"A political party in Austria that started as a joke is surging in the polls after coming up with an unusual strategy to curry favor with Vienna's populace — proposing a policy that would give a monthly barrel of beer to each household in Austria's capital. The aptly named 'Beer Party,' is currently polling at 12%, faring better than the center-right ÖVP party, which earned 10% in the latest poll, according to The Local, an English-language news outlet based in Austria.

If the state's elections were held today, the Beer Party would be on track to pick up city council seats. The Beer Party started out as satire. Dominik Wlazny, a 36-year-old musician, doctor, and performer created the group in 2015 to draw attention to what he saw as corruption within Austria's political ranks.

The organization's priorities include getting rid of taxes for beers served at bars while simultaneously upping the tax on 'Radlers' — a 50:50 concoction of beer and lemon soda — as well as similar mixed-drink 'atrocities.' Meanwhile, the party's Radler buy-back program would allow people to turn in the lemon-flavored drinks in exchange for 'real beer.'

Wlazny ran for president in Austria's 2022 elections, becoming the country's youngest-ever candidate at 35 years and 10 months. Among his list of policy goals were a media literacy campaign in schools and a competency test for elected officials. He earned roughly 8.1% of the vote that year, per EuroNews. Besides its beer-themed policy goals, the party also holds a progressive stance on trans rights and green initiatives and wants to expand investments in public transport and sports facilities."

Nick Gallagher, Austria's Beer Party Surges in the Polls Ahead of State Election, The Messenger

Stocks slipped gear back into rally mode today, rising into their highs in the late afternoon on dodgy volumes.

Wash - rinse - repeat.

VIX fell.

The Dollar chopped sideways.

Gold and silver rebounded also going out near the highs.

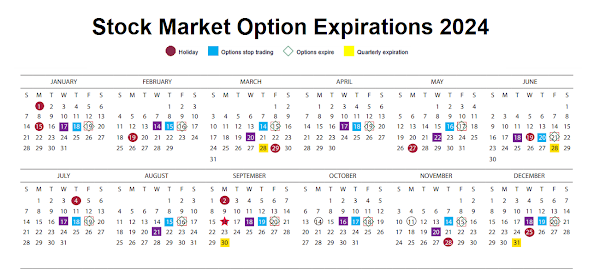

Stock option expiration tomorrow.

There will be a February gold futures contract option expiration next week.

I like the idea of Austria's Beer Party.

We also have less serious satirical political parties in the US that propose outlandish policies and offer even less qualified candidates than the British.

They are called the Democrats and the Republicans.

And because they act so goofy doesn't mean that they are crazy. They just think you are.

And you shouldn't have to be a banker or billionaire to be able to party hearty on the government tab.

Have a pleasant evening.