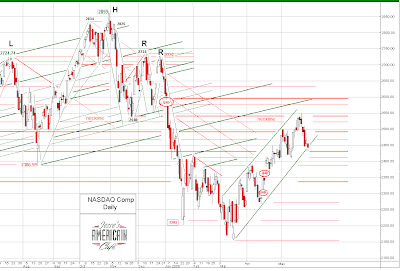

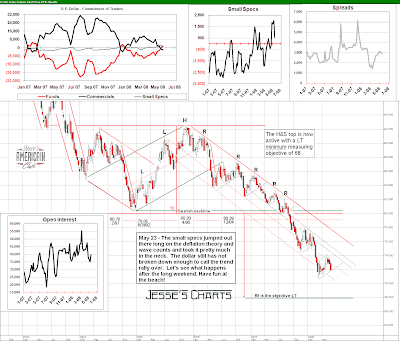

The breadth and volume of the market has been narrow. We remain in a bearish posture on US financial assets that we took roughly around the market peak in October of 2007, and will stay guardedly bearish until the banking crisis is settled.

We are quite certain that it is not behind us yet, not by a long shot. There is another bigger shoe to drop, although that may not occur until the next president takes office, and the Republicans deliver the coupe de grace to the US public. We are also in an economic recession, and the length of the downturn could extend well into 2009 with the damage intensifying if the Fed fails to bring off its gambit of bailing out the banks without triggering a rather nastier bout of inflation, much worse than we are already experiencing.

The pundits' argument on Fox News is that there is "$3.5Trillion" cash on the sidelines, and that this money must go somewhere to seek a return, and the only logical place to get the best returns is in equities.

Oh really? Lets take a look at the actual returns for past year.

There is a significant amount of disinformation being tolerated in the corporate news media these days, and the integrity of many of our institutions are in question. Naive citizens become agitated by the emotional side issues, and we'll expect that to become worse as the national elections approach. Sometimes it borders on hysteria, even among normally intelligent people. This is fed in particular by some news channels, and it is probably best to avoid them as they are a form of pollution to the rational mind.

Signs of the times. We are experiencing a sea change, and traumatic disruptions may become more severe and frequent, especially for those unable to see past the change and understand it in context.

The experience is not dissimilar to other times of historic change and trauma. The experience of Germany and the US between the World Wars comes to mind. The character of the people will be tested. Let us hope we maintain a perspective, and come through this as gracefully as is possible.

'Permabear' Peter Schiff's Worst-Case Scenario

By Kirk Shinkle

May 30, 2008

US News and World Report

Economic punditry tends to fall broadly into glass-half-full or half-empty categories. Then there are those who see a cracked glass, teetering on the edge of a table just moments from a shattering fall. Enter Peter Schiff, the permabear president of brokerage Euro Pacific Capital and coauthor of last year's Crash Proof: How to Profit From the Coming Economic Collapse.

Schiff spent the past decade urging brokerage clients to jump ship from the American economy ahead of what he views as inevitable pain caused by a toxic cocktail of lax monetary policy, wayward spending, and tougher competition from all corners of the globe.

Even with some pain already felt as America's economy stumbles, Schiff saw nothing but downside in a recent chat with U.S. News. You'll want to buckle up for some characteristically apocalyptic talk from one of the gloomiest market watchers around. Excerpts:

Say something positive about the U.S. economy.

There's nothing good to say about our situation. The policies both the Fed and government are pursuing are making the situation worse. We've been getting a free ride on the global gravy train. Other countries are starting to reclaim their resources and goods, so as Americans are priced out of various markets, the rest of the world is going to enjoy the consumption of goods Americans had previously purchased. This is a natural consequence of this phony economy. If America had maintained a viable economy and continued to produce goods instead of merely consuming them, and if we had saved money instead of borrowing, our standard of living could rise with everybody else's. Instead, we gutted our manufacturing, let our infrastructure decay, and encouraged our citizens to borrow with reckless abandon.

So what are you doing about it?

I'm getting my clients' money outside of the United States as fast as they can send it to me. I've been recommending that to my clients for close to 10 years. You've got to own resources and energy. I was saying oil was going to $200 a barrel in 2002. I've been buying gold, silver, industrial metals, and all kinds of stocks. My main theme is the global economy will survive and the U.S. economy is a disaster. Everything is about how you benefit from the increased purchasing power and rising standard of living in the rest of the world.

OK, where are the best non-U.S. markets this year?

I still like Singapore, Hong Kong. Asian markets are the place to be. I like resource markets like Scandinavia. I'm spreading my chips around the world. I'm just avoiding the United States.

What are your best or worst calls through this downturn?

I've been bearish on bonds. U.S. bonds have lost a lot of real value but not nominal value. I still think that's going to be proven to be correct. While the housing bubble was inflating, I was telling people to rent. I was telling people to get out of tech stocks in 1998 and 1999. They kept rising, but then they collapsed, and I turned out to be right. The reality is I don't think I've been wrong on anything.

Most people disagree with that sort of pessimism. If you're staying in the United States, how do you invest?

If you want to be in U.S markets, you avoid anything connected with the American economy. You avoid retailers, the home builders, the financials—anything having to do with consumers buying something or paying back the money they borrowed. If you want to invest in U.S. markets, stick with exporters and resource companies. I've been saying that for five or six years; I haven't gotten anything wrong. We shorted subprime mortgages. I have clients that made 10 times their money. We've never sold an oil stock. We've never sold a gold stock.

Why don't you think soaring oil, grains, or commodities prices are the next bubble?

These prices do not constitute bubbles. They simply constitute the repricing of goods to reflect the diminished value of our money. The way you can tell there's not a bubble is that these markets are clearing. People are buying food and eating it. They're buying gasoline and using it. Speculators aren't buying gasoline and warehousing it in big facilities because they think the price is going to go up. At the same time, we've increased the supply of money dramatically, and the Fed is increasing it even faster now to deal with the bursting of the housing bubble. The only thing that can happen is for prices of commodities to rise to reflect the equilibrium of a greater supply of money. It's not even that oil prices are going up. Oil prices are staying the same. What's happening is the value of money is diminishing, so we need more units of currency to buy the same amount of oil or wheat or corn or whatever.

How about some predictions?

• I think the stock market is headed lower. Gold is going to be $1,200 to $1,500 by the end of the year. That puts the Dow at a less-than-10-to-1 price ratio to gold. Right now, it's about 13 to 1. That's another 30 percent drop in the real value of stocks by the end of the year if you price them in gold. The Dow was worth 43 ounces of gold in 2000. It'll get to 10 by the end of the year and continue to fall from there.

• Oil prices had a pretty big run and might not make more headway by the end of the year. But we could see $150 to $200 next year. I don't think oil will hit $250 because there will be enough destruction of demand in the United States to keep it from doubling. The big problem for us is if the Chinese substantially allow their currency to rise. It could increase at least fivefold against the dollar over the span of a year or two. That reduces the price of oil by 80 percent for 1.3 billion Chinese. Consumption would go through the roof, and that will drive prices through the roof for us.

• At a minimum, the dollar will lose another 40 to 50 percent of its value. I'm confident that by next year we'll see more aggressive movements to abandon the dollar by the [Persian] Gulf region and by the Asian bloc. That's where the stuff really hits the fan.

You're a Ron Paul adviser. He's out of contention, so who wins the election, and what happens then?

The Obama presidency will be like the Jimmy Carter presidency on steroids. I'm pretty sure it's Obama because the economy will be so bad into the election that as damaged a candidate as the guy is, I don't think a Republican could beat him. I think Ron Paul could've had a slim chance because he was different enough.

So how bad do you think this economy will get?

The other problem we'll have during those years is civil [unrest]. There will be a big increase in crime. People are going to be hungry. People are going to be cold. There's a sense of entitlement in this country, and when a lot of people used to having things suddenly don't, everybody looks for someone to blame.

Really?

We're going through a very rough period in our history. In many ways, it's going to be worse than the Depression.