserve in advance, 3211-3161 or on the website (still & TV cameras inclusive). The charge for members/non-members is 1,700/2,600 yen, non-members eligible to attend may pay in cash (menu: braised chicken with rosemary and cream sauce). Reservations canceled less than one hour in advance for working press members, and 24 hours for all others, will be charged in full. Reservations and cancellations are not complete without confirmation. For meal service, please enter the room by 12:25.

10 September 2009

Japan: The Triumph of Crony Corporatism Over the Individual

Japanese officials sometimes have the endearing quality of coming out and openly saying what they are doing, or intend to do, in support of dodgy political and financial arrangements that would make a Wall Street banker blush, if they are still capable of such an act of modesty.

Japanese officials sometimes have the endearing quality of coming out and openly saying what they are doing, or intend to do, in support of dodgy political and financial arrangements that would make a Wall Street banker blush, if they are still capable of such an act of modesty.

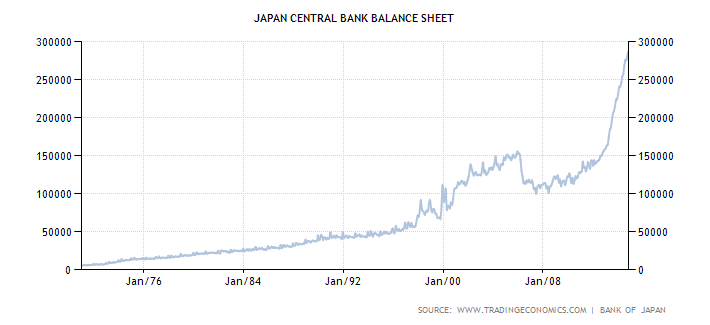

The former Japanese Central Banker Toshiro Muto said in March that '"in principle equity values should be set by the market and authorities should avoid manipulating prices because doing so would hurt the stock market’s reputation."

Apparently in this case 'in principle' means 'theoretically, as is convenient," because Mr. Muto goes on to recommend that the Japanese Central Bank and government throw principles aside and buy stocks to support the Japanese banking cartel, which has crippled that country for the past fifteen to twenty years.

Notice how in his talk, Muto says that this arrangement will be temporary, until Japan can export its way out of its financial difficulties.

The challenge might be that most of the countries intend to 'export' their way out of their central bank created economic difficulties. China and India have already passed on the notion of becoming mass importers in the foreseeable future.

Perhaps the fate of the world rests on the ability of the nations of Africa and Polynesia to obtain the suitable credit ratings and FICO scores to become mass consumers with debts that can not possibly ever be repaid, à la mode Amerique? Is South America willing to once again mortgage its future for the sake of the financiers? I am sure that any appropriate arrangements can be made by the Central Banks with the target nations' ruling elites.

Japan is one of the worst examples of crony capitalism in the world. Its ruling LDP party has been a disgraceful example of serving private corporate interests, and acting without honor, honesty, and integrity.

Why doesn't the Bank of Japan just give the money to the banks, and let them buy stocks higher using leverage in the futures index markets like the Anglo-American crony capitalists? This is considered much more respectful of the market driven economy in the West.

"As the boom developed, the big men became more and more omnipotent in the popular or at least the speculative view... the big men decided to put the market up, and even some serious scholars have been inclined to think that a concerted move catalyzed this upsurge." J. K. Galbraith, The Great Crash of 1929

After all, as the industrialist, financier, and Democratic National Chairman John Jacob Raskob observed in August 1929, "Everybody ought to be rich." And so for a time they were, seemingly all powerful, invincible, as gods.

And the abyss swallowed them all. And then the descent into madness in Asia, Africa, the Mideast, and in Europe: and finally a world in flames. Monstrous actions done in the name of economic necessity, room for growth, fuel for industry, a new order for the ages, and at all times the will to power of the few. All the gods of greed.

And at last, the twilight of the gods. Götterdämmerung. Until the old gods rise again.

And so here we are, trembling at the veil.

(Note: this news piece below is not current. It is from earlier this year. It demonstrates the 'roots' of the rallies which we are seeing today in the world bourses. They are an illusion.)

Bloomberg

Japan May Need to Buy Stocks, Ex-BOJ Deputy Muto Says

By Mayumi Otsuma

March 10 (Bloomberg) -- Former Bank of Japan Deputy Governor Toshiro Muto said the government and the central bank may need to buy shares temporarily to support the country’s ailing stock market.

When global equities plunge, “it’s very meaningful for the government’s share-buying institution and the Bank of Japan to buy stocks to support the market,” Muto said at a forum co- hosted by Bloomberg News in Tokyo today. “However, such purchases cannot last forever and should be justified only as a tool to avert a crisis.”

The Nikkei 225 Stock Average is at a 26-year low, eroding banks’ capital and making them reluctant to lend. Finance Minister Kaoru Yosano said today that the government has a “strong will” to combat the credit squeeze resulting from the stock-market slump.

Muto, currently head of the Daiwa Institute of Research, added that "in principle" equity values should be set by the market and authorities should avoid manipulating prices because doing so would hurt the stock market’s reputation.

The government has already allocated 20 trillion yen ($203 billion) and the Bank of Japan has set aside 1 trillion yen to buy shares owned by banks. Yosano last month ordered lawmakers within the ruling Liberal Democratic Party to study ways to bolster stocks, including the feasibility of the government directly purchasing equities in the market.

Keidanren’s Plea

Keidanren, Japan’s largest business lobby, yesterday called on the government to allow a public entity to sell state-backed bonds and funnel the proceeds into the flagging stock market.

The Nikkei slid 0.4 percent today to 7,054.98, the lowest since October 1982, on concern shrinking global demand and rising fuel prices will weigh on company earnings.

An unprecedented drop in exports since last quarter has forced Japanese manufacturers to cut production at a record pace and fire thousands of workers. The central bank forecasts the economy will shrink 2 percent in the year starting April 1, the worst in 60 years.

Muto said exports will drive Japan’s eventual recovery. Deflationary risks outweigh concerns about inflation in the world’s second-largest economy, he added.

Muto served as the central bank’s deputy chief for five years following a 37-year career at Finance Ministry. He was the government’s first choice to succeed Toshihiko Fukui as governor last year, only to be rejected by the opposition- controlled upper house, which said his stint at the ministry may hamper the bank’s independence.