Posted by Keith Hazelton, Anecdotal Economics

Benjamin Franklin, when asked at the conclusion of the Constitutional Convention in 1787 what that assembly had created, purportedly responded, “A republic, if you can keep it,” which seems likely given his remarks to Convention members on that September day immediately prior to their vote on the proposed Constitution in its original form.

Often, but on far more occasions in the last three years, we are reminded of a portion of those remarks. Dr. Franklin, given his age (81) and health, asked to have his commentary read to delegates preceding what he hoped would be a unanimous vote in favor of a nonetheless flawed agreement.

“In these sentiments, Sir, I agree to this Constitution with all its faults, if they are such; because I think a general Government necessary for us, and there is no form of Government but what may be a blessing to the people if well administered, and believe farther that this is likely to be well administered for a course of years, (but) can only end in Despotism, as other forms have done before it, when the people shall become so corrupted as to need despotic Government, being incapable of any other.” (Emphasis mine.)

And the question we keep pondering is,

“Are we there yet?” Are we merely slouching toward despotism, or have we arrived? Are we already so corrupt so as to

need despotic government, what with Vampire Squids and corporate/union-bought elections and Congressional bystanders and regulatory capture and Systemically Important Too Big To Fail and Gulf of Mexico oil well disasters?

(Despotism, by the way, describes a form of government by which a single entity rules with absolute and unlimited power, and may be expressed by an individual as an autocracy

or through a group as an oligarchy according to Wikipedia, the world's leading source of made-up information, which is good enough for us.)

In previous posts we have observed the growing and discernible disconnect between several types of government-reported economic data such as Retail Sales and actual state sales tax collections, and the Employment Situation and withholding tax collections. Others also have made solid cases for these disconnects between statistical theory and economic reality and it occurs to me that, far from being isolated or random events, they are evidence of much more disconcerting forces at work.

Fudging on unemployment numbers or "rounding up" retail sales reports may seem like minor infractions, and many of these government data reports have been manipulated for years, maybe half a century, but they represent a pattern of conscious, calculated design of "don't worry, be happy, the government's in charge, nothing to see here, so move along."

The Bureau of Labor Statistics (BLS), for example, estimates who is working and who is not, but conveniently excludes millions of people from its composition of the unemployment rate who are not working but neither deeming them “unemployed” because they are “marginally attached” to the workforce or are “discouraged” by a lack of job prospects and no longer are looking for employment (2.3 million as of March 2010 plus another 3.4 million “persons who currently want a job,” who also aren’t counted as unemployed).

Side note: You are well aware, of course, the Social Security Administration probably could tell us monthly almost exactly how many people really are working, not working, working part time, self-employed, and so on based on its receipts of tax withholdings from employers. It is beyond the pale to imagine SSA could not furnish a version of the monthly Employment Situation that would be far more reliable by orders of magnitude than the guesses of the BLS.

As to why government statistical agencies may be reporting "happy" numbers, well, you know the answer to that...government statistics are

lying's fifth circle of hell, just a shade better than Campaign Promises.

How about the major changes to the Producer Price Index and the Consumer Price Index which were made in the 1980s and 1990s to greatly reduce reported inflation numbers as a means of containing the cost of living adjustments (COLAs) for Social Security recipients, as John Williams at

ShadowStats extensively has reported for years?

Or the March 2010 Monthly Treasury Statement, which understated the true government deficit last month by including a $117 billion collection described as “proprietary receipts from the public” by the Treasury, likely TARP repayments but not defined as such. Or the December 2009 Monthly Treasury Statement in which $45 billion extracted from the nation’s banks as a 13-quarter advance FDIC premium also was shown as a “negative outlay” which creates a significant understatement of the true FY2010 deficit picture (so far, $162 billion this fiscal year, which will understate our true deficit by about 10 percent).

Or the “New” General Motors wasting millions of (tax) dollars for print and television ads to promote a fictitious narrative that it has “repaid” government loans of $8.1 billion (to the U.S and Canada) “plus interest” five years early when in fact SIGTARP, the Special Inspector General of the Troubled Asset Relief Plan Neil Barofsky, told Congress and Fox News that GM

did no such thing, that the loan “repayment” did not come the old fashioned way from sales and earnings but from a "cash advance" on another TARP facility which both governments will count as additions to their already significant equity positions. Nothing in those ads mentions the many tens of billions of taxpayer dollars borrowed from China which flowed into General Motors and Chrysler pre-bankruptcy which never will be repaid.

And now the New GM wants to create another automobile financing company, or buy back its former GMAC/Ally unit which itself has received nearly $20 billion of government Too Big To Fail largesse, so it may become even more profitable by returning to sub-prime auto and everything-else lending and have a happy IPO later this year, because as everyone knows, including the New GM's management, there's precious little profit in building cars no one wants and few can afford. "As a dog returns to its vomit, so a fool repeats his folly," (Proverbs 26:11) as

Jesse's Cafe Americain recently observed.

How about the seeming inability to legislate

any significant financial reform in the wake of the worst economic crisis in 80 years, a crisis which, mind you, needed fewer than eight years to erupt once the last shred of restraint – Glass-Steagall – was forcibly removed at the end of 1999 by those who, coincidentally (paging Messrs. Rubin and Summers), have profited so handsomely from its demise.

The Banking Act of 1933 – Glass-Steagall – was a wonder of simplicity in a simpler era. It set forth in a

mere 37 pages of text the safeguards necessary to separate commercial banking from everything else and to ably prevent for 66 years – two full generations – any meaningful implosion of the nation’s financial system. Any search for cause and effect of The Great Recession must begin here. The useless financial reform act – the Dodd act – weighs in at a lobbyist-induced

1,500+ pages, and will do nothing to prevent another financial crisis, nothing to dismantle Too Big Too Fail, nothing to contain derivatives, nothing to audit the Federal Reserve and nothing to curtail abuses in consumer financial practices.

Yet where are the criminal investigations? Where is the FBI? Where are the Congressional inquiries and panels and special prosecutors? Where are the indictments? Where are the perp walks and the jail sentences? Where is the

justice, Mr. Holder and your 50 friends among the states? Aside from two former Bears Stearns hedge fund managers in 2007, and a pretend hedge fund manager - Mr. Madoff - in 2009, a weak SEC civil show-case against Goldman Sachs in 2010 and the mostly voluntary, golden-parachute-enabled "retirements" of a handful of TBTF C-level executives, a number of which, John-Thain-like, merely have revolved around the door a couple of times and landed at another lucrative looting opportunity, nothing has happened. Nothing, nada, zero, zip, dick. Nothing. It's breathtaking in its design and execution.

We now are reliably told the TARP program will cost less than $100 billion when all is said and done. Huh? What about the

$2 trillion-plus of added government debt which itself adds tens of billions to the annual interest servicing burden, or the

$1.5 trillion-plus willed into existence by the Federal Reserve? Who are they kidding?

Or a Health Care Act which, in 2,500 pages manages to spend about another trillion dollars or so and leaves no health insurance company behind, effectively criminalizing, albeit with monetary penalties far less than the cost of individually paid health insurance plans, anyone not otherwise exempted who fails to purchase health care coverage.

It seems to us, after thinking about this topic for some time now, that we have arrived. We have arrived at that point in our civilization in which our government deems it acceptable to obfuscate about things both small and large on the basis that, Jack-Nicholson/Colonel-Jessup-like, we (the rest of us who aren’t lodged in the political/oligarchical castes)

“can’t handle the truth.”And most of the time it would appear they are right, that we – the rest of us – can’t be bothered with such discrepancies and inconsistencies, falsehoods and half-truths. We're too busy trying to keep the house, make the mortgage and auto loan and credit card and student loan payments. We're too focused on our own financial survival to be concerned with what goes on at a national leadership and direction level. And doesn't it just seem

a little too convenient for those who wish to plunder the wealth of the nation to keep the other 90 percent of us so strapped with indebtedness and an outdated personal moral conviction that debts should be repaid regardless of their potential to physically and mentally harm one's well being or, heaven forbid, harm one's all-important credit score, when walking away from debt has been an accepted business practice for

centuries?

It only seems to matter on those rare occasions when things blow up, and the average, non-voting, non-taxpaying citizen awakens from his or her media-induced stupor to ponder that when the curtain is drawn away, it reveals only humans and not wizards, or that the outgoing tide reveals who has been swimming naked or when the emperor is shown to be undressed. But interest in such matters wanes quickly, and the thirst for change recedes silently into renewed acceptance of the status quo, as we now discover.

Soon, no doubt, when markets resume their upward trajectory and the Dow returns to and surpasses 14,250 (probably by this summer) and oh-don't-worry-about-those-6.5-million-log-term-unemployed-because-they're-just-lazy, much of this unpleasantness of the last three years will be forgotten by those more interested in only good news and Dancing With the Stars and American Idol, and the continued warnings of the Cassandras will be deemed evidence that these are, once again, merely the musings of disaffected social misfits or bad-news-opportunists who deep down must hate America (right up until the point at which the next crisis erupts, and erupt it will).

In fact, our short attention spans

are relied upon by the political class of both parties and by the oligarchical class which controls it, as magnificent wealth transfer schemes blossom anew (talk about green shoots...) and the all-so-brief period which has elapsed between the “days away from financial Armageddon” of September 2008 and the "all clear, business as usual" of May 2010 insures, like the watered-down, useless "financial reform" legislation written by financial industry lobbyists which certainly will pass soon, that the laudable goal of making safe our financial system and returning it to the status of handmaiden to legitimate capital-producing and jobs-creating enterprise, will be discarded in exchange for the pretense of life as we knew it, circa 2006.

Only this time, effectively having

destroyed the middle class of Boomers, Gen X-ers, Gen Y-ers, Millennials and Echo Boomers, and having bought the complicit silence of the of a near-majority (47% of Americans paid no income tax whatsoever in 2008) in exchange for bread and circuses, and having largely destroyed the previous primary mechanism by which wealth has been stolen and transferred (credit creation and personal indebtedness), the masters of the universe will have to find a new scam, which, at this writing, appears to be

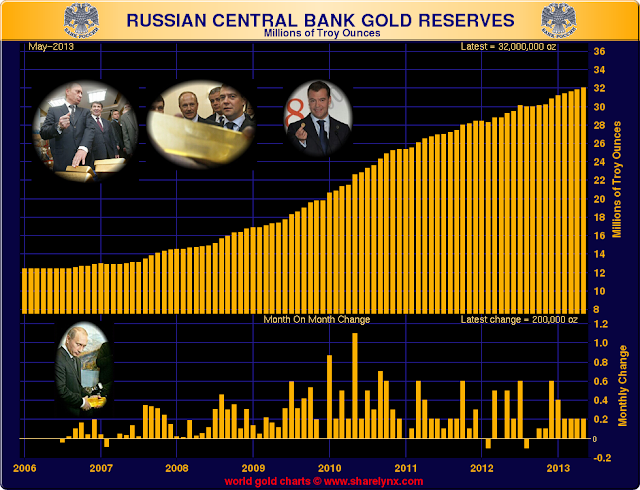

sovereign government debt, currencies and commodities, because turning back the calendar to 2006 alone

will never recreate the consumer spending/debt orgy of 1982-2006.

In fact we think the oligarchs realize this, and they are redoubling their efforts to pillage as much as possible

before the real collapse occurs, even as its seeds already have been sown in this crisis which now

appears, by design and deception, to be ending.

That collapse draws nigh, and Roubini and Taleb and Ritholtz and Panzer and Jesse and Tyler and Mish and Yves and Charles Hugh Smith and Joe Bageant and many, many others already see it, yet all are being dismissed -

again - as those nattering nabobs of negativism who, broken-clock-being-right-twice-a-day-like, were merely “lucky” in guessing about the immediate past crisis as former Fed Chairman Alan Greenspan suggested in a recent television interview.

Tell us Greece is not the

"sub-prime" of early 2007; that the US$150 billion "cure" to be soon applied by the EU and IMF is only

can-kicking but will allow one and all to congratulate themselves on "containing" an isolated problem and to quickly return to the never-ending cocktail party, that is until the next Greece Fire which spreads to one after another country, including, ultimately, the possibility of the conflagration

reaching bond markets in the U.S.Or that a mere US$1 trillion of bailout/rescue/currency support recently proposed by the Eurozone and the IMF to "shock and awe" financial markets dominated by the recently rescued TBTFs who busily apace

bet against the very governments which saved them (except now in Germany), is not merely

another stealth rescue of these giant financial institutions which, having been caught with a bit too much Club Med sovereign debt on their books while their own prop traders work hard to destroy its value, now cry out -

again - that the risk of their insolvency -

again - threatens the global financial and economic systems.

Or that the battling machines of high-frequency trading, which briefly wiped out and then restored a trillion dollars worth of fictitious (paper) wealth in fewer than 15 minutes mid-afternoon May 6

th in a dry-run rehearsal of things to come, won't now become

even more emboldened and empowered to manipulate financial markets in any manner necessary to insure continued quarters of perfectly profitable trading days.

(May 6

th should have been a non-event. We were

expressly warned by the Manhattan Assistant US Attorney in a July 2009 court filing, in which it was alleged that a former Goldman Sachs quant trading programmer stole Goldman's "secret proprietary trading code," that

"there is a danger that somebody who knew how to use this program could use it to manipulate markets in unfair ways." Well, duh. Doesn't it just seem like someone took this code, or a similar one, out for a test drive earlier this month?)

Soon, perhaps if not already, the wealth transfer will be complete, and a

newly impoverished, former middle class will wake up from their recliners to find not only is Dancing With the Stars over, but also is their former debt-fueled way of life as the economy staggers, unemployment escalates, more good jobs are exported and living standards rapidly erode. (

Irony alert: Their former U.S. employers, who effectively have downsized and off-shored their way to record profits, will find they have destroyed their own customer base - the former middle class - who no longer can afford their products.)

When 40 million people are receiving food stamps at one end of the economic spectrum (and probably another 20 million eligible according to the Department of Agriculture), and the bulk of financial and real assets have been concentrated into the top 10 percent of the other end of the economic spectrum, nothing good can come of it. So the well-off cohort will remain well-off and will conspire to direct through their agents in government only enough resources to buy the complicity and silence of the bottom 40 percent, like tax breaks, food stamps, health care subsidies and so on, and the soon-to-be-former middle class will be ground into yet lower levels of the economic ladder, such, that when the looting has concluded, we will see a top 10 percent and a bottom 90 percent, much as feudalistic Europe in the centuries of the Dark Ages.

(We strongly recommend two books on the subject, both of which in far more detail and eloquence lay out the symptoms, causes and effects of our slouch toward despotism:

Survival +, by Charles Hugh Smith at

Of Two Minds, and

Deer Hunting With Jesus: Dispatches From America's Class War, by Joe Bageant at

Joe Bageant (and whose recent post about the American Hologram

Lost on the Fearless Plain also is required reading).

“All lies and jest… Still a man hears what he wants to hear and disregards the rest,” so said Paul Simon, which rings so true more than four decades later. We hear what we want to hear, and, apparently, what we want to hear is that

all is back to normal, that all is good, that the wizards have everything under control, and that nothing bad can ever happen again.

So, are we there yet? Have we not already abdicated our responsibilities as citizens and tacitly embraced the despotism of which Franklin predicted 222 years ago, having become so corrupted (contaminated) as to require

the despotic government of an oligarchy dedicated to insuring the truth never gets in the way of a good narrative, an enormous disparate accumulation of wealth and a firm grip on the levers of power to ensure the preservation of that wealth?

A few Tea Party primary victories and incumbent "mandatory retirements" aside, nothing will change in Washington as long as the strings of campaign cash and lobbyist perks are being pulled elsewhere. The "outs" who soon will replace some of the "ins" promptly will forget about their mandates from the voters the day they move into their new D.C. offices and townhomes and realize from moment one their only responsibility is to their own rational self-interest of

being re-elected in 2012 and 2014 and 2016.

Et tu, Barack?

And if Benjamin Franklin is not prescient enough for you, how about the Teacher, in Ecclesiastes, Chapter 1, v.13-18, from about 2,300 years ago:

What a heavy burden God has laid on men! I have seen all the things that are done under the sun; all of them are meaningless, a chasing after the wind. What is twisted cannot be straightened; what is lacking cannot be counted. I thought to myself, "Look, I have grown and increased in wisdom more than anyone who has ruled over Jerusalem before me; I have experienced much of wisdom and knowledge." Then I applied myself to the understanding of wisdom, and also of madness and folly, but I learned that this, too, is a chasing after the wind. For with much wisdom comes much sorrow; the more knowledge, the more grief. (Emphasis added.)

Indeed, with wisdom comes sorrow, and from more knowledge, more grief. Would, sometimes, that we could empty so much of it from the mush of our remaining gray matter and then we wouldn't have to pretend it's all good, when, in fact, it’s anything but good, as soon, perhaps in a matter of a few short years, we shall see.

We first wrote the following paragraphs in

June 2006, long before sub-prime lending, a bursted housing bubble, Bear Stearns, Fannie Mae, Freddie Mac, Lehman Brothers, Merrill Lynch, CitiGroup, Bank of America, JPMorgan Chase, Goldman Sachs, GM, Chrysler, the Federal Reserve, the Treasury Department and The Great Recession began to dominate our lives, when Franklin’s predictions and our inexorable slouch toward despotism first appeared on our radar screen:

The transition from unitary executive to dictator – conservative, benevolent or otherwise – will not happen in the waning months of the current administration, so uniquely manifested by America's First Triumvirate of George Bush, Dick Cheney and, until recently, Karl Rove, but succeeding chief executives may choose overtly to expand further the envelope-pushing and Constitution-trampling of the 43rd President and his neo-conservative command-and-control cabal as the American oligarchy, and the nation, slouches slowly toward despotism.

As such, we will one day awake from our debt-financed, pleasure-induced stupors to find one person or group firmly in charge, answering to no one, especially not Congress, and in complete grasp of the military, the intelligence agencies, the treasury, the Federal Reserve and the financial and judicial systems. It will happen – it is happening – an inch at a time, until the day comes when not only will we, the fun-loving, celebrity-worshipping, civic-duty-abhoring citizens of America, so embrace the notion of despotism, we will think it entirely our own idea.

Are we there yet?

Keith Hazelton is an Adjunct Professor of Finance at Oklahoma City University's Meinders School of Business and an Economic Adviser to the Oklahoma Bankers Association. His opinions are his own.