We set a technical short at the top of the range around 1100, and caught this downdraft. But it does not help that we're making money but don't know why. We were mostly just killing time and playing Fallout 3.

We set a technical short at the top of the range around 1100, and caught this downdraft. But it does not help that we're making money but don't know why. We were mostly just killing time and playing Fallout 3.

Rumours abounding.

Dick Bloviate downgraded WFC, but the unspoken reasons why are the most interesting? Something wicked after the bell? Executive pay? Earnings?

Hedge funds front running their pending indictments?

Nervy longs watching for a serious move to the exits? Typical wash and rinse at day's end in a late stage Ponzi market? The trading desks casting for shorts?

We would not call this one unless we break support at 1060 and spike it hard.

Just another day for the naturally efficient markets in the reign of The Great Reformer.

Stay thirsty my friends.

21 October 2009

Absolutely Breath-taking Failure at 1100 in the Last Thirty Minutes of Trade

23 September 2009

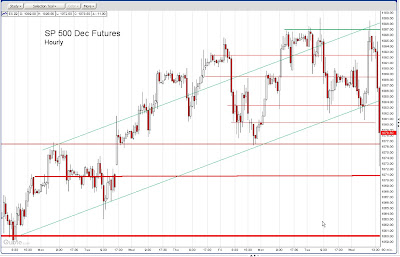

SP Futures Hourly Chart at 3 PM

Market volumes are still thin, and driven heavily by momentum traders and Wall Street wiseguys setting up the small specs, looking into what they holding, and then raising them out of their seats on short term spikes and drops.

Today was likely a bit of a letdown on the Fed news, that is, profit-taking, but the dips *should* continue to get bought once the funds sell off dogs into the monthly and quarter close and start window dressing which will likely begin Friday or Monday.

If any exogenous event occurs this market could drop hard and fast because it is all froth, and little conviction. Third quarter earnings *could* look good by comparison, but we have it in the back of our minds that October may be bloody.

Bernanke is disgraceful in his stewardship of the financial system, although it could be argued that he is doing his part, raising liquidity, but Obama and his crew are failing in their task of reforming the system and helping to direct that liquidity into fruitful efforts, rather than bonuses to their patrons on Wall Street.

20 August 2009

SP Futures Hourly Chart at 10:45 AM

The dynamic on the chart is the short term potential double bottom "W" and the developing intermediate H&S distribution top.

A pullback of 4% with a move to a higher high is supportive of the 'new bull market' scenario and we would expect the media cheerleaders and paid market strategists to hit the pom poms hard if the Street can make this happen.

Volumes are light enough. But we also sense a growing cynicism and distrust of the US financial markets in traders and investors. There is a recognition that the game is rigged, and the 'house' is skimming a larger piece of the daily liquidity thanks to government money and new technology.

This 'skim' may destroy a game while enriching the house, as all seasoned casino operators know. It is not clear to us that the Wall Street crowd can practice this sort of longer term restraint.

19 August 2009

SP Futures Hourly Chart at 1 PM

The US equity markets have bounced back to key resistance on a much great than expected drawdown in oil inventories.

The trade today seems very technical (ie short squeeze by the 100 million dollar men) and lacking in conviction.

Let's see how the markets deal with this and then trade accordingly. Volumes remain light, and may do so until September. However, if anything 'happens' this market may flop as convincingly as Obama's "change" platform.

17 August 2009

SP Futures Hourly Chart 9:45 AM with the SP Weekly Chart

So far this is merely a pullback from a consolidation, and a likely distribution top in the making as insiders continue to take profits on their ponzi pump in US equities.

We signalled 'defensive' last week, and that the risk reward in the market was dangerous, and we exited or hedged all longs. Time to Get Defensive

Now we wait to see if this is just a pullback from a consolidation, with a subsequent rally to new highs, or a break in the market slightly ahead of our forecast target. We have been looking for a 3% pullback first, and then a rally to the final high for the year.

The obvious level to watch is the neckline.

Bear in mind that these 100 million dollar men on Wall Street make their pay by taking investors, and the economy, for rides up and down in stocks, commodities, and just about any other market they can push using the leverage of their taxpayer supported funds.

The SP Weekly Chart show that a rally back to 1014 on the cash market represents an approximate 38.2% rally from the bottom. This number is one of the key fibonacci numbers watched by traders. The next stop higher would be 50%.

03 August 2009

30 July 2009

SP Futures Hourly Chart Updated at 3 PM

See why we put *IF* the neckline is broken on that potential H&S top?

Goldman, Wall Street and their friends in government and the media came out swinging this morning. The SP futures took off from the neckline on some fairly thin rationales, but good enough for an end of month paint job.

This is starting to feel like a real top being formed, with the Wall Street crowd and their demimonde out with the pom poms trying to cheer the institutions and smaller investors with end of month 401k money into the market to buy them out of this anemic rally near a high note.

If you are long or hedged as we are in a paired trade then you are doing all right for a choppy market, and if you are short your timing is probably a little ahead of the market at least, and you are feeding the machine. If you are long and strong, well then, good luck to you.

Be careful. For the longer term this rally appears to be just business as usual into the end of the month with insiders selling vigorously and with a few of the Wall Street crowd front running it with positional and inside information on every turn.

As a reminder watch the VIX and the NDX futures, and perhaps a broader index or two, as well as the SP 500 since those futures are the paintbrush most highly favored by the tape painters.

GDP tomorrow. Who can tell how it will turn out, except to say it will likely be revised. We'll ignore the headline and look more deeply into the numbers.

29 July 2009

SP Futures Hourly Chart at 2:30 PM EDT

A potential Head and Shoulders top has formed. It will be a valid formation but the objective will not be activated until and unless the neckline is broken.

Volumes remain light, with lots of technical gamesmanship that contributes to quite a bit of volatility in the short term, aka a 'daytrader's market.'

There is quite a bit of 'tension' in the market ahead of the GDP report tomorrow. The consensus is for growth of 1.5%. We are still a couple of weeks short of the timeframe we have projected for a top and the beginning of a leg down in markets, but some data or exogenous surprise could accelerate this.

There is a de facto partnership between the government and the banks with regard to the financial system and the economy which is spilling over to the equity markets. This is a similar arrangement that brought us the housing bubble and the credit crisis after the tech bubble and crash of 2001, which itself was a reaction to the Asian and Russian currency crisis of the late 1990's.

The financial engineers will likely not abandon their efforts until they either succeed, or finally shake the real economy apart and destroy the US financial system and currency. How they define 'success' is likely to be stability at the price of freedom, a classic oligarchy with 'enlightened despots.' Their financial engineering will require ever greater control over policy and priorities to maintain its artificial equilibrium.

The banks must be restrained, the financial system reformed, and the economy brought back into balance before there can be a sustained recovery.

22 July 2009

SP Futures Hourly Chart at 2:30 EDT

Some short term indicators are flashing that we are nearing at least a short term top. There is also indication of distribution of stock here by insiders to the public, which is also an indication of a possible top. This judgement is based on many charts and indicators not shown here.

Having said that, our discipline will not prompt us to do any seriously non-hedged shorting until the 'trendline' Key Pivot is violated at least on a daily close, and then confirmed by a move lower.

The market is rising on thin volumes, and unless the sellers come back in, it can continue to drift higher on program trading and short squeezes.

We are within two weeks of a potential 'crash window' where a final top will be made, and a selloff with a significant leg lower will be seen into the end of year. The window is a bit wide for now, a six week period starting around August 17th. We will hope to tighten that up by the end of July.

This is only a probability, not a hard forecast. But it has us edgy to be on the long side, even in precious metals miners, without hedging a general market decline. The Cashflow in the market is looking a bit stretched. We may have to wait until later in earnings season for this to shake out.

In sum, the markets seem 'precarious' and unstable to us, but not enough to jump in front of the market to the bear side yet.

As an aside, we are seeing quite an increase in 'screwy fills' on the bid ask level II where fills on the retail side seem to be made 'out of bounds' of the usual bid/ask action.

We do not use market orders normally and would not suggest them here for those that do. The market makers are shaving fills and front running perhaps although that is harder to spot except on the thinly traded stocks where other issues may come into play.

But we are seeing far too many fills BELOW our limit bids on some stocks to believe this market is functioning normally.

16 June 2009

SP Futures Hourly Chart

This is a quad witch option expiry week. The futures front month is rolling over but we have not yet made the change to September futures.

Volumes remain remarkably light even for June.

Support is obvious.

Keep a close eye on the VIX volatility.

08 June 2009

SP Futures Hourly Chart at 2:30 PM

The volumes remain thin, and the market appears to be in the control of the big trading desks, flush with TARP money, and the demimonde of hedge funds and daytraders.

Be in this market for the short term only, or not at all. The manipulation of certain funds, options and indices makes this a 'professionals only' market.

Let's see if any serious support breaks, ahead of the second quarter earnings. The mainstream media is preoccupied with bread and circuses, and the financial news media is an extended informercial, if not propaganda machine.

There is no economic recovery, only a paper chase. The Obama Administration is failing to take the next steps of creating an industrial policy that places the US labor force and economy on an equal footing with the rest of the world, and reforming the financial system which is unbalanced to the point of deformity and inefficient to say the least.

05 June 2009

SP Hourly Futures Chart at 2:30 PM

The SP futures are climbing the trellis of a reflationary ramp on thin volumes.

Although we would not suggest stepping in front of it, and certainly not seriously shorting it until the trend is broken, nevertheless the move has all the feel of artificiality and will meet its test when earnings start coming out for Q2.

From what we have seen on the fundamentals of earnings, stocks seems very fully valued here, and would not be looking for a great deal of upside, particularly when the banks finish their price manipulation to support their equity offerings to pay back their TARP funds.

"There is something wonderful in seeing a wrong-headed majority assailed by truth." John Kenneth Galbraith

14 May 2009

SP Futures Hourly Chart at 3 PM and Short Term Indicators After the Close

As a reminder, tomorrow is a stock options expirations, so manipulation of the tape in the short term at least is the order of the day. This may explain some of the recent bounce in equities despite the poor economic news.

We also get some interesting economic data including the long term TIC flows, Capacity Utilization, Industrial Production, preliminary Michigan Sentiment for May, Empire Manufacturing and of course the CPI.

If we get a solid break to the downside, expect a marked increase in 'hysteria.' This will be the time for a trader to keep a cool head. Rants are fine if they help you release stress, and they can be fun, but ranting does not put money in your bank account and can turn into an emotional crutch, a bad habit that distracts you from seeing valuable information with a clear head.

The short term indicators have been updated after the close, and a daily SP 500 chart with the moving averages has been added. The SP 500 is at a key support level.

Here is the daily SP 500 Chart with an Important Observation on the Moving Average

13 May 2009

SP Hourly Futures Into the Close of Trading

Today's economic data helped to crush the green shoots speculation and the long short squeeze in support of the banks' secondary stock offerings.

I am bearish, and think a test of the lows is in the cards. But the influx of narrow money and collaborative effort between the banks and the Obama Administration makes shorting a perilous activity, especially in these low volume markets.

A 'trigger event' of almost any intensity will burn this market to the ground, so the long side is beyond consideration here at least for us.

So what does that mean? We're weighted slightly to the short side but waiting for the short term Sell Signal from our indicators.

12 May 2009

07 May 2009

04 May 2009

SP Futures Hourly Chart Update at 2:30 PM

This may be a 'reflationary rally' such as we had seen off the market bottom in 2003 which precipitated the housing bubble. The rally in gold and silver with the falling dollar helps to reinforce that view. The Treasury and Fed are monetizing debt at a brisk pace. This is bullish for stocks from a nominal standpoint at least.

We are skeptical of an economic recovery, and prefer to think of this stock market action not as signalling a real bottom but as a sucker's rally in which insiders unload positions on the naive and unsuspecting who are taken in by false optimism. It is difficult to tell however, given the opaque nature of the US financial system.

The chart technicals say that if it is not a genuine renewal of the bull, then the rally will likely fail around 915-920. If it is, then it obviously may keep drifting higher along the diagonal trendlines until something dislodges its momentum.

The market will let us know which one it is reasonably soon. Try not to outguess it if you value your portfolio. This is still a "trader's market."

Our key short term indicators have not yet delivered a SELL signal.

30 April 2009

Is the Rally Over, Almost Over, or Still on Its Way to a New High?

"Life is a School of Probability." Walter Bagehot

Probability does not tell you what WILL happen. It only tells you what is likely to happen, with a generous dose of conditionality.

Probability is a living, changing condition in the markets. Additional iformation over time will modulate the forecasts and levels of support and resistance.

23 April 2009

SP Futures Hourly Charts and Short Term Indicators

The market is being supported in a reflationary ramp. The volumes are light, and the action is being dominated by traders who are skittish, and not determined buyers with the conviction to hold.

Is the government involved in propping this market? Are Ben and his friends at Treasury trying to mask the weakness in the banking system?

Of course they are. The proper question is really how long can they hide their errors and mismanagement, and the damage they have caused and are causing to the national economy, if not that of the globe?

These are frightened men, many of whom have compromised their integrity already. Do not underestimate the rationales they will apply to justify actions you, the ordinary person, might consider inconceivable.

22 April 2009

The Setup in the US Equity Markets and SP Futures Hourly Chart

The action in the SP futures market has been particularly heavy handed and blatant since the heads of the money center banks met with the Community-Organizer-in-Chief at the White House. This market is being shoved around like a gaijin granny on the Tokyo subway in rush hour.

The action in the SP futures market has been particularly heavy handed and blatant since the heads of the money center banks met with the Community-Organizer-in-Chief at the White House. This market is being shoved around like a gaijin granny on the Tokyo subway in rush hour.

To our minds, it is just as likely that we are being set up for a terrific leg down. In our experience the big dogs tend to dominate certain portions of the short side at the apogee of a stock market pump. Our target for a failure point on the SP June futures is about 858-864.

This market is utterly overbought according to the McClellan Summation Index. Let's see if they can keep it floating up. This does not look like a sustained ramp however, but the pump that sets up the dump.

At some point the equity market will start moving higher and keep going, to fantastic levels perhaps, if a serious inflation sets in. The stock markets in the Weimar Republic were spectacular, if one ignored the reality behind the appearance. We think it is far too early in the game for this, but are keeping an open mind to all possibilities.

The best probability is that we are seeing a pump and dump, in order to provide some income to the beleaguered banks through their proprietary trading desks. We have not been tracking it, but one has to wonder if Goldman Sachs fully placed its large secondary equity offering designed to pay back their TARP funds. The markets often miraculously levitate in sympathetic conjunction with key IPOs and equity tranches.

The banks must be restrained, and the financial system must be reformed, before there can be any sustained economic recovery.

SPY Have Become Hard To Borrow

Posted by Tyler Durden at 9:33 AM

Developing story: Traders confirm several locations indicating SPDRs are no longer automatic borrow and have made their way to the Hard To Borrow list: pre-borrow call is needed versus automatic short prior, as not enough underlying inventory.

Have fun hedging the market when you can not short. Wholesale market squeeze is being orchestrated.

At times such as these, the Cafe uses several indicators to test the nature of a rally. One simple method however is to just watch a parallel market. We like to watch the Nadaq100 futures for confirmations when the SP is being used to manage a market move.