"Narcissus so himself, himself forsook,

And died to kiss his shadow in the brook."

William Shakespeare, Venus and Adonis

Tony Sanders has a very interesting column today pointing out a remarkable spike higher in 'skew risk' for the SP 500.

Here is the definition of skew risk from the the Chicago Board of Options Exchange:

The crash of October 1987 sensitized investors to the potential for stock market crashes and forever changed their view of S&P 500® returns. Investors now realize that S&P 500 tail risk - the risk of outlier returns two or more standard deviations below the mean - is significantly greater than under a lognormal distribution. The CBOE SKEW Index ("SKEW") is an index derived from the price of S&P 500 tail risk.

The crash of October 1987 sensitized investors to the potential for stock market crashes and forever changed their view of S&P 500® returns. Investors now realize that S&P 500 tail risk - the risk of outlier returns two or more standard deviations below the mean - is significantly greater than under a lognormal distribution. The CBOE SKEW Index ("SKEW") is an index derived from the price of S&P 500 tail risk.

Similar to VIX®, the price of S&P 500 tail risk is calculated from the prices of S&P 500 out-of-the-money options. SKEW typically ranges from 100 to 150. A SKEW value of 100 means that the perceived distribution of S&P 500 log-returns is normal, and the probability of outlier returns is therefore negligible.

As SKEW rises above 100, the left tail of the S&P 500 distribution acquires more weight, and the probabilities of outlier returns become more significant. One can estimate these probabilities from the value of SKEW. Since an increase in perceived tail risk increases the relative demand for low strike puts, increases in SKEW also correspond to an overall steepening of the curve of implied volatilities, familiar to option traders as the "skew".

The original posting in complete is below. I did want to take a moment to try and put this skew reading in a better context for the average reader.

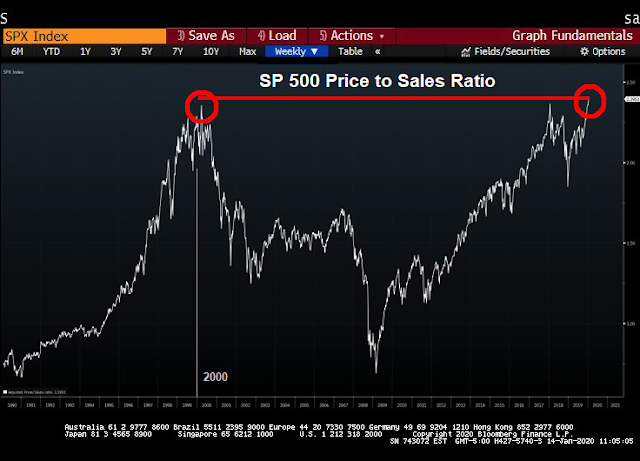

As you can see from the chart below the

spikes in skew are more of an 'early warning' indicator with several steps in the two prior instances of crashes, associated with the tech bubble in orange and the housing bubble in red. I imagine history will find a similarly snappy name for our current bubble which is encompassed in light green.

I wish to stress that there is no simple linear relationship, ie a spike in skew is followed by a crash within six months, with any certainty. In other words, seeing this spike in skew and then selling all your stocks and going short the market with triple leveraged ETFs is probably not a good idea and is not likely to be fruitful, timing and market decays being what they are.

The spike in skew is more of an

indication of trouble, of a stress and fear in the system perceived by some of the more sophisticated in the market who presumably also have superior access to information.

I do believe that in the two prior cases here the continuing rally of SP 500 index after a spike in skew was at least partially a result of the 'Greenspan put' and the 'Bernanke put'.

That is, in reaction to fear and instability in the equity markets, the Fed modified its policy actions that had the effect of supporting the extension of what were at heart a mispricing of risk attributable to credit bubbles. The Fed is not the only actor in this. The regulators and the custodians of the public trust are very much involved in these sorts of macro mistakes.

What made this even more damaging was that, particularly in the latter case, these bubbles were wrapped around a core of extensive control frauds and intentionally mismanaged perceptions of risk, with quite a few enablers both on the Street and within the media and the regulatory bodies, either passively or actively.

I am not saying that all the motives of all the actors were malevolent. But some were.

The notion that the market is infallible is rank romantic nonsense because it will always be within the domain of human action, and is therefore a product of human nature and subject to monopoly and manipulation without the conscious efforts of 'referees.'

N’en déplaise à ces fous nommés sages de Grèce,

En ce monde il n’est point de parfaite sagesse;

Tous les hommes sont fous, et malgré tous leurs soîns

Ne diffèrent entre eux que du plus ou du moins.

In spite of every sage whom Greece can show,

Unerring wisdom never dwelt below;

Folly in all of every age we see,

The only difference lies in the degree.

Nicolas Boileau-Despréaux, from Mackay's Madness of Crowds

And I fear that as so often in the past, though 'this may be madness, there may also be a method in it.'

I would take this spike in skew as more of an indicator of a probability. Notice that the skew spiked earlier in this latest phase, and then dropped as the market continued to rally higher.

There is nothing to say that this will not happen again. Why? Because there are a number of exogenous variables at play in any major market movement to say the least, as noted above in the policy actions of the Fed for example. As Walter Bagehot observed, 'life is a school of probabilities.'

I can easily feature a plaintive response from the economists, 'well what are we supposed to do?'

Reform the market. Get it back to a more stable and less fragile and conductive construction as we had in the 60 or so years following the reforms of the New Deal, which were overturned with the active involvement of so many economists, politicians, and Fed members in the 1990s.

But until that happens I am afraid we will see a series of bubbles and crashes, what I and others have called 'bubble-nomics.'

It is not the 'new normal.' It is an aberration that seeks to sustain itself as the status quo. It is a miscarriage of justice, as old as Babylon and as evil as sin.

It does seem to be a reasonable bet that the ruling classes, existing as they do in an echo chamber of their own illusions, will do nothing to change this without exterior motivation, or compulsion.

It will be an interesting race to see which market blows up first, the stock market or the precious metals markets. Today

Denver Dave asks if there is a scandal brewing in the paper gold and silver market. I would say again, and as I am sure that Dave and others have said and would agree, that there is a high probability, based on some easily observed factual data, of a serious scandal, so much so that it is merely a question of

when that particular pot boils over if nothing changes.

And it may be diverting to observe the increasingly obtuse actions that the plutocrats and their bureaucracy may take to 'save the system.' Or perhaps, at long last, one small crash will serve as the catalyst for many in a grand bonfire of the vanities. But if not, there will be more.

"Make no mistake about it, just as Lehman Brothers was set up to take the fall for triggering the 2008 collapse, China is being groomed as the new scapegoat for the coming crisis. But China’s economic slump is only a symptom, not the disease...

The reality is that the repeal of Glass-Steagall ushered in the greatest wealth transfer scheme in the history of America, allowing six mega banks in America to control the vast majority of insured deposits, use those taxpayer-backed deposits to gamble for the house, loot the bank from the inside by paying billions of dollars to select employees and customers and then hand the gambling tab to the taxpayer when the casino burns down. This model is a staggering headwind on both U.S. and global growth because it has created the greatest wealth and income inequality since the Great Depression.

Pam and Russ Martens, The Real Reason Global Stocks Are Flashing Red this Morning

So in sum, as I seem to have to say so often lately, 'timely caution is advised.'

Here is the original article from

Confounded Interest.

SKEW (S&P 500 CRASH RISK) RISES TO HIGHEST LEVEL EVER!

The CBOE Skew index, a measure of tail risk for the S&P 500 index, just exploded.

It is now at the highest level on record.

It looks like an S&P 500 index downturn follows the SKEW breaching the 140 level.

This is not surprising given how much air has been pumped into asset markets like the S&P 500 index.