“We are slow to master the great truth that even now Christ is, as it were, walking among us, and by His hand, or eye, or voice, bidding us to follow Him. We do not understand that His call is a thing that takes place now. We think it took place in the Apostles' days, but we do not believe in it; we do not look for it in our own case."

John Henry Newman

And indeed, based on the above, we might further wonder if that fallen one, which is the very absence and antithesis of goodness, is also walking the earth among us, and summoning the similarly proud and willful with his intoxicating illusion of power to his embrace as well. Oh no, this surely could not be.

Stocks rallied today in light trading as I suggested that they might yesterday.

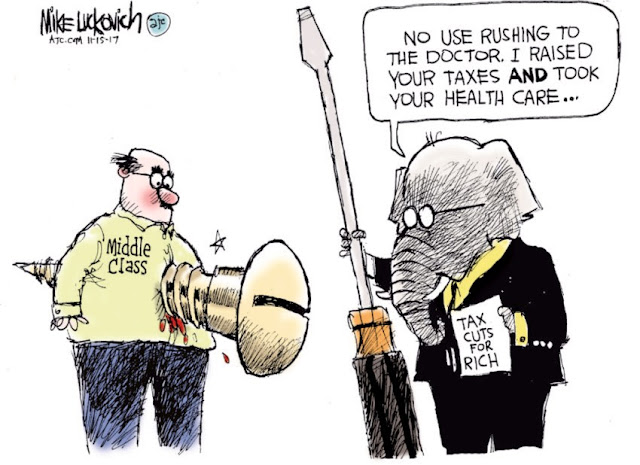

Our elites' hypocrisy knows no bounds.

Bloomberg notes that the House's Tax Reform is 'littered with loopholes for the wealthiest.'

Gold and silver took back a little of the losses from yesterday's resurgent dollar.

Tomorrow is likely to be a slightly buoyant day unless *something happens* overnight, and stocks will most likely strike a level early, and then move sideways for the rest of the day as the adults leave for their holiday.

There will be a light half day of trading on Friday.

I was reading a very interesting article today about Heinrich Himmler's order of 24 Nov 1944, to stop the horrific killing machine he and his minions had constructed at the camps. Himmler thought that if he stopped his genocide, and offered to ship some of the camp inmates to Switzerland, that the Allies would agree to treat himself and his followers as honorable prisoners of war, rather than as the despicable war criminals that they were.

When it became apparent that he would not be easily excused for his years of foul and unspeakable crimes, he settled the matter by biting down on a capsule of cyanide, thus escaping the hangman's news.

His delusion of an easy amnesty based on a last minute, very cynical and transparent change of heart, seems ridiculous, doesn't it?

As Czesław Miłosz wisely noted about such absurdly convenient misconceptions about life, many are lulled by 'the huge solace of thinking that for our betrayals, greed, cowardice, and murders that we are not ever going to be judged.'

Have a pleasant evening.