skip to main |

skip to sidebar

I would be embarrassed to tell you the prices that were paid for some new positions this morning as the wiseguys 'ran the stops' for another dose of shock and awe. To run the stops means to take the price down quickly with wanton selling to trigger stop loss orders which have been preplaced, creating further selling 'at market.' The exchanges and market makers can see where they are concentrated beforehand.

Over the weekend a reader showed me anecdotal evidence of naked short selling and tape painting by the major financials on some of the Canadian exchanges that was fairly shocking, but required further investigation. He has been sending this to their regulatory authority and been ignored.

For a country with such a sound banking system, the equity markets in Canada are quite exceptional. The Canadian exchanges sometimes appear to be like a carney sideshow, at times making even the Comex look good by comparison. Why they tolerate that sort of thing in such a normally sensible country makes one wonder, as it seems all out of character.

By the way, today is federal election day in Canada. Does anyone south of the border have the vaguest idea of what the issues are for one of their largest trading partners and neighbors? Judging by the mainstream media I think not.

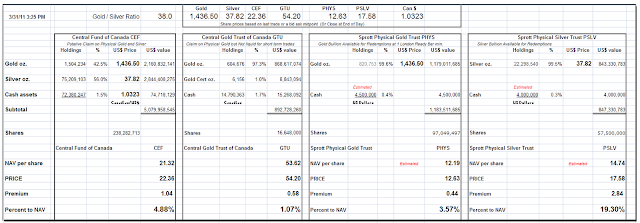

I rarely discuss specific mining stocks and will not do so here. But there are some interesting divergences in the precious metal funds this morning as can be seen in the chart below.

Later...

And near the end of day...

I would start shifting to a net short if the SP futures crack 1290 to the downside.

Until then I would rather be long gold and silver, including some miners, from the dip as mentioned yesterday, and use any stock index and other asset shorts to hedge positions in miners and perhaps silver.

The Net Asset Value Premium chart is included below. There is hardly a bubble like activity in those premiums although the divergences are interesting. They indicate a fear of a break in supply in the physical silver market in my opinion, and not just among retail investors.

People in the trade know Sprott has the silver AND that they can take delivery of it if push comes to shove and they need actual possession of it for some reason. There is no other way that I can explain this except as some arbitrage trade. There must be a fairly sophisticated fear of a risk of a default in the silver bullion market and PSLV is being used to hedge that risk. At least that's my take on this, but I could be wrong.

The economic data continues to indicate a growing stagflation in the US. Fresh information out of the European sector suggests that a 'retructuring' of sovereign debts may be coming. The same could be said of the US, but its nice to own the ratings agencies and be providing liquidity lifelines to half the worlds multinational banks. It adds a panache to one's financial profile, and is certain to buy at least a few friends amongst TWCTF (those who control the flow).

There could be a cage match brewing between the Anglo-American controlled World Bank, and the European dominated IMF, especially if the BRIC's obtain some representation there. In most cases of intense diplomatic discussion it is wise to follow the money, and war, including currency war, is continuation of diplomatic efforts by other means.

Carl Levin has referred Goldman Sachs to the SEC and the Justice Department for multiple counts of perjury and violations of various securities laws. His YESness is trying to raise a billion dollars for his presidential re-election campaign, and those internet donations are not flowing freely from the masses. So would you like to place any bets on a meaningful investigation and any forthcoming indictments? Well apparently some are willing to make that bet. Goldman CDS Jumps on Levin Claims

I'd rather bet that this is some variation of the Chicago-style extortion rackets, with a bait and switch kicker. Been there, seen that done last election. But make little mistake there is almost no one keeping almost anyone of size honest these days between the government and business. The Wall Street satanspawn have co-opted the process.

Without reform of the international trade regime and the imbalanced FIRE sector there will be no sustainable recovery.

This version includes the recent expansion of Sprott Gold and the latest update on the Central Trust.

The premiums to net asset value are interesting.

Notice that the Canadian dollar continues to strengthen against the US dollar, and the gold/silver ratio has dropped to the 36 range.

If the premium on PSLV is rational, then one has to wonder about the premium being applied to CEF. Does the auditing and redemption policy on PSLV make that much of a difference? Something for those who manage these funds to think about as they seek to differentiate themselves from the lesser regarded gold and silver ETFs, SLV and GLD, at least from the perspective of confidence in insurance as well as in gain.

I watched Inside Job last night and I strongly recommend that you see it, and show it to others. It is a very well done, concise, and understandable depiction of the US financial crisis, and how the failure to reform continues to cripple the real economy and the currency, to the detriment of the great majority of the people for the benefit of a relative few who have bent the government, the financial sector, and even the universities to their will.

As an aside, I finally watched No End In Sight, which is another documentary by Charles Ferguson and his team on the Iraq War, concentrating on the blundered occupation and the roots of the insurgency. It is also well worth watching.

These documentaries are a little painful, because they strip away the illusion that these fellows who run things know what they are doing and are competent. This is why I have been saving them up for the right moment where I thought I could bear it. The recent rise in silver and gold gave me the heart to finally watch them, comforted by a feeling that I was not without alternatives.

I have seen whole companies lose the sense of meritocracy, and become like an oligarchy run by a few strong personalities, and their inner clique, stooges and girlfriends, and effectively destroy themselves while those running it line their pockets. There is an elite that is wreaking havoc on the US national level, and it is affecting the global economy.

And to cap the evening, I finally watched Bush Family Fortunes by Greg Palast, which was not nearly so well done as Ferguson's two documentaries, but certainly capped off a discouraging evening's viewing.

What struck me the most is the sheer banality and lack of honorable character, much less virtue, in these financial men and politicians. The financial sorts such as Blankfein and Fuld are like caricatures of human beings. And the politicians are obviously phony and beneath contempt, without honor, lacking even the common virtues underneath a cultivated facade, 'whited sepulchres, which appear beautiful outward, but are within full of dead men's bones and all uncleanness.'

“False greatness is unsociable and remote: conscious of its own frailty, it hides, or at least averts its face, and reveals itself only enough to create an illusion and not be recognized as the meanness that it really is. True greatness is free, kind, familiar and popular; it lets itself be touched and handled, it loses nothing by being seen at close quarters; the better one knows it, the more one admires it.”

Jean de la Bruyere

When justice finally comes, hell is coming with it.

The price of the Central Fund of Canada is likely to remain a bit depressed relative to its NAV and historical averages until their recent additional unit offering is absorbed and the bullion is added to the trust's holdings. The price at which the underwriters obtained their additional shares may act as a short term 'magnet' for the price.

TORONTO, Ontario (March 29, 2011) – Central Fund of Canada Limited (“Central Fund”) of Calgary, Alberta announced today that it plans to offer Class A Shares of Central Fund to the public in Canada (except Québec) and in the United States under its existing U.S.$1,000,000,000 base shelf prospectus dated September 8, 2009 and filed with the securities commissions in each of the provinces and territories of Canada, except Québec, and under the multijurisdictional disclosure system in the United States pursuant to a proposed underwritten offering by CIBC. Central Fund will only proceed with the offering if it is non-dilutive to the net asset value of the Class A Shares owned by the existing Shareholders of Central Fund.

The remaining amount of approximately U.S.$394,295,000 of the original U.S.$1,000,000,000 provided for in the base shelf prospectus is available for this offering. Substantially all of the net proceeds of the offering will be used for gold and silver bullion purchases, in keeping with the asset allocation policies established by the Board of Directors of Central Fund. Any additional capital raised by this offering is expected to assist in reducing the annual expense ratio in favour of the Shareholders of Central Fund...

TORONTO, Ontario (March 30, 2011) - The Central Fund of Canada Limited (“Central Fund”) is pleased to announce that a syndicate of underwriters (the “Underwriters”) led by CIBC have exercised their right to purchase an additional 1,800,000 Class A Shares at a price of U.S.$22.30 per Class A Share, for additional gross proceeds of approximately U.S.$40,000,000 to Central Fund. The Underwriters agreed earlier this morning to purchase 14,350,000 Class A Shares for gross proceeds of approximately U.S.$320,005,000.

The purchase price of U.S.$22.30 per Class A Share is non-dilutive and accretive for the existing Shareholders of Central Fund. The additional net proceeds have been committed to purchase gold and silver bullion for settlement at closing, in keeping with the asset allocation policies established by the Board of Directors of Central Fund. This offering is expected to assist in reducing the annual expense ratio in favour of the Shareholders of Central Fund."

Gold is right up against the big inverse head and shoulders neckline around 1440.

I am struggling to see a breakout here, but it is possible. The last big neckline breakout took place around a failed option expiration gambit.

Maybe Jamie is too preoccupied with the largest unsecured, non-syndicated bank loan every (to AT&T as a bridge loan to buy T-Mobile) to worry about Blythe's capital needs.

I think this AT&T acquisition, and its very rich price, is indicative of what is wrong with the US economy. Money is being generated and held by fewer hands who continue to use it to consolidate their economic and political power.

But these things ebb and flow. The mighty sow their own destruction in their excesses and their overreach. The reign godless as if triumphant, until they fall back upon their knees. It can be a curse or a blessing, to see the true face of that which you serve.

I take profits, holding bullion but trading paper, and retire to the kitchen for the evening trade.

The appetites and customers seem unchanging, but there is always something a little different on the menu if you look carefully. And over long periods of time, tastes and fashions will change back and forth, but the basic ingredients remain the same.

It will be interesting to see if this is a rounded intermediate correction and consolidation followed by a resumption of the fundamental trend and a new breakout higher, as we had seen in May-August last year.

More on this tonight.

I have lightened up on my bullion longs, and taken down some of the paired trade hedges on the other side. I own no miners at this time and my leverage is nil. I am interested in the short side of US equities but am biding my time. They did not break until the second week of January last year as I recall.

My short term bullion positions had grown to be my largest ever, as I felt more confident than usual that 1370 gold and 28.50 silver would hold support and that the selloff was very artificial. These jokers are not all that subtle at times. Their market manipulation has been particularly bold and heavy handed of late. Too Big To Fail or Prosecute apparently.

This lessening of my positions, however, has less to say about what I think is going to happen next, and more about my personal circumstances. After the New Year I will once again be preoccupied with non-financial things that are much more important to me. I should have plenty of waiting time to keep abreast of broader events and will maintain posting.

Money is necessary and we must provide for ourselves. But family and friends are to the heart of our priorities, our life. Things can be replaced, but people can't. And of course, God is all in all.

“Bankers know that history is inflationary and that money is the last thing a wise man will hoard.” Will Durant

I have reopened a 'long bullion - short stocks' paired trade as of yesterday weighted to rather net short stocks but have added to the bullion side here to make it more 'balanced.' I like to capture profits on one side of the trade by adding slowly to the other side if I am running imbalanced but one has to be careful with this approach. The less experienced are better off in cash here, waiting to see where things settle down.

It will be interesting to see if support on the SP futures holds above 1174. I could be adding to the short US stocks position depending on how things progress.

There will be no sustained recovery or financial stability while the market is dominated by TBTF institutions supported by cheap money from the Fed. It really is all about the reform, or lack thereof, and a system that is based on political corruption, insider dealings, and control frauds by con men, what Charles Hugh Smith has called the banality of evil.

The financial jackals will need to look for fresh prey and new hunting grounds.

"The biggest opportunity for us is not necessarily to do more things, but to be Goldman Sachs in more places." Lloyd Blankfein

And the developed nations and their people in their suffering might keep this more famous aphorism in mind:

"Le secret des grandes fortunes sans cause apparente est un crime oublié, parce qu' il a été proprement fait." (Behind every inexplicably great fortune there is a crime that remains undisclosed because it was well executed.) Honore de Balzac, Le Père Goriot

Notable that the Gold/Silver price ratio has dropped below 50.

I have noticed that the Sprott Gold Bullion Fund units outstanding is fluctuating slightly. I wonder if the trust is buying and selling their units in the market on a low scale basis for purposes of cash management. The amount of bullion held is not changing.

If you click on the category name "Net Asset Values" at the bottom of this entry you can see the prior reports like this.

I expect gold and silver to meet our forecast targets of 1450 and 30 barring a meaningful correction in US equity prices. The rally is powerful indeed as people and institutions around the world flee the actions of the US banking system and the fraudulent financial activity that surrounds them. It seems intimately tied to the US dollar, in its creation, use, and distribution. The problem is not that dollars are being created but rather that they are being created and diverted over to unproductive activity including war, fraud, and speculation.

Franklin Delano Roosevelt once said,

"In politics, nothing happens by accident. If it happens, you can bet it was planned that way."

I think this same general axiom applies to certain categories of financial developments. If a firm's or trader's track record looks too good to be true, it probably is. And in my own opinion the US financial markets are rife with insider trading, confidence games, and manipulation.

Obama and the Congress has failed to reform the Too Big To Fail banks, and so this is the state the world now finds itself in with Wall Street and other big multinational banks taking record bonuses from their people. In the US alone Wall Street will be taking a record $144 billions in bonuses this year while the country suffers. To put this in context, M1 money supply is now about 1,800 billion. So Wall Street is taking about 8% of the national M1 money supply in personal bonuses this year not including subsidies both direct and indirect. That is not a financial system; that is racketeering. And any reform movement that does not address this need for systemic reform is misguided at best, and quite possibly yet another calculated diversion from the monied interests.

Here is a Chinese cartoon clip describing the US financial system as it is today.

I am holding no positions now since I am a bit distracted by personal matters, and that this will be almost full time for the next few days. I therefore closed my short term silver and gold longs and their hedges this morning so I will not be distracted by them. Gold and Silver are already so close to the targets I set so many months ago that I consider them fulfilled and would not quibble over a few dollars more. Now we will see what happens next.

In the end all things pass away, and only love endures. I will be watchful for a sign that the US equity market has topped but will resist the temptation to anticipate it. My sense it that we are not quite there yet but I have an open mind, and as I said the other day, I will not underestimate the resolve of the bankers to raise another credit bubble.

With the addition of 7.5 million units, presumably from the allotments to the underwriters, the cash position of the Sprott Physical Silver Trust has risen to over 180 million US dollars according to their data and our calculations.

According to the terms of this trust, the monies must be applied to the purchase of silver bullion. Sprott may have already arranged for the delivery and price of the bullion, but has not yet booked it. Or perhaps they must still secure supply.

Gold and silver received some fairly stiff and obvious bear raids this morning, at least by recent standards, no doubt in anticipation of the FOMC announcement of Quantitative Easing II this afternoon. Market manipulation will continue until public confidence is restored. lol.

Today I am still running light positions in a well balanced pair of long bullion and short stocks, particularly in the financial sector. I expect I might make some changes around 2:45 New York time this afternoon.

The gold premiums are highly contracted.

This could be the result of arbitrage hedging which we have discussed in the past. Essentially one could buy the futures and sell short PHYS and pocket any premium differential.

Traditionally it had been a sign of a lack of 'exuberance' in the specs over the future price moves.

The premiums tended to expand during speculative public buying AND short squeezes in the unit trusts.