COMMENTARY: THE WEEKEND INTERVIEW

COMMENTARY: THE WEEKEND INTERVIEW

Theodore J. Forstmann

The Credit Crisis Is Going to Get Worse

By BRIAN M. CARNEY

July 5, 2008

The Wall Street Journal

New York

Twenty years ago, Ted Forstmann contributed a scathing – and prescient – op-ed to this newspaper warning that the junk-bond craze was about to end badly: "Today's financial age has become a period of unbridled excess with accepted risk soaring out of proportion to possible reward," he wrote in October 1988. "Every week, with ever-increasing levels of irresponsibility, many billions of dollars in American assets are being saddled with debt that has virtually no chance of being repaid."

Within a year, the junk-bond market had collapsed, and within 18 months Drexel Burnham Lambert, the leading firm of the junk-bond world, was bankrupt. Mr. Forstmann sees even worse trouble coming today.

For a curmudgeon, he is a cheerful man. When we met for lunch recently in a tony midtown restaurant, he was wearing a well-tailored suit, a blue shirt and a yellow tie. He spoke with the calm self-assurance of someone who has something to say but nothing left to prove.

"We are in a credit crisis the likes of which I've never seen in my lifetime," Mr. Forstmann warns. He adds: "The credit problems in this country are considerably worse than people have said or know. I didn't even know subprime mortgages existed and I was worried about the credit crisis."

Mr. Forstmann denies being an expert in the capital markets. But he does have some experience with them. He was present at the creation of the private-equity business. The firm he co-founded, Forstmann Little, rode the original private-equity boom in the 1980s while skirting the excesses of the junk-bond craze in the later years. It was for a time the most successful private-equity firm in the world, renowned for both its outsize returns and its caution. For two years after Mr. Forstmann wrote his 1988 op-ed, Forstmann Little sat on $2 billion in uninvested funds, waiting for the right opportunities. Savvy investments in Dr. Pepper and Gulfstream, among others over the years, helped make Mr. Forstmann a billionaire.

These days, he devotes most of his professional attention to IMG, the sports and entertainment agency. But the economy has him worried.

Mr. Forstmann's argument about the present crisis starts with the money supply. After Sept. 11, 2001, the Federal Reserve pumped so much money into the financial system that it distorted the incentives and the decision making of everyone in finance. (That distortion of risk, the extreme lowering of the bar in assessing the viability of projects and investments, is known as "moral hazard." Some economic commentators attack the notion as 'old-fashioned moralism' as a rhetorical device. It is nothing of the sort. It is a defense of private finance. - Jesse)

He illustrates this with what he calls his "little children's story": Once upon a time, when credit conditions and the costs of borrowing money were normal, the bank opened at 9:00 a.m. and closed at 5:00 p.m. For eight hours a day, bankers made loans and took deposits, and then they went home.

But after 9/11, the Fed opened the spigot. Short-term interest rates went to zero in real terms and then into negative territory. When real interest rates are negative, borrowing money is effectively free – the debt loses value faster than the interest adds up. This led to a series of distortions in the financial sector that are only now coming to light. The children's story continues: "Now they [the banks] have all this excess money. And they open at nine, and from nine to noon or so, they're doing all the same kind of basically legitimate things with it that they did before."

So far, so good. "But at noon, they have tons of money left. They have all this supply, and the, what I would call 'legitimate' demand – it's probably not a good word – but where risk and reward are still in balance, has been satisfied. But they're still open until five. And around 3:30 in the afternoon they get to such things as subprime mortgages, OK? And what you guys haven't seen yet is what happened between noon and 3:30."

Straightforward economics tells us that when you print too much money, it loses value and prices go up. That's been happening too. But Mr. Forstmann is most concerned with a different, more subtle effect of the oversupply of money. When it becomes too plentiful, bankers and other financial intermediaries end up taking on more and more risk for less return. (Among others we were pointing this out as early as 1998 as it was apparent in the tech bubble of which we were participating. When the Fed started the cycle again in 2003 we were astounded, incredulous. It did cost us some money, because we could not believe the Fed could be that wantonly reckless. - Jesse)

The incentive to be conservative under normal credit conditions is driven in part by what economists call opportunity cost – if you put money to use in one place, it leaves you with less money to invest or lend in another place. So you pick your spots carefully. But if you've got too much money, and that money is declining in value faster than you can earn interest on it, your incentives change. "Something that's free isn't worth much," as Mr. Forstmann puts it. So the normal rules of caution get attenuated. (Anyone who has functioned in a corporate finance position or owned and managed a significant business understands this notion intimately, almost second nature. - Jesse)

"They could not find enough appropriate uses for the money," Mr. Forstmann says. "That's why my little bank story for the kids is a fun way to put it. The money just kept coming and coming and coming and coming. What are you going to do with it? IBM only needs so much. The guy who can really pay his mortgage only needs so much." So you start thinking about new ways to lend the money, which inevitably means riskier ways.

"I don't know when money was ever this inexpensive in the history of this country. But not in modern times, that's for sure." Combine this with loan syndication and securitization, and the result is a nasty brew. Securitization and syndication allow the banks to take the loans off their books and replenish their capital. They then use this capital to make new loans, which they securitize or syndicate and sell to the hedge funds, which buy them with the money they borrowed from the banks. For a time, everyone makes money.

Combine this with loan syndication and securitization, and the result is a nasty brew. Securitization and syndication allow the banks to take the loans off their books and replenish their capital. They then use this capital to make new loans, which they securitize or syndicate and sell to the hedge funds, which buy them with the money they borrowed from the banks. For a time, everyone makes money.

In fact, for six years, a lot of people made a lot of money in this environment. (At the time we preferred to call it the looting of America's future - Jesse) So much money that, as Mr. Forstmann notes, the price of admission to the Forbes 400 list of the richest Americans has gone from $500 million 10 years ago to over $1 billion today. (Mr. Forstmann was bumped from the list two years ago, his reported 10-figure net worth no longer enough to keep pace.)

At the same time, both the size and the number of hedge funds and private-equity funds have ballooned. "I used to have one of the biggest private-equity funds in the world," he says matter-of-factly. "It was, I don't know, $500 million or a billion dollars. If you don't have a $20 billion fund now, you're kind of a [nobody]," Mr. Forstmann says. (The term he used to describe those of us without $20 billion PE funds was both more colorful and less printable than "nobody.") "And so what does that tell you?"

Mr. Forstmann hasn't raised a new fund in four years. But he doesn't blame the hedge funds or the private-equity funds – they are not the villains in his story. "Fundamentally, I don't see them as a cause," he says. "Obviously the proliferation of hedge funds and private-equity funds has created its own dynamic. But this proliferation is simply a result of the vast increase in the money supply."

Mr. Forstmann has been around a long time, so he's seen a lot. But is it possible that he's simply fallen behind the times? By his own description, he's a bit of a figure from another age – "a bit like Wyatt Earp in 1910."

But it would be a mistake to dismiss Mr. Forstmann's pessimism too quickly. After all, he knows something about both credit and crises.

"You've got [Treasury Secretary Henry] Paulson saying 'Oh, you see the good news is it's over.'" The problem, according to Mr. Forstmann, is that it's far from over. "I think we're in about the second inning of this." And of course, the credit crisis wasn't even supposed to last this long. "This all started in August [of 2007], and it was going to get cleared up by October. It hasn't gotten cleared up at all."

One reason is that the proliferation of new financial instruments has left the system more closely intertwined than ever, making a workout, or even a shakeout, much more difficult. Take what happened to Bear Stearns. "What should the health of one brokerage firm in America mean to the entire global financial system? To an ordinary person, probably not much. But in today's world, with all the interdependence, a great deal."

This circular creation of new credit, used to buy more newly created debt, all financed by ultracheap money and all betting with each other, has left the major firms hopelessly intertwined. "It's very interrelated," he says, locking his fingers together. "There's trillions and trillions of dollars that slosh around between all these places and if one fails . . ." He doesn't finish the thought. (On a scale from 1 to 10, we're fucked - Jesse)

Early in our conversation, Mr. Forstmann describes his conversational style as "Faulknerian." The word fits. He jumps between thoughts, examples and anecdotes in a pure stream of consciousness. One such aside is about Warren Buffett and the rule of the three "I"s.

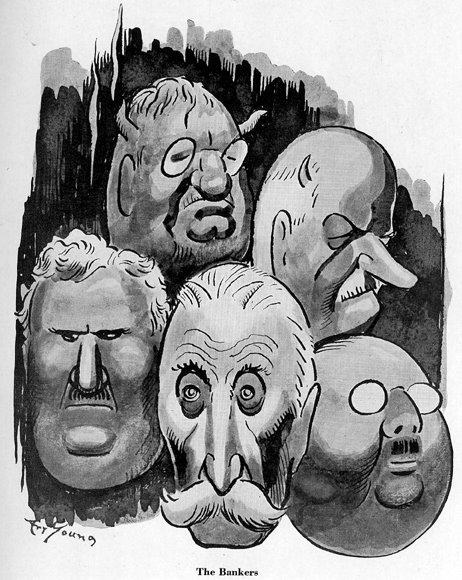

"Buffett once told me there are three 'I's in every cycle. The 'innovator,' that's the first 'I.' After the innovator comes the 'imitator.' And after the imitator in the cycle comes the idiot. Which makes way for an innovator again." So when Mr. Forstmann says we're at the end of an era, it's another way of saying that he's afraid that the idiots have made their entrance.

"We're in the third 'I' for sure," he interjects an hour after first introducing the "rule." "And that always leads to something. Innovators don't just show up. Some disaster takes place because of the idiots, and then an innovator says, oh, look at this, I can do this, that or the other thing." That disaster is now.

In other words, "In order to fix what's going on in the United States there's going to have to be a certain amount of pain. The market's going to have to clear somehow. . . and it's hard for me to believe that it gets fixed without" upheaval in the financial system, the economy and the country as a whole. "Things are going to fail. Enterprises are going to fail. The economy is going to slow," he warns.  To be clear, although Mr. Forstmann talks about "fear and greed" getting out of whack, his is not a condemnation of "greedy speculators" or a "culture of greed" or any of the lamentations so popular among the populists in Washington. It is a diagnosis of the ways in which the financial sector responded to a government policy of printing money that was free, or nearly so. "The creation of much too much money caused all of this excess," he says. In other words, his is not an argument for draconian regulation, but for sound money. (If he really believes that the monied powers were not major precipitants behind this, were not actively lobbying the Congress for the relaxation of long standing reforms, were not packing government positions with their alumni, and were not in part behind the election of a willing tool, the prince of Idiots, then we lose all respect for him - Jesse)

To be clear, although Mr. Forstmann talks about "fear and greed" getting out of whack, his is not a condemnation of "greedy speculators" or a "culture of greed" or any of the lamentations so popular among the populists in Washington. It is a diagnosis of the ways in which the financial sector responded to a government policy of printing money that was free, or nearly so. "The creation of much too much money caused all of this excess," he says. In other words, his is not an argument for draconian regulation, but for sound money. (If he really believes that the monied powers were not major precipitants behind this, were not actively lobbying the Congress for the relaxation of long standing reforms, were not packing government positions with their alumni, and were not in part behind the election of a willing tool, the prince of Idiots, then we lose all respect for him - Jesse)

Nor does he blame Alan Greenspan, even though he argues that this all started with the dot-com bubble and 9/11. "Greenspan," he allows, "had really tough decisions to make, so I don't think it's a black-and-white kind of thing at all." It was, and is, rather, "a case of first impression." Mr. Greenspan, he says, admits that he was "totally sure" that what he was doing was right. But he had "no idea what the consequences [were] going to be." (ROFLMAO. So who would be to blame, the dog? The dog ate our economy? No one wants to name names, because they know before its over that there will be blood. - Jesse)

According to Mr. Forstmann, we are now living with those consequences. And the correction has only begun.

Mr. Carney is a member of the editorial board of The Wall Street Journal.

skip to main |

skip to sidebar

"Let your light shine before others, so that they may see your good works, and glorify your Father in heaven."

Potage traditionnel, consommé sophistiqué

mardi et jeudi à la table du propriétaire

pas de McMuffin

aux champignons et pommes frites

aux cerises

aux-bleuets

“One day, we will have to stand before the God of history. And we will talk in terms of things we've done. And its seems to me that I can hear the God of history saying, 'That was not enough. For I was hungry, and you fed me not. I was naked, and you clothed me not. I was devoid of a decent sanitary house to live in, and you provided no shelter for me. And consequently, you cannot enter the kingdom of greatness.'" Martin Luther King

LE CAFÉ AMÉRICAIN

Mes Amis du Café

"Let your light shine before others, so that they may see your good works, and glorify your Father in heaven."

.

Matières à Réflexion (descending order)

- Elliot Abrams and the Banality of US Human Rights Policy

- US Congress 'Warns' International Criminal Court

- Broad US Housing Prices Follow Money Printing

- Aaron Maté: What the US Has Done in the Ukraine

- Klippenstein: How Big Money Dictates to the US Media

- Wall Street Megabanks Replay Hubris of 2008 Collapse

- Gideon Levy: Holding a Mirror to Ourselves (video)

- Richter: Where oh Where Did My Rate Cuts Go?

- Second Boeing Whistleblower Dies of Infection

- Stoller: US Oil Companies Price-Fixing Conspiracy

- Netanyahu Govt Attempting to Sabotage Gaza Ceasefire

- The Berkeley Free Speech Movement 1964 (video)

- MLK On Freedom of Speech and Assembly (video)

- Sachs: Shocking Suppression of Free Speech (video)

- JPM and Regulators Keep Dark Trading Secrets

- Reprise: Likely Origins of the Covid-19 Virus (video)

- Goldman Rehires Notorious Dallas Fed Insider Trader

.

.

Our Daily Prayers

Let us pray for those whose hearts are hardened against His grace and loving kindness by greed, fear, and pride, and the seductive illusion and crushing isolation of evil.

We pray that we all may experience the three great gifts of our Lord's suffering and triumph: repentance, forgiveness, and thankfulness. And in so doing, may we obtain abundant life, and with it the peace that surpasses all understanding.

We pray that we all may experience the three great gifts of our Lord's suffering and triumph: repentance, forgiveness, and thankfulness. And in so doing, may we obtain abundant life, and with it the peace that surpasses all understanding.

.

.

Search Le Café Archives

.

.

MÉTAUX PRÉCIEUX QUOTIDIEN

Bitcoin

.

.

Translation Service

.

Divertissement Éducatif

.

Archives de Blog

.

.

Soupes, Potages et Bouillons

Potage traditionnel, consommé sophistiqué

Canapés et Apéritifs de la Maison

mardi et jeudi à la table du propriétaire

OEUFS BÉNÉDICTE

pas de McMuffin

English Breakfast

Salade Niçoise

Gigot d'Agneau

Légumes rôtis

Schweinshaxe

Girolles

Homard

CÔTE DE BOEUF

aux champignons et pommes frites

GÂTEAU AU CHOCOLAT FONDANT

Clafoutis

aux cerises

GÂTEAU AU FROMAGE

aux-bleuets

Statistiques de Visiteurs depuis 2/2007

Le Propriétaire

Notice of Copyright © Droit d'Auteur

This original work on this site is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 US License

I make every attempt to respect the rights of others. If you feel that something here has infringed your work please let me know and I will correct it immediately. It is not always easy to determine the status of material posted to the Internet with regard to fair use and public domain.

It is available for your use at no cost, but with attribution and a link to the original posting.

I make every attempt to respect the rights of others. If you feel that something here has infringed your work please let me know and I will correct it immediately. It is not always easy to determine the status of material posted to the Internet with regard to fair use and public domain.

Need Little - Want Less - Love More

These are personal observations about the economy and the markets. In providing information, I hope this allows you to make your own decisions in an informed manner, even if it is from learning by my mistakes, which are many. As a standing policy I never provide individual investment advice to anyone. My comments are intended to be reflection on general macro financial and economic events and trends.