'What has been will be, what has been done will be done; there is nothing new under the sun.'

Ecclesiastes 1:9

"The commercial world is very frequently put into confusion by the bankruptcy of merchants that assumed the splendour of wealth only to obtain the privilege of trading with the stock of other men, and of contracting debts which nothing but lucky casualties could enable them to pay; till after having supported their appearance a while by tumultuary magnificence of boundless traffic, they sink at once, and drag down into poverty those whom their equipages had induced to trust them."

Samuel Johnson, Rambler #189, January 7, 1752

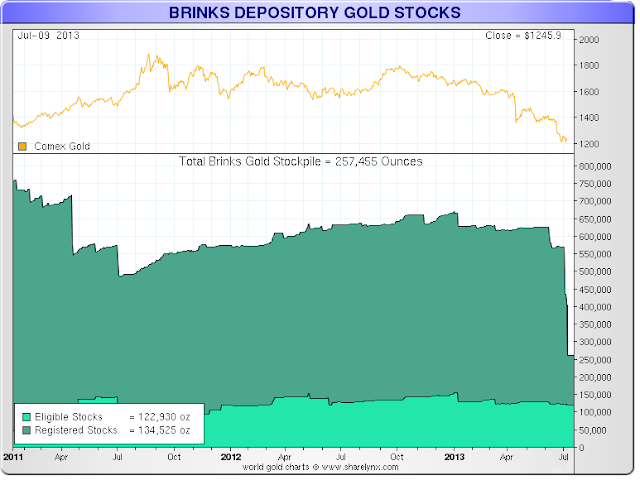

'Registered gold' is bullion in the Comex warehouse that is available to futures contracts standing for delivery. There is also a much larger category of ounces stored, at least according to reports by some organizations, that are 'eligible' to be sold, if the owners of the bullion should decide to place them in the 'registered' category.

According to the chart below the number of registered ounces at the Comex are approaching a record low. That in itself has some significance, but I think the point of this chart is that the registered category typically reaches these low levels at major market bottoms.

Simply put, owners of bullion are not willing to put their bullion up for sale at the paper gold market price set by Comex. They would rather let it sit in storage and pay fees.

Now, in addition to this, there is quite a bit of controversy and speculation that the bullion banks have been leasing out that customer gold that is being held in storage. That is what is known as

rehypothecating.

Rehypothecating simply means that a financial institution uses an asset that is pledged as collateral for another transaction of their own. And these days these rehypothecation schemes tend to go to multiple stages like a daisy chain, or dominos. Bank A takes a customer asset and lends it out to Bank B. Bank B uses that same asset as collateral to Bank C. And Bank C uses that same asset once again.

We saw this first level rehypothecation in the collapse of MF Global. That company was using customer assets, whether they be cash, financial paper, and even actual bullion, as collateral with other banks, including JP Morgan it appears, to back their own private speculation in the markets. When the markets turned against them, the collateral was 'called' and the scheme collapsed.

What made that rehypothecation particularly odious is that such assets held by a clearing broker are considered untouchable and 'sacred.' But as it came out in the aftermath of that scandal, we are indeed in different times with regards to oaths, pledges and obligations in finance.

This is not all that dissimilar in character to the Madoff scheme, which is why it is prohibited. Customers provided the Madoff fund cash, the front men and Bernie Madoff took their fees, and then that money was committed to pay other fund obligations, notably the returns that investors holding paper obligations were owed if they chose to withdraw them. Madoff just

cut to the chase and did not bother with the investment part of the deal.

So if there is a rehypothecation scheme going, and there is a run on the bullion banks at these prices, as customers refuse to voluntarily offer their bullion for sale, and other sources of supply become exhausted, eventually a 'market break' will occur and the scheme will be exposed.

And to complicate matters, it is likely that a significant quantity of gold has been leased out from central banks into these rehypothecation schemes that will not be easily returned. This would be considered 'career affecting' and rather embarrassing to the governments.

Like the case of the Madoff fund, many people on the periphery of the transactions knew that there was a likelihood of fraud, and that at the very least, something was wrong. But it is risky to say or do anything, and very lucrative to keep one's mouth shut and hope to plead ignorance of the scheme later on.

Conspiracy is hard to prove unless one has 'smoking gun' admissions on tape, and too often not even then in this culture of fraud where the professional courtesy of moral hazard is more the rule than the exception.

I should note that even in the endgame stages of the exhaustion of a highly leveraged rehypothecation scheme, a more likely outcome would be to let the price of gold rise, and hope that this tempts new bullion supplies on to the market. This would allow the cycle of this scheme can go along for another turn of paper selling and price manipulation.

I do think that the spike in gold to $1900 was just such an instance. And the opposite was tried in the recent price smackdown, because allowing the price to rise put some of the derivatives bets of the TBTF financiers at risk. They have to work that short position down first before allowing gold to rise in price.

But I would not be surprised if they will try and frighten out holders of bullion with more price raids before this. That ploy eventually fails as the bullion passes into stronger, more sophisticated hands. And the governments and people of the East are certainly doing their part to make it happen.

It will not be the registered inventory at the Comex going to zero that will break this scheme. Rather the registered inventory at the Comex will fall to zero within the context of a general run on the bullion banks. First one or two, and then a rush. We may continue to see scattered shortages for some time first. Confidence breaks over a long period of time, and then it collapses all at once.

This rehypothecation scheme has its roots in the 1990's. I think that the crucial turning point in this occurred in 2000-2001 with the selling of England's gold in an act that became known as

'Brown's Bottom.' It was likely done to rescue some bullion banks that had been caught on the wrong side of a bullion carry trade.

I do not think it is a question of

if this rehypothecation scheme fails, but

when. I no longer doubt that there is a highly leveraged rehypothecation scheme in the precious metals markets, and probably others as well. The circumstantial and direct evidence is just too persuasive.

Since Germany apparently cannot have its 300 tonnes of sovereign gold back for almost seven years, one might conclude that only a relatively small amount of bullion is required to collapse this paper pyramid scheme. We are likely in the

endgame.

So let's see what happens. I think after the worst is exposed, people will remark how obvious it all was. It will be like the housing bubble, which really was the vehicle for the CDO pyramid scheme of mispricing of risk, abuse of collateral, and fraudulent representations of ownership and quality.

The western governments may try to impose some draconian settlement. And I think most of the world, and a goodly portion of their own countries, will tell them 'to go shit in their hats,' as my old boss used to say. And then the coverup will begin, the small fry and scapegoats who were involved will be thrown to the wolves, and losses distributed to the innocent. That is where we are now with the latest credit bubble.

The jokers who are behind these types of schemes are bad enough. They are despicable conmen, no matter how one wishes to cover up their schemes with sophisticated words and jargon. Madoff was simply a thief. And so were the responsible parties at Enron, MF Global, the LIBOR manipulation, the mortgage debt frauds, and so forth.

These schemes of manipulating key prices and commodities is as old as markets, as old as the folly of greed.

The notion that markets are naturally virtuous and self-correcting are a ludicrous and harmful fallacy, generally nurtured by conmen who seek to corrupt them.

But their enablers, those who facilitate the schemes and cons and who defend them too often for the rewards of position and pay, are just as bad. And that net of culpability reaches further and wider, into the chambers of government and the halls of universities.

The perpetrators will be brought to account eventually. It is for us to see that justice is done in this world in accord with the law. And if the law is corrupt, it is our duty to work for its reform.

If you have your wealth secured in the right ways and places, you may not be overly affected by this scandal, except perhaps from some anxiety and scarcities of goods that will pass with time. Life does go on. These fellows are not necessary to the functioning of society. Quite the contrary, they are parasites.

I do think being prepared is a good idea. But look at those who were ruined by Madoff and MF Global. If you did not have your money with either of them, you were not affected all that badly.

I tend to think that this scheme too will be circumscribed a bit, through a coverup, and the printing of a virtual moat of paper. And I think we all know how to deal with even a serious inflation whether we feel confident of it or not. I still do not believe that a hyperinflation is likely.

Those of us who lived through the serious inflation of the 1970's will remember what it was like. Those on fixed incomes may suffer the most, and we need to make sure that the pigmen do not take advantage of them, or add to their misery. And they will try.

This latest crop of demi-gods knows no shame and has little self-restraint. They are walking occasions of sin. And they are always with us. It is just that sometimes we let down our guard, and justice fails.

History repeats, and remarkably so, because we so easily forget what we and our forethers have learned, and succumb to the same old temptations and excesses of the few.