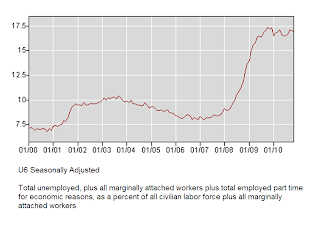

Reality briefly penetrated the fog of appearance this morning as US Non-Farm Payrolls came in at 39,000, a significant miss from the expected 150,000. Unemployment ticked up higher from 9.5% to 9.8%.

An analysis of the data showed a slight indication that the recovery has stuttered and stopped, but it will take a few more months data to confirm this.

The adjustments seems to dampen the potential headline number but are within bounds of the prior six years. The Birth Death Model actually came in negative which was a bit of an outlier but certainly a refreshing nod to reality.

Looking at the historical Oct-Nov growth in the unadjusted numbers for the past six years shows a clear downward trend from the high in November 2005, with the low coming in November 2008. The growth as it stands in 2010 is roughly the same as it was in 2004, although the 2010 numbers will likely be revised in the next two reports.

Stocks and the Dollar initially plunged on the news while gold rallied threatening to take out psychological resistance at 1400. I guess we now know why gold and silver were obviously hit by sharp manipulative selling yesterday, in order to take the prices down below breakout levels. Be on watch for shenanigans in the markets today, especially the SP futures markets.

There can be no sustained economic recovery until the median wage and employment improve and this requires specific reforms and programs to repair the damage caused by twenty years of irresponsible monetary, regulatory, and fiscal policy and a growing imbalance in the balance sheets of the middle class. Repairing the status quo merely restores the unsustainable.

The Fed's approach to quantitative easing is nothing more than an adjunct to the trickle down, supply-side approach. Provide money to the banks and the people will borrow; provide subsidies and tax cuts to those who have the most already and the condition of the many will improve. Trickle down, supply side, and efficient markets hypothesis are at best mistaken economic theories, and at worst coldly calculated propaganda by the same people who co-opted the political process and brought forward the control frauds that led to the financial crisis.