skip to main |

skip to sidebar

It was 'Risk On' today as stocks rallied and went out on their highs and gold followed.

The US Dollar dropped to a post WW II low against the Yen on talk of QE3. I suspect strongly that someone in Treasury shared some prospective monetary actions with their Asian counterparts today. Apparently they are not so sanguine about the benign affects of modern monetary theory, even of the more benign and traditional Keynesian sort.

The Fed Is Laying the Groundwork for Further Easing - Thoma

Stimulus will not work in a system that remains unbalanced and broken, with the real economy skewed to support a non-productive financial class. And austerity will merely bring the final crash and counter reaction more quickly. It will not 'get it over with.' It is more like driving faster so you can impact with this bridge abutment rather than one further down the road. A flaming wreck is rarely a good outcome. We might consider fixing the car instead. But that would require a change of drivers.

See you Sunday night.

If you had a calm trading day today then you probably were not trading.

Gold and silver were smacked down fairly hard in a two step operation around the NY open this morning in a blatantly obvious bear raid. Stocks also sold off quite sharply.

But then the markets started to recover, if one knows what to look for. I responded by taking down my short stock positions, and added substantially to my bullion position a little after 10 AM.

Something in the selloff did not seem right. Volumes became almost non-existent and prices drifted higher for the rest of the day.

Then this story hit the wires in the afternoon about 3 PM NY time.

The Guardian UK

France and Germany Agree to €2 Trillion Euro Rescue Fund

By David Gow in Brussels

France and Germany have reached agreement to boost the eurozone's rescue fund to €2tn (£1.75tn) as part of a "comprehensive plan" to resolve the sovereign debt crisis, which this weekend's summit should endorse, EU diplomats said."

Was this known in advance by some market participants? It certainly could be thought so. It proved to be a decent opportunity to add back to my metals positions and I was glad I took off the short stock hedges.

So what next? It is hard to say, because this is a very light volume, headline driven market, and the fundamentals are taking a back seat to the events of the day at least for now, with the events dominated by European debt concerns.

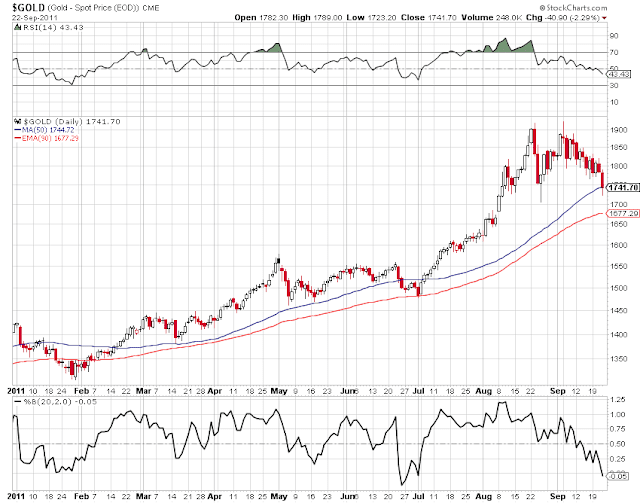

Gold is locked into a trading channel, and I have been buying weakness and selling strength at extremes while it remains therein. How and where it might break out or down I cannot say. But the trend looks up barring a liquidation event.

Speaking of bank chicanery, I see where Bank of America is shifting Merrill Lynch derivates to the books of a bank subsidiary that is fat with FDIC insured deposits.

Apparently the FDIC and Federal Reserve have differing views of this maneuver.

But it should help to clarify why Glass-Steagall needs to be reinstated. And why the Fed may be a poor choice as bank regulator, itself being a private institution owned by the banks.

Gold was strong overnight but was stepped on quite hard about 9 AM London time as is often the case. The east buys and the west sells.

Nothing has broken out yet. So we wait a bit and bide our time.

I am running some moderate gold bullion and a light silver addition on the ability to hold 32. A small hedge short broad stocks goes with it. No miners yet in the portfolio.

Silver and especially gold had nice rallies today as it was 'risk on' with Sarkozy and Merkel crooning a lullaby to the equity markets. The dollar retreated sharply from its zenith. It has not yet broken uptrend.

I wonder if the metals liquidation is over, and if the hands that remain are strong and relatively unleveraged. We will not know until the stock market corrects again and we see if the metals follow.

Earnings season is coming up for stocks. I am not impressed with the stock rally today and put a small short position back on since we have reached my 'bounce' targets. Now we see if we rally on or not.

I am long gold bullion. We have not yet broken out and may be coming to a similar situation that we have had a bounce, but it must move higher than 1680 and 1700 and stick a couple days close to say the trend is higher again in the short term.

So I have a little hedge back on. If the metals break out and stocks keep rallying then the miners look a little more interesting.

I have included the December Gold futures chart to make some of the levels of resistance and their meaning easier to see.

"Get ready for the Pan Asian Gold Exchange, scheduled to open in June, 2012 in Kunming City, Yunman Province...Pan Asian will allow Chinese to speculate in gold futures contracts or buy physical gold through an account with a bank or broker. All 320 million customers of the giant Agricultural Bank of China will simply be able to use their Renminbi, the Chinese currency, from their bank accounts to trade gold. Sounds bloody dangerous doesn’t it.

It means the spot market in gold could be headed for China, and away from London’s Metals Exchange or the Comex in New York. I’d like to know who is going to oversee and regulate all this action. For example, when the Comex raises margin requirements to dampen speculative fervor– will China be governed by that? I doubt it very much..."

Robert Lenzner, The Chinese Mean to Control the Global Gold Market, Forbes

I assume the author, who is the national editor for Forbes, is satirizing some of the silly statements about gold recently appearing in certain other financial journals, all given by Very Serious People (VSP) who say even the most patently absurd things with self important weight, if not decorum.

About twenty years ago Steve Forbes explained his abiding fondness for the gold standard one evening over hors d' oeuvres during a break in a business conference about southeast Asia as I recall. He has promoted it several times since then including during a brief run for president many years ago, and this year predicted a return to a gold standard in the US within five years.

As you may recall I do not recommend such a rigorous standard at this time, given the debilitated nature of the US financial system. But I do think some other countries might consider giving it at least partial consideration and serious thought in their longer term currency plans, along with silver. It is one antidote, even if imperfect, against banker manipulation and financial excess.

And this is why the Anglo-American bullion bank cartel fears any discussion of gold that is not managed carefully, since certain people might get ideas. Here is a news flash for them. They already have those ideas, and you are whistling past your nearly empty vaults. A hideaway home near Lake Lucerne or vacation ranch in Paraguay may be an advisable alternative.

The charts are obviously at a decision point and they may be pushed by the headlines from Europe.

Have a pleasant weekend.

"When nothing seems to help, I go and look at a stonecutter hammering away at his rock, perhaps a hundred times without as much as a crack showing in it. Yet at the hundred and first blow it will split in two, and I know it was not that blow that did it, but all that had gone before."

Jacob Riis

Gold had another up day with stocks, as it was 'risk on' with renewed hopes for fresh infusions of liquidity as we saw from the Bank of England.

I tended to view this action as more 'technical' than fundamental.

I don't like the headline correlation between stocks and the metals like gold and silver which would normally function as a safe haven in a time of increased risk.

Notice the new lines of broad support and resistance levels on the gold chart. We have not yet broken to the upside, so caution is advised.

"The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold's function as an international reserve currency. They don't want to see other countries turning to gold reserves instead of the U.S. dollar or Euro.

Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar's role as the international reserve currency. China's increased gold reserves will thus act as a model and lead other countries towards reserving more gold."

China World News Journal, Shijie Xinwenbao, 04/28/2009

The market rallied today again on headline hopes of an orderly resolution to the Greek default.

There is likely to be a Greek debt default and restructuring. What the market does not yet understand is how it will be packaged and the extent of the damage to the debtholders, in particular some of the European banks.

According to Bloomberg the Europeans are running new bank stress tests based on a range of scenarios. I think the biggest variable is a haircut on the debt ranging from 21 to 50 percent.

What is a bit disappointing is that gold and silver continue to move with stocks, in the 'risk on risk off' trade. It would be better if gold were to rise as a risk aversion flight to safety trade. But of course there is quite a bit of perception management going on.

Non-farm payrolls coming up, and it may remind the markets of other risks. Be careful. The downtrend is not yet broken.

I tend to view 1540 to 1580 as key support for the gold futures based on the third chart.

Depending on how they wrap the rescue I am still thinking that a rally and some spikes will take gold back into a track to hit $2000 by year end. But let's not get ahead of ourselves.

Another low is possible at the supports indicated. And there is significant risk yet in the year end target. But once the ball gets rolling a $150 up day could break the usual pattern of capping rallies at 2%. The western central banks have used quite a bit of their reserves in this latest beat down of bullion.

And I still think the silver Comex market will resolve into a de facto default with forced cash settlements. I am not sure how they will justify this travesty. I think a case could be made that we are already there with so many deliveries being pushed into paper settlements with GLD and SLV.

But let's allow this to play out to the almost inevitable bitter end. There will be a story, and there will have to be some provision to head off an avalanche of litigation.

There is intraday commentary on the derivatives markets with an emphasis on the Anglo-American dominance of the precious metals derivatives markets.

Gold caught a little bounce this afternoon and even closed rising despite a stronger dollar and a weak stock performance. But given the technical damage in the chart it was not significant.

It remains oversold and in a trading range as indicated on the chart. It really could go either way depending on whether their is a resumption of liquidation selling. But the fundamental trend and all the reasons for gold and silver to move higher is still in place. So we will most likely see a resumption of the bull market trend.

Wait for it.

The best I can say about this options expiration week, and the recent Night of the Long Knives, is that is over.

Have a pleasant weekend. Good night.

The markets are waiting for some catalyst, some reason for their next move.

Until then they just churn back and forth.

Gold December futures fell to 1535 and Silver to 26.15 in the overnight session as a determined night bombing raid took them down in the least liquid period of the 24 hour trading day, with the low being reached around 2 AM New York time.

Silver Dec futures are now at 30.78 in New York, virtually unchanged from their open at 30.85, or up over $4.50 from the low.

Gold is at 1623 now, or up $88 from its overnight low.

The December SP 500 Futures had bottomed at 1116 around the same early morning hours, and are now at 1158 or about 42 point from the overnight lows.

Gold has NOT yet broken the short term downtrend, marked with a sharply declining blue line on the chart.

Tomorrow is option expiration on the Comex as we might have expected. I would hope that long term investors would take advantage of these price drops by locking in physical bullion purchases when they can.

However, it is hard to do this with the leverage and margin requirements on Comex especially on the overnight globex trading session. How can an average trader hope to maintain a position? And that is the basis of their schemes.

"It is not immediately clear at this juncture who was selling or why - but in placing such a huge order into the market when the least number of market participants were active tells you that they were out for dramatic effect.

Anyone looking to offload significant amounts of metal at the best possible price would have done so when both London and New York were both open - this would have ensured they would have hit the market when it was most liquid and ensured they got the best price for their sale.

Clearly finessing gold into the market was not their motive - they wanted a statement."

Ross Norman, Sharps Fixley

The interplay between the LBMA 'physical market' and the New York 'futures markets' is fairly obvious. The leverage on the LBMA physical market for gold and silver, as opposed to the London Metals Exchange which trades base metals, is reputed to be around 100 - 1. So any 'run' on the metals will stress the system.

According to their website the LBMA market markers are some of the largest Too Big to Fail banks including UBS, Société Générale, Merrill Lynch (BoA), Credit Suisse, Barclays, Goldman Sachs, JPM, HSBC, The Bank of Nova Scotia ScotiaMocatta, Deutsche Bank.

Big Sell Off today in US markets as cash was being raised over renewed fears of a Euro-meltdown and a US recession.

The long gold - short stocks trade provided balance into this correction, but as of today the stock shorts are gone.

Let's see if the short term trends have bottomed. Unless this is the big one Elizabeth, I think they just might be.

If you are not in it, wait for it. But it is coming, like a freight train.

A selloff. Oh my what a surprise! Yo Blythe, these moves in the metals in front of options expiration are getting way too obvious, and even a bit old.

You will top Kweku Adoboli's $2 billion loss at this rate.

There are high expectations ahead of the Fed's September announcement tomorrow afternoon.

Traders are betting the Fed will cap rates in Operation Twist. There are also even odds that the Fed will cut the rate it pays on bank reserves which it holds. The thinking is that it will give banks more incentive to lend. The downside is the view that if it becomes too close to zero, people will stop making markets in the shortest term Treasuries.

If they do lower this rate, I will view it as justification for the view I put forward over the past two years that the Fed interest payment on reserves acts as a bit of a drag on commercial activity by drawing funds out of the marketplace, in addition to being a tool for managing short rates around the zero bound.

Nice bounce in gold today, but notice it still has not broken the short term down trend. I expect that situation to be resolved one way or the other around 2:30 tomorrow afternoon. But that is the short term paper market. The broad sweep of the global physical market is another story altogether.

"...For what it is worth, this [leased central bank] gold goes right into an Asian vault and it is gone from the West permanently. This is having the effect of transferring Western solid assets over to the East, in size. This has the appearance of desperation because in the end this is really an attempt to save the too big to fail banks that are on the wrong side of a derivative play yet again. That is the reason this is being done.

Western central banks don’t really want that gold to disappear like that, they don’t want to sell that gold. They had to raise dollars in a hurry to pump liquidity into the system, but in the end, as I said, the gold is gone. In the old days the gold would be floating around the LBMA system, there would be a little bit of erosion, but today that gold is being sucked into the East.

This price action has had the effect of creating bearish sentiment, but meanwhile the physical buyers are just sitting there and constantly accumulating physical gold. There are massive orders for tonnage of gold, incredible amounts between $1,715 and $1,760. This has the effect of putting a physical floor under the price of gold. If they make a push to the $1,715 level that would be suicide in my opinion. There are simply too many massive orders for physical gold down to that level for that to be breached.

During this quarter this leased gold is supposed to be paid back, but how? As the central banks come to grips with the reality that the leased gold is gone, there may be a religious experience to the upside in gold and you will see the gold price break the $2,000 level."

London Trader: Massive Physical Floor Under Gold as Asia Buys What West Offers - KWN

This scenario tracks with my charts to an almost uncanny level. But let's see what happens. We still have to get past the FOMC monentary decision tomorrow and the Comex option expiration next week.

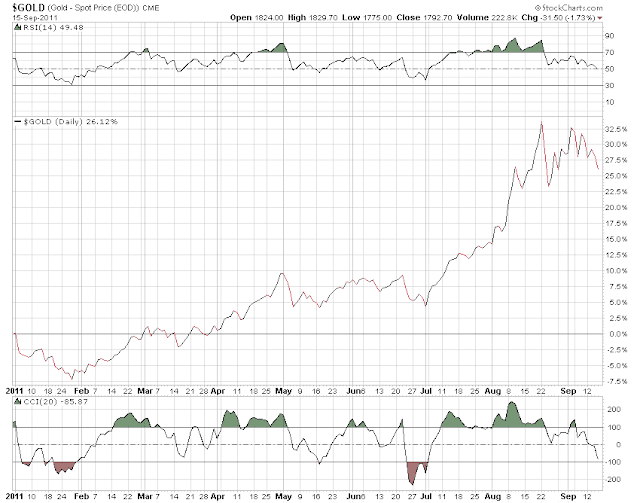

The Gold Daily and Silver Weekly charts are growing rather large since the key breakouts that mark this leg of their bull markets. It does give the big picture, but it could make things a little more difficult to see for the short term movements. Here is a closer look at daily gold.

Although there are a number of possibilities, some of which have been promoted by other 'name' chartists which people have sent to me, it seems most likely that gold is in a short term consolidation pattern, as a pronounced symmetrical triangle. A breakout to the upside seems most likely. That breakout will target 2100.

Notice that gold seems to find resistance and support roughly every $100 higher, at the 80's. So we might expect some hesitation and resistance at the 2080 level should the break out occur.

Barring a major intervention by the central banks, or a liquidation selloff, I fully expect gold to continue to move higher. Rumour has it that China has responded with its terms to remain neutral during such an intervention, and they were draconian indeed. And there is no controlling the mass buying by the peoples of Asia which is still just awakening. Actual buying repression, as opposed to simple price manipulation, is most likely in continental Europe if bank runs occur.

Other forms of general political repression which are already underway in the Mideast, are most likely to make their appearances in at least a few Western countries seeking their Orwellian fulfillment. This depends on some variables which are understandably difficult to forecast. Who will be the first Nato member to declare martial law? .

This is not over, not by a long shot. There is no resolution to the global currency and financing situation which is in a multi-decade change from one system to another. So I would say that we are roughly half way there. My long term target for gold has been in the $4000 to $5000 area, although a spike panic could take us as high as $6700. If it reaches that point I will be a seller of at least a portion of my long term holdings.

My longer term target for silver is in the $250 area, although its volatility could take it above $400 in a buying panic or exchange signal failure. I would consider selling long term silver holdings at the $400 level.

All these levels are obviously reviewed as more data becomes available. What else would an intelligent person do?

Watching the intermediate trend on the second chart, the dip towards 1700 was most likely a significant buying opportunity. I hope so as I took it, and in some size, although I have added and subtracted to that position as the trading fluctuations have suggested in this short term pattern.

I own no stocks, and have a slight short position on the SP.

As a reminder, there is a two day FOMC meeting this week, with their announcement on the 21st. There is also a Comex option expiration next week on the 27th.

Keeping safe is never easy when power is in the hands of the self-interested.

"The thing is right now we are nowhere near bubble territory. If gold were $10,000 we’d be having a conversation about whether that was a bubble, but at the $1,800, $1,900 level that’s absolutely not the case. If you are going to ride this long-term trend at the very high levels that we are talking about, you are just going to have to bear this volatility...."

Jim Rickards

This certainly appears to be a 'risk off' scenario for the metals and the dollar, as statements from Europe rallied stocks and caused some money to flow back into riskier assets and out of safe havens.

But the action in the metals for the past few days has smacked of a determined effort by some large entities, quite possibly central banks, to drive the price down and keep it from breaking out and running higher over $2,000. The timing of a determined gold price action in light trade with the Swiss Bank intervention in the franc.

I suspect we may see additional interventions over the next few weeks, as suggested by the ECB today, and of course in conjunction with the FOMC meeting next week.

The central banks of the West appear increasingly desperate to avert a financial crisis, and the discoveries that proceed from market breaks such as this. And desperate people do desperate things, especially when it involves conflicts of interest and potential charges of malfeasance in office.

I had warned that with the FOMC and a Comex expiration next week we should brace for a rough time in the metals. That comes with the territory. We are having a correction in a bull market.

Stay away from leveraged and short term betting, and play the longer term fundamentals if you find this sort of volatility to be unpalatable.

Gold-Backed Dollar Puts Fair Value at $10,000 Per Ounce - Bloomberg