"Fed chair Ben Bernanke has long argued that central banks can bring down long-term borrowing rates by purchasing bonds "at essentially no cost". His frequent writings rarely ask whether foreigner investors – from a different cultural universe – will tolerate such conduct. Mr Bernanke is betting that under a floating currency regime there is no risk of repeating the disaster of October 1931, when the Fed had to raise rates twice to stem foreign gold withdrawals, with catastrophic consequences."

"There isn't enough capital in the world to buy the new sovereign issuance required to finance the giant fiscal deficits that countries are so intent on running. There is simply not enough money out there... If the US loses control of long rates, they will not be able to arrest asset price declines. If they print too much money, they will debase the dollar and cause stagflation."

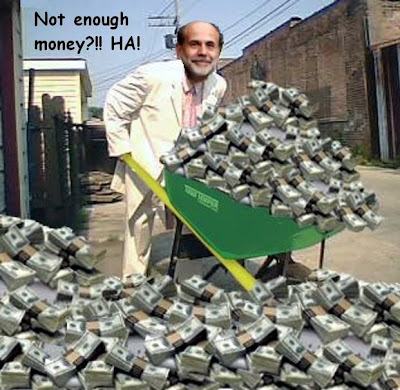

There is enough money if the Fed can run the printing presses fast enough. That is the whole point. The bet is that people will continue to accept it in return for real goods and services, pretending that it has the same marginal value without regard to how much the Fed creates.

The method is to look good by attempting to make most of the competing forms of currency and stores of wealth look equally bad.

UK Telegraph

US bonds sale faces market resistance

By Ambrose Evans-Pritchard

9:19PM BST 24 May 2009

The US Treasury is facing an ordeal by fire this week as it tries to sell $100bn (£62bn) of bonds to a deeply sceptical market amid growing fears of a sovereign bond crisis in the Anglo-Saxon world.

The interest yield on 10-year US Treasuries – the benchmark price of long-term credit for the global system – jumped 33 basis points last week to 3.45pc week on contagion effects after Standard & Poor's issued a warning on Britain's "AAA" credit rating.

The yield has risen over 90 basis points since March when the US Federal Reserve first announced its controversial plan to buy Treasury bonds directly, a move designed to force down the borrowing costs and help stabilise the housing market.

The yield-spike may be nearing the point where it threatens to short-circuit economic recovery. While lower spreads on mortgage rates have kept a lid on home loan costs so far, mortgage rates have nevertheless crept back up to 5pc.

The Obama administration needs to raise $2 trillion this year to cover the fiscal stimulus plan and the bank bail-outs. It has to fund $900bn by September.

"The dynamic is just getting overwhelming," said RBC Capital Markets.

The US Treasury is selling $40bn of two-year notes on Tuesday, $35bn of five-year bonds on Wednesday, and $25bn of seven-year debt on Thursday. While the US has not yet suffered the indignity of a failed auction – unlike Britain and Germany – traders are watching closely to see what share is being purchased by US government itself in pure "monetisation" of the deficit...

The US is not alone in facing a deficit crisis. Governments worldwide have to raise some $6 trillion in debt this year, with huge demands in Japan and Europe. Kyle Bass from the US fund Hayman Advisors said the markets were choking on debt.

"There isn't enough capital in the world to buy the new sovereign issuance required to finance the giant fiscal deficits that countries are so intent on running. There is simply not enough money out there," he said. "If the US loses control of long rates, they will not be able to arrest asset price declines. If they print too much money, they will debase the dollar and cause stagflation.

"The bottom line is that there is no global 'get out of jail free' card for anyone", he said.

"The bottom line is that there is no global 'get out of jail free' card for anyone", he said.The US is acutely vulnerable because it relies heavily on foreign goodwill. China and Japan alone hold 23pc of America's $6,369bn federal debt. Suspicions that Washington is trying to engineer a stealth default by letting the dollar slide could cause patience to snap, even if Asian exporters would themselves suffer if they harmed their chief market.

The dollar has fallen 11pc against a basket of currencies since early March. Mutterings of a "dollar crisis" may now constrain the Fed as it tries to shore up the bond market. It has so far bought $116bn of Treasuries as part of its "credit easing" blitz, out of a $300bn pool.

When the Fed first said it was going to buy Treasuries in March the 10-year yield to dropped instantly from 3pc to near 2.5pc, but shock effect has since worn off. Any effort to step up purchases might backfire in the current jittery mood.

In the late 1940s the Fed was able to cap the 10-year yield at around 2pc, but that was a different world. The US commanded half global GDP and had a colossal trade surplus. The Fed could carry out its experiment without worrying about foreign dissent.

Fed chair Ben Bernanke has long argued that central banks can bring down long-term borrowing rates by purchasing bonds "at essentially no cost". His frequent writings rarely ask whether foreigner investors – from a different cultural universe – will tolerate such conduct.

Mr Bernanke is betting that under a floating currency regime there is no risk of repeating the disaster of October 1931, when the Fed had to raise rates twice to stem foreign gold withdrawals, with catastrophic consequences. This assumption may be tested.

It is not clear where the capital will come from to cover global bond issues. Asian central banks and Mid-East oil exporters have cut back on their purchases of US and European bonds as reserve accumulation slows. Russia has slashed its holding by a third to support growth at home. Even Japan's state pension fund has become a net seller of bonds for the first time this year the country's population ages.

Japan's public debt will reach 200pc of GDP next year. Warnings by the Japan's DPJ opposition party that, if elected this autumn, it would not purchase any more US debt unless issued in yen, is a sign that the political mood in Asia is turning hostile to US policy.

There is no evidence yet that foreigners are in the process of dumping US Treasuries. Brad Setser from the US Council on Foreign Relations said global central banks added $60bn to their US holdings in the first three weeks of May.

This is bitter-sweet for Washington. It suggests that private buyers are pulling out, leaving foreign powers as buyer-of-last resort.

We just have to hope that G20 creditors agree to put a clothes peg on their nose and keep buying Western debt until the crisis passes, for the sake of the world.