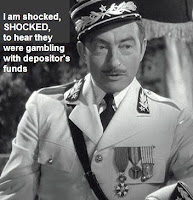

"You are told that your ONLY job is take as much money from your customer's pocket as you can and put it in your pocket. Then they give you all the crappy little accounts and you hit the phones hard and convince them to buy the stuff all the bigger accounts which are "desk" accounts are trying to sell. You move up to "desk" accounts when you prove that you can sell freezers to eskimoes. Aggressive rookies in derivatives beat the bushes globally to find any smaller unloved accounts and they plug them full of exotic derivatives that were designed to have huge yields and no downside - until the markets become very volatile, that is. Before this is over, we will see that just about every financial firm around the globe is loaded with highly questionable derivatives."

Confessions of a Wall Street Bond Trader

Caisse d'Epargne Had EU600 Million Derivatives Loss

Caisse d'Epargne Had EU600 Million Derivatives LossBy Fabio Benedetti-Valentini

October 17, 2008 08:07 EDT

Oct. 17 (Bloomberg) -- Groupe Caisse d'Epargne, the French customer-owned bank in merger talks with Groupe Banque Populaire, reported a 600 million-euro ($807 million) loss on equity derivatives after stock markets plunged last week.

The loss occurred at the proprietary-trading unit of Caisse Nationale des Caisses d'Epargne, the lender's holding company, the Paris-based bank said today. The team of about half a dozen people exceeded trading limits in terms of size and risk, said an official at Caisse d'Epargne. (Rogue traders again, les joueurs compulsifs - Jesse)

European stocks last week slid 22 percent, driving the Dow Jones Stoxx 600 Index to its worst week on record, on concern the deepening credit crisis will push the economy into a recession. The equity derivatives losses don't affect the ``financial solidity'' of Caisse d'Epargne, which has more than 20 billion euros of shareholders' equity, the company said. The stock market plunge may have led to losses at other banks.

``Everyone will have incurred big losses because of market volatility,'' said Bahadour Moussa, a consultant specializing in derivatives recruitment at London-based Pelham International. ``A lot of the banks will have positions they can't unwind or shift and that are losing money, and when the time's up, they'll have to publish losses.'' (Everyone was doing it, Maman - Jesse)

Bank Rescue Plan

Bank Rescue PlanBanks in Europe and the U.S. are also grappling with the impact of the global credit crisis. The French government this week announced plans to loan as much as 320 billion euros to banks to unlock lending and to spend as much as 40 billion euros on equity stakes in financial companies, if needed.

Caisse d'Epargne and Banque Populaire started merger talks last week, with the encouragement of the French state, as the financial crisis put pressure on banks to combine. The banks are the main shareholders of Natixis SA, the Paris-based investment bank that piled up about 3.9 billion of writedowns tied to the U.S. subprime mortgage market collapse by June 30.

The loss doesn't affect the merger plan between the holding companies of Caisse d'Epargne and Banque Populaire, the official said. A deputy of Julien Carmona, Caisse d'Epargne's head of finance and risk management, has been suspended because of the loss and the bank is pursuing ``sanctions'' against the members of the proprietary-trading desk, he said.

Lagarde Calls for Inquiry

French Finance Minister Christine Lagarde, in a statement, said the losses don't threaten the financial strength of Caisse d'Epargne. She asked the French banking commission to carry out an inquiry into the trades, and to ensure that French banks are complying with market controls.

The announcement comes about nine months after Societe Generale SA, France's second-largest bank by market value, reported a 4.9 billion-euro trading loss because of unauthorized bets by Jerome Kerviel. (Le Rogue Trader prototype - Jesse)

The announcement comes about nine months after Societe Generale SA, France's second-largest bank by market value, reported a 4.9 billion-euro trading loss because of unauthorized bets by Jerome Kerviel. (Le Rogue Trader prototype - Jesse)Caisse d'Epargne and Banque Populaire formed Paris-based Natixis in 2006 by merging their investment-banking and asset- management businesses. They own about 34.5 percent each in Natixis and agreed on Sept. 29 that they may raise their holdings by as much as 2 percent each.

Natixis said in July that it plans a ``strong reduction'' of its proprietary-trading business as it cuts 850 jobs and trims costs by 400 million euros in 2009 to restore profitability. French banks had at least 18 billion euros of writedowns and provisions so far stemming from the collapse of U.S. mortgages. (Bonjour, mon nom est Guillaume, et je suis un 'derivatives trader' - Jesse)

Caisse d'Epargne, formed by 21 member banks, is France's third-largest consumer banking network by branches, with 4,770 agencies. Caisse d'Epargne had 358 billion euros of savings and deposits at the end of 2007.

Derivatives are financial instruments derived from stocks, bonds, loans, currencies and commodities, or linked to specific events like changes in the weather or interest rates.