I have no particular allegiance to either the hyperinflation or the deflationary camps. Both outcomes are possible, but not yet probable. Rather than being a benefit, occupying the middle ground too often just puts one in the middle, being able to see the merits in both arguments and possibilities, and being unwilling to ignore the flaws in each argument. But this is where reason takes me.

In a purely fiat regime, where a monetary authority has the ability and the willingness to monetize debt, there is NO mandated, no predetermined outcome for hyperinflation or deflation in the event of a credit crisis, unless that money is pegged to an external standard, which is ruled out by definition in a purely fiat regime.In a credit crisis there is often a 'credit crunch' which is what was seen in the financial system when short term credit transactions seized up out of fear. This is not the same as a true monetary deflation which is a real contraction in the money supply, at the least. So far we have not seen this. And we may never.

Also, I would have to agree that the eventual fate of all fiat currency is failure and reissuance of a 'new' currency, due to the sustained erosion of a seemingly incessant, if gradual, inflation. This does not HAVE to be, but it is, as an outcome of human nature. Men will always and everywhere eventually succumb to the temptation of currency debasement, a free lunch, and so they cannot be trusted to manage a nation's affairs with the unrestrained keys to the Treasury.

And at the end of a currency's lifespan, there is quite often a bout of serious inflation that precipitates the reissuance and restructuring. How long this period of time can be no one can say.

That is the simple fact of it. The only limitation on the Fed's ability to inflate is the value of the dollar and the bonds; that is, their acceptability to 'creditors' who are willing to exchange goods and services with real value for paper.

And it should be perfectly clear that to choose a monetary deflation as a fiat policy decision for a country that is a net debtor would be bizarre to say the least.

Everything else is noise and generally ad hominem attacks. And the louder the noise, the less likely the person speaking knows anything about monetary systems.

I read that the Fed has taken on (a euphemism for 'monetized') roughly half of the Treasury debt issued in the second quarter of 2009. And it is quite likely that this is only a part of it, that a good portion of the rest of the debt was arranged for with other central banks, including those who are engaged in large scale currency manipulation of their own which is a de facto monetization on the road to default as China will be finding out most likely some day.

There is quite a bit of misunderstanding on the issue of deflation. As we have discussed before, deflation driven by slack demand is not uniform across product and service classes as it would be during a true monetary deflation. That is because goods and services vary in the elasticity of their demand.

Yes some prices will decrease, as one would expect, especially in those assets whose value has been inflated during a preceding bubble and discretionary items with a significant elasticity of demand.

But other items will remain stable or even increase in price, particularly essential items, and those provided from a sector with an oligopolistic framework.

Why? Because those who control access to essentials will seek to increase prices and 'rents' even during severe recessions to make up for lost revenue streams and profits in other areas of their business. Barring government intervention, every crisis has its profiteers.

So we have the phenomenon of banks being bailed out by the government, with public funds, not lending as they had promised, and greatly increasing fees and cutting services whenever and wherever they can on certain instruments such as credit cards, for example. Or other financial firms taking advantage systemic flaws and leverage and loopholes to game the markets, extracting what amounts to increased rents, a tax, on the nation's transactions, further dragging down the real economy.

Credit is not money. Debt is not money per se. These are things that are instrumental to the process of money creation and destruction.

If I 'owe you' ten dollars, are you ten dollars richer? Not unless you hold some sort of legally enforceable piece of paper to back it up, and even then there is a discount on the value of that paper which is repayment risk, the possibility that I might default on that arrangement.

Money is the sanction of the monetary authority on a particular debt arrangement. It is limited to only that which has been sanctioned, that which passes through the hands of the creditor "into" the money system. This may occur at the point of origin, the central bank, or one of its officially designated representatives, sanctioned by executive order or under the law created by the Congress.

One does not count a private debt obligation held by the creditor as money, in addition to the actual currency that was delivered to the debtor. That would be double counting, a misunderstanding of the accounting system. The debt held by the creditor is an asset, of varying liquidity and risk.

If you have an unused credit card with a $1000 credit limit, do you have $1000 dollars? Does that $1000 dollars exist anywhere? No, clearly not. You may act differently in having it, it may influence your behaviour, but it is not money.

Once you use that card, and 'borrow' $1000 on that credit line, then it does exist as money, and a corresponding liability of $1000 is created and is held by the bank as an asset.

Is that $1000 debt obligation being held by the bank the same as the $1000 in money that was created when you borrowed it and spent it, putting it into motion within the real economy? No. If anything we might have learned from this credit crisis should sink in, the value of collateralized debt obligations, a collection of assets on a variety of instruments, is deeply affected by risk.

This is why a private debt obligation cannot be money, because it is not significantly riskless and is more an asset. Anything that bears a significant risk of default that is not tied to the full faith and credit of the central monetary authority is not money. It is a product, some proxy for money.

Is the savings deposit in excess of FDIC at my local bank 'money?' Yes, but not of the same quality as cash in my pocket. That is why there are a variety of money supply figures.

Is the reduction of debt directly correlated to the levels of money in the nation's monetary supply? It depends on how it is accounted. The debt can be written off, and no 'money' is destroyed per se but the bank will take a writedown on assets. We are seeing this in action today, as vast amounts of CDS and MBS are devalued on the books of the banks.

We make a distinction obviously between the existence of the money itself, and the means or ability to create money through a particular process, which can itself be impaired, without a reduction in the aggregate supply of 'money' depending on how you account for it.

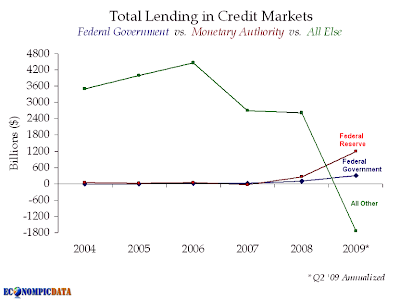

Here is an interesting chart. It clearly shows the precipitous dropoff in commercial lending, and the actions of the monetary authority and the government to step in and support lending, primarily in the programs of the Fed.

This lack of productive economic vigor is impairing the ability of the Fed to maintain an organic growth in the money supply. But it does not stop it. They have some limitation or impairment in their ability to manage the money supply, because of the slack demand in the economy and the loss of the aid of the 'money multiplier' and the moribund velocity of money. The money that is created by the Fed without a corresponding increase in economic activity is 'hot money' that is particularly dangerous from an inflationary perspective.

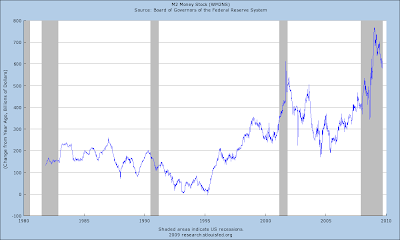

Here is an interesting paradox. At a time of slower growth rate of money supply, many might think that this is 'good' for the dollar, because less dollars means more value for each dollar, right? In essence, this is one of the major tenets of those called 'deflationists.'

First, there are not less dollars. The growth rate of dollars is slowing but as one can see, this is a relative thing historically.

But here is the key point.

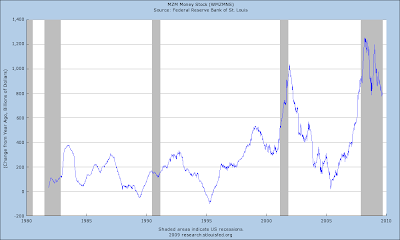

The growth rate of dollars is slowing at the same time that the 'demand' for dollars, the velocity of money and the creation of new commercial credit, is slowing. GDP is negative, and the growth rate of money supply is still positive, and rather healthy. This is not a monetary deflation, but rather the signs of an emerging stagflation fueled by slow real economic activity and monetization, or hot money, from the Fed. The monetary authority is trying to lead the economic recovery through unusual monetary growth. All they are doing is creating more malinvestment, risk addiction, and asset bubbles.

Money supply and the rate of money supply growth is a confusing topic, primarily because lots of commentators twist it and split hairs about it to make points, without really caring to explain what is actually happening to those who are not specialists. 'Experts' hide behind terminology to obfuscate the situation to support particular policy initiatives under a cloud of fear, uncertainty and doubt. Despicable.

We have not written it out and worked the details yet, and the lags and expectations are always a significant issue, but generally the growth in the broad money supply should bear a positive relationship to the growth rate of real economic activity, with the appropriate lags. It ought not to lead it or lag it artificially except in extreme circumstances. Using money as a 'tool' to stimulate or retard economic activity is a dangerous game indeed, fraught with unintended consequences and unexpected bubbles and imbalances, with a spiral of increasingly destabilizing crises and busts. The Obama Administration bears a heavy responsibility for this because of their failure to reform the system and restore balance to the economy in any meaningful way. Whether it is cowardice, ignorance, or corruption is difficult to judge, but it is a failure without regard to motives.

What makes matters worse is that given the cumulative years of government 'tinkering' some of the key economic measures are hopelessly spoiled. The Consumer Price Index is probably the best example as is shown at Shadowstats. Consumer inflation is a key problem because it is used, as the chain deflator, in calculating real GDP, the basic measure of economic activity in a nation.

And so after the cumulative years of financial engineering by the government and the Federal Reserve, here we are today, caught in an ugly cycle of boom and bust, with an outsized financial sector, a government controlled by the money interests, and a productive economy in a systemic decline.

And this is why we say:

The banks must be restrained, and the financial system reformed, and the economy brought back into a balance between the productive and administrative sectors, before there can be any sustained recovery.