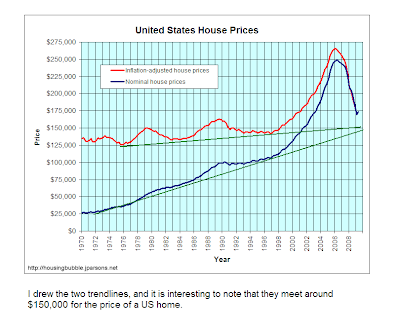

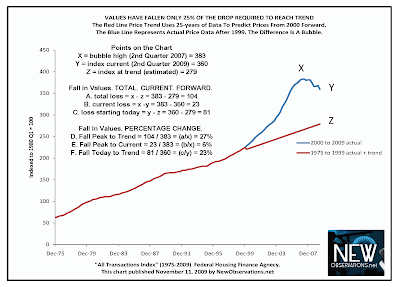

Here is the graph associated with a view of the deflating housing bubble that shows we have appreciably fallen, further than the 25% in the blog entry from yesterday.

For the details on this view read

here.It appears that both sets of numbers, the ones above and the ones from yesterday, have been adjusted somewhat.

The numbers from yesterday are Indexed to 1980 = 100, and are therefore a percentage of increase.

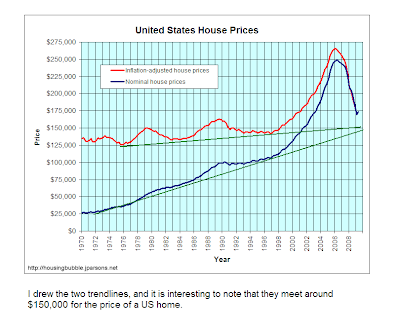

The numbers above are nominal prices, and then adjusted for inflation using some governmental measure presumably.

One appears to be based on median prices, and the other on total transactions.

I have not yet reconciled the two views, as I am rather tired and 'under the weather,' compliments of the children's propensity to bring home their sniffles and sneezes at this time of year, the head colds that seem to linger endlessly, despite the repeated application of vitamins, chicken soup, sudafed, ibuprofen, and the occasional sip of Beaujolais Noveau. But for today at least I am, like Mr. Buffett is to the economic recovery, 'all in.'

And yes, I did finally break down and listen to the spouse, obtaining a swine flu vaccination. Perhaps it will help me think like a Fed banker and figure out their gameplan. lol.