"The Brussels Eurocrats are in the image of Plato’s Philosopher King, only there are too many Kings all believing themselves to be the most capable ruler. For two years I have written that the European leaders feared referenda more than anything, for direct democracy was an affront to the wisdom of the self-anointed elite. The European project was too important to be left to the capricious voters...The ruling elites, the Davos Gang, are not really financially astute for the Greeks could have kicked the proverbial can down the road for a mere 7.5 billion euros. Today’s market response to the new uncertainty probably wiped 500 billion in value off global equity markets and raised borrowing costs for the less credit-worthy countries of peripheral Europe. Egomania, like a membership in a quality credit card company, has a price to be paid...It is not economic contagion but political contagion that strikes fear in the heart of Angela Merkel."Yra Harris, Looking Back on the European Dystopia"Our main challenge, since the global financial crisis, has been to make rapid (or at least as rapid as possible) progress toward achieving these objectives. While it has taken a long time, and extraordinary monetary policy actions, the U.S. economy is now close to full employment..."Stanley Fischer, Vice Chairman Federal Reserve, Monetary Policy In the US and Developing Countries, 30 June 2015

And in fairness to the hubris of the Eurocrats, the same thing can be said today about the ruling elite in the US, especially the Federal Reserve. At some point in the credibility trap, power begins to serve itself without the veil of reason or the pretense of progress towards a 'cure.'

And as for The Recovery, maybe the ruling elite don't even know anyone who is unemployed, or struggling as one of the working poor. Why would they fraternize? Or maybe Stanley Fischer was just pulling our leg, winding us up, in light of the 37% of the people not in the labor force.

And as for The Recovery, maybe the ruling elite don't even know anyone who is unemployed, or struggling as one of the working poor. Why would they fraternize? Or maybe Stanley Fischer was just pulling our leg, winding us up, in light of the 37% of the people not in the labor force.

Now that the political class has put on the feed bag of corruption, they need only pay attention to the rabble during the occasional election contest. It is not a genuine two way conversation between representatives and the people, but performance art which is carefully stage managed using a mountain of dark money. Otherwise, the people can be generally ignored while in pursuit of personal power and privilege.

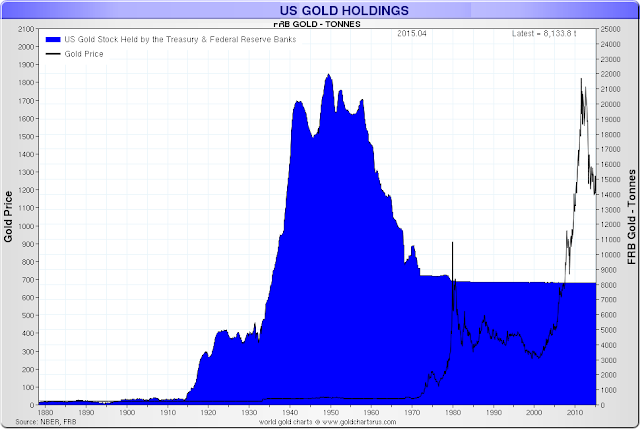

Gold and silver were held down to the lower bound of their trading ranges for the end of the 2nd quarter.

Almost 4 million ounces of silver were 'claimed' on the Comex. As can be seen from the warehouse reports however, the physical bullion in the warehouses is mostly pushed around the plate, like unwanted vegetables. It is becoming an embarrassment, and barely sustainable.

Accounts will be balanced. Even the biggest lies, intended to last for a thousand years, unwind. There is a reckoning coming, and a downfall.

Have a pleasant evening.