Residential Real Estate in the US is in serious trouble, and a drag on the real economy. And yet it is holding up a bit because the Fed is buying over $1 Trillion in mortgage debt, presumably at artficially high prices to support it, and of course the too big to fail Wall Street Banks who were wallowing in the residential real estate bubble.

Residential Real Estate in the US is in serious trouble, and a drag on the real economy. And yet it is holding up a bit because the Fed is buying over $1 Trillion in mortgage debt, presumably at artficially high prices to support it, and of course the too big to fail Wall Street Banks who were wallowing in the residential real estate bubble.

Commercial Real Estate is much worse, a bloodbath in progress. Down 42% and dropping with store, office and apartment vacancies soaring. And much of that paper is held by regional banks and REITs like Boston Properties (BXP), Vornado Realty Trust (VNO), Brookfield Properties (BPO), and a host of private firms and trusts.

Like the residential market, the pain in commercial real estate is not distributed evenly across geographic regions. So far the public equities have recovered reasonably after a breathtaking plunge, as compared to the SP 500's decline from the top. I am watching them for an indication or at least a confirmation of a double dip, a potential next leg down in the real economy and the financial markets.

I hope Ben is wearing a truss if he tries to put a floor under this one.

At least the rental market will be more economical for the foreclosed homeowners, but its hard to see who will be opening new retail stores and commercial businesses in the near future.

My Budget 360

Commercial Real Estate Is $3.5 Trillion Time Bomb Hitting the Economy

Some of you are probably not aware that the commercial real estate market has crossed a dreaded line in the sand. Commercial real estate (CRE) that includes apartments, industrial, office, and retail space is now performing worse than residential real estate. Not just by a little but by a good amount. While the CRE bust took about a year longer than the residential housing bust, once problems started hitting in this market prices have been steadily collapsing. At the peak, it was estimated that CRE values hit $6.5 trillion in the country. With $3.5 trillion in CRE debt outstanding, this seemed to provide a nice equity buffer. That buffer is now erased.

First we, need to examine the actual decline in CRE values by looking at data gathered by MIT:

Putting together all CRE values we find that the market has fallen by a significant 42 percent. Now assuming this figure, that $6.5 trillion is now “worth” approximately $3.7 trillion giving us an equity cushion of $200 billion for all CRE properties in the U.S. I doubt this figure is even that high. It is safe to say that commercial real estate is now in a negative equity position. The U.S. Treasury has discussed plans on bailing out this industry but not much has been done on this front since all the bailout funds have been concentrated on residential real estate and protecting the too big to fail banks. Many CRE loans are held in the smaller regional banks that are actually small enough to fail. The FDIC will be busy in 2010 given the above data.

Now looking at the residential market, prices fell earlier but have recently stabilized because trillions of dollars have been used to prop up the system:

Read the rest of the story here.

16 January 2010

US Commercial Real Estate a Multi-Trillion Dollar Bloodbath in Progress

12 December 2009

The Trend in the Freddie Mac US Housing Price Index

I suspect that the US Treasury and the Fed will continue to monetize the decline in housing prices and the mortgage market. We may see an inflation so that this trend is never realized in nominal values. Ultimately, the government may bury most of the losses in a currency devaluation.

US Housing: Four More Years to Fall - Michael White "The exhaustive Freddie Mac price index fell 2% nationwide in the 3rd quarter and analysis of its data predicts prices will continue to fall for the next four years.

"The exhaustive Freddie Mac price index fell 2% nationwide in the 3rd quarter and analysis of its data predicts prices will continue to fall for the next four years.

While Freddie announced Tuesday that its purchase-only index has gained for the past two quarters, the “Classic Series” of the Conventional Mortgage Home Price Index, which includes refinance appraisals as well as purchase values, has fallen 9% from the high in June 2007 and 3.8% for this year.

The projections say homeowners have lost only $1 for every $3 they can expect to lose in the end.

The trends show values will fall for four years through September 2013. Readers should take this estimate as an educated guess. The estimate may have greater relevance than forecasts described in mainstream-media headlines which typically fail to place new data within a long-term trend..."

17 November 2009

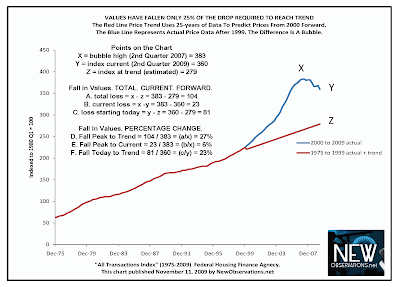

Have Home Prices Only Fallen 1/4 of the Way to Trend?

Interesting chart to say the least.

Ben is pumping the money buttons so hard that the trend may be realized a bit higher in nominal terms once inflation kicks in.

But it may not yet be the best time to buy that new home, unless it is done for a primary residence, and with great care.

As forecast here several times earlier this year, commercial real estate will be a train wreck in 2010. That should help housing find another leg down.

New Observations.net

Values Have Fallen Only 25% of the Fall Needed to Reach Trend

By Michael White

November 11, 2009

PRICE TRENDS / WAR OF THE WORLDS (Part 4): Property owners nationwide have lost only one dollar for every four dollars they can ultimately expect to lose on their home...

Read the rest here.

25 October 2009

CapMark Eats Its Balance Sheet - Declares Bankruptcy

We are watching a train wreck in slow motion, with the Fed and Treasury putting on a smoke and mirrors show to hide the gory details of perfidy.

We are watching a train wreck in slow motion, with the Fed and Treasury putting on a smoke and mirrors show to hide the gory details of perfidy.

Recovery without jobs, solvency, real consumption, or increased manufacturing is not a recovery. This is the corpse of an economy coughing up the remnants of its vitality in response to the Fed's monetary Heimlich maneuver.

And when it is done there will be nothing left, except a pile of markers and an unpayable debt, insolvency and default.

Oh, the dollar will surely stagger for a while, and do some turns and twists to confound the speculators, but its condition is worsening. And what is unthinkable to those who maintain a studied ignorance of history will be a fait accompli... fin du régime, le siècle du dollar.

WSJ

Capmark Seeks Chapter 11

By MIKE SPECTOR, LINGLING WEI AND PETER LATTMAN

October 26, 2009

One of the nation's largest commercial-real-estate lenders filed for bankruptcy protection in Delaware, the latest sign that problems in that market are far from over.

Capmark Financial Group Inc. has been one of the biggest lenders to U.S. investors and developers of office towers, strip malls, hotels and other commercial properties. An independent company that used to be the commercial lending unit of GMAC LLC, a financing affiliate of General Motors Co., it has been in financial straits for months and warned in September that it might have to file for Chapter 11 reorganization.

In its bankruptcy filing, Capmark listed assets of $20.1 billion and liabilities of $21 billion as of June 30. Citigroup Inc. is the agent on much of Capmark's secured debt. Other holders of Capmark's secured debt include hedge funds Paulson & Co., Anchorage Advisors and Silverpoint Capital, a person familiar with the matter said. (The asset - liabilities balance does not seem all that bad. Just how dodgy and marked to fantasy are those assets anyway? - Jesse)

Some of Capmark's debt that can't be repaid might be converted to stock, the person said. Current plans call for all Capmark businesses to be preserved as part of a reorganized company or "sold as going concerns for full value," the same person said.

The filing comes amid similar troubles in the commercial-property arena. Mall-giant General Growth Properties and hotel-chain Extended Stay Inc. filed for bankruptcy in the past year, and more commercial-company real-estate ventures could fail amid an inability to refinance debts and reduced customer traffic as consumers continue to pull back. The difficulties are a blow to Capmark's private-equity owners. In 2006, a group led by Kohlberg Kravis Roberts & Co., Goldman Sachs Capital Partners and Five Mile Capital Partners paid $1.5 billion in cash to acquire lender GMAC's commercial real-estate business, which they renamed Capmark.

The difficulties are a blow to Capmark's private-equity owners. In 2006, a group led by Kohlberg Kravis Roberts & Co., Goldman Sachs Capital Partners and Five Mile Capital Partners paid $1.5 billion in cash to acquire lender GMAC's commercial real-estate business, which they renamed Capmark.

At the time, Capmark proclaimed it was poised to tap capital markets and realize the full potential of all its businesses, which include lending to commercial-property developers and investors; managing investment funds that bought commercial-real-estate debt; and collecting payments on loans, or "servicing." GMAC, meanwhile, boasted the deal would free up $9 billion in capital it could redeploy.

But the deal didn't work out for any of the parties. GMAC suffered heavy losses on its real-estate loans and faced further pressures on its car-financing operations when the auto market collapsed. It eventually had to tap federal bailout money.

KKR, which has written its Capmark investment down to zero, declined to comment. A Capmark spokeswoman didn't respond to requests for comment.

Capmark, based in Horsham, Pa., recently reported a $1.6 billion second-quarter loss. The company deteriorated along with the deep problems plaguing the commercial-property market. Capmark has originated more than $10 billion in commercial-real-estate loans, according to Moody's Investors Service.

One of Capmark's deals was the landmark Equitable Building that rises 33 stories above downtown Atlanta. In 2007, San Diego real-estate firm Equastone LLC paid $57 million for the office tower and took out a $51.9 million mortgage from Capmark Bank. Equastone planned to expand the tower and attract a tenant with pockets deep enough to rename the building.

In April, Capmark Bank foreclosed on the building after Equastone defaulted on the debt.

Adding to Capmark's pressures, the Federal Deposit Insurance Corp. had notified the company it must raise capital and boost liquidity at its Utah bank, which has roughly $10 billion in assets. The bank makes and holds commercial mortgages.

The bank isn't part of Capmark's bankruptcy filing. Capmark Bank got a $600 million capital infusion from its parent company in late September.

Capmark has retained law firm Dewey & LeBoeuf LLP and financial advisers Lazard Frères & Co. LLC, Loughlin Meghji + Co. and Beekman Advisors Inc.

The company has about 1,800 employees located in 47 offices world-wide. It recently reached an agreement to sell its North American servicing and mortgage-banking operations to a new company owned by Warren Buffet's Berkshire Hathaway Inc. and Leucadia National Corp. for as much as $490 million.

Under the deal's terms, the sale could occur while Capmark is in bankruptcy but would require a bigger cash payment.

16 April 2009

Second Largest US Commercial Retail Real Estate Company Files for Bankruptcy

This is the tip of the iceberg, still the early stages of failures in the real economy which has been distorted beyond all reason by the outsized financial sector, a failed regulatory regime under the influence of Wall Street, and reckless financial engineering by the Fed.

AP

Mall operator General Growth Properties files for Chapter 11 bankruptcy

Alex Veiga, AP Real Estate Writer

Thursday April 16, 2009, 3:14 pm EDT

LOS ANGELES (AP) -- The nation's second-largest shopping mall owner, General Growth Properties, filed for Chapter 11 bankruptcy protection Thursday in a tough bargaining move to restructure its $27 billion in debt.

General Growth, which owns more than 200 malls including four in Colorado, said shoppers at its malls will not be affected by its bankruptcy filing.

The Chicago-based company is paying the price for its aggressive expansion at the height of the real estate boom. General Growth, like many homeowners during the frenzy, bought several properties at top dollar and now is finding lenders unwilling to refinance.

The real estate crisis has been slow to affect the market for retail, hotels and office buildings. But the delinquency rate for commercial loans, while still relatively low, is creeping up and could deepen the economic recession.

"While we have worked tirelessly in the past several months to address our maturing debts, the collapse of the credit markets has made it impossible for us to refinance maturing debt outside of Chapter 11," Chief Executive Adam Metz said in a statement.

The news sent the real estate investment trust's stock down 16 cents, or 15 percent, to 89 cents in midmorning trading. The stock traded last spring as high as $44.23.

The move by the General Growth had been widely anticipated since the fall, when the company warned it might have to seek bankruptcy protection if it didn't get lenders to rework its debt terms. Efforts to negotiate with its creditors ultimately fell short late last month.

Chapter 11 protection typically allows a company to hold off creditors and operate as normal while it develops a financial reorganization plan.

The company had about $29.6 billion in assets at the end of the year, according to documents filed with the U.S. Bankruptcy Court in the Southern District of New York.

The company noted that some subsidiaries, including its third party management business and joint ventures, were not part of the bankruptcy petition.

General Growth said it intends to reorganize with the aim of cutting its corporate debt and extending the terms of its mortgage maturities. The company has a financing commitment from Pershing Square Capital Management of about $375 million to use to operate during the bankruptcy process.

Last month, General Growth said it got lenders to waive default on a $2.58 billion credit agreement until the end of the year.

But its Rouse Co. subsidiary failed to convince enough holders of unsecured notes worth $2.25 billion as of Dec. 31 to accept a proposal that would let the unit avoid penalties for being behind on its debt payments and give it some time to refinance its debt load.

In February, the company reported lower-than-expected fourth-quarter funds from operations and a dip in revenue amid weaker retail rents.

The company has suspended its dividend, halted or slowed nearly all development projects and cut its work force by more than 20 percent. It also has sold some of its non-mall assets.

13 February 2009

The Next Bubble to Implode: Commercial Real Estate

Cartoon courtesy of Giovanni Fontana