"A number of high-profile investors remain huge holders of gold and silver, amid continuing concern about inflation and the dollar. Mr. Paulson, known for his lucrative bet against mortgages a few years ago, told investors he still has most of his personal money in gold-denominated funds operated by Paulson & Co. Mr. Paulson told investors Tuesday morning that gold prices could go as high as $4,000 an ounce over the next three to five years, as the U.S. and U.K. flood the money supply." WSJ

"The bankers are waging a paper silver war on paper longs. This is why I urge all of you not to play the crooked Comex. The Comex is nothing but a paper game. Do not use leverage whatsoever. Just go and buy the physical silver from your local dealer or bank. This is what will kill the bankers game." Harvey Organ, 3 May 2011

I told a small group of traders, with whom I speak about the markets and our positions during the day, that I was pulling my big Russell 2000 short position hedges off around 3 PM, and was buying into some deeper long positions in the metals sector. And so I did.

Unless this is going to turn into a liquidation event, I believe the consolidation/correction, whatever you wish to call it, is about done, save perhaps for another gut check or two in case the dip buyers get over eager. There was a little profit taking rally back in the last hour, so perhaps I was not the only one who had this idea.

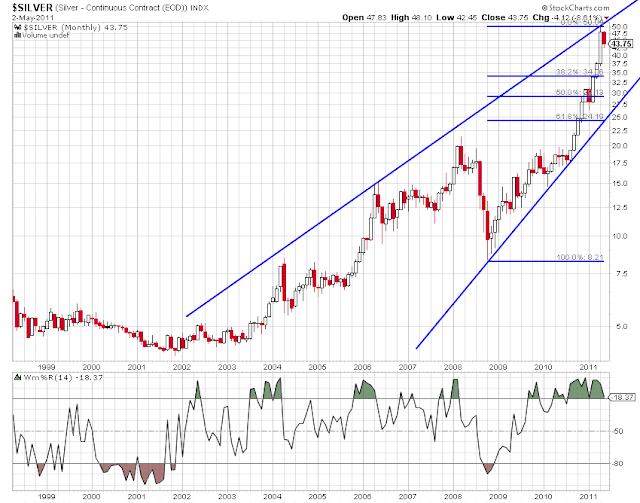

Silver May futures retraced roughly 38.2% of their gains since the last major correction intraday around the low of 40.50, (or 50% from the point of the last breakout), and the major stock indices tested key support levels as well. Gold has done remarkably well, but just eyeballing the chart, it too corrected almost 50% of its recent gains. The gold silver ratio is now back to something a little more familiar around 37.

I was very glad to see this correction in silver because it had gone parabolic. As Jimmy Rogers said, if silver had kept going it would have set itself up for a much greater fall later on. If we can sustain a more reasonable appreciation in the market, I think the upside is much further than most think. It depends on how the banks are able to unwind and hedge their shorts, and the progress silver makes as a store of value and alternative currency, particularly in Asia.

As you know I said I was taking my profits last week. I started buying back in yesterday and today and am now holding PM positions again with some hedges for a stock selloff.

I tend to believe that much of this market action in the States is just the tail wagging the dog, the few managing market prices for their fairly narrow personal benefit. So perhaps this little episode is done for now. The offtake of physical at these lower prices overnight has to be killing the supply lines.

There are rumours that some of the PIGS have been selling their central bank gold under some duress. Too bad they do not have any silver.

I do think there could be a more profound correction in the markets, but not yet. However, something could happen, or I could just be wrong.

Now that Blythe has had her fun, let's see what happens.

Until the banks are restrained and the balance is restored to the economy, markets will not be returning to anything resembling 'normal.'

My friend Pierre Leconte does not agree with my charting of silver, and offers one of his own. I include it here below to show the other side of the discussion.

Obviously I do not believe his chart is probable, but it is possible. I would not measure the retracement from the very bottom

He presents his argument, en français, here at Forum Monétaire de Genève. Here is an 'automatic translation into English.

I would not draw my retracement levels in this way, or a rising wedge in this manner. But that is a matter of taste. His chart does help to explain where some people obtain their forecast of a drop in price to the $27 dollar level. He is using a monthly logarithmic chart.

I will not offer any criticism of his point of view, except to say that I think he does not address the leverage in the market, that is, with the dwindling supplies that have been sold many times, and the persistent buying of bullion that is stressing the 'paper markets.' This is not incidental but critical. The rally in silver is because of a breaking down of a long term scheme to manipulate the price using paper and leverage. And the condition that caused this has not been relieved or corrected. But this is my point of view, my conclusion with which one may or may not agree.

We can discuss these things and remain friendly. This is what makes a market. And the market is the one who will tell us eventually what is correct.

But I think that while Blythe may play the coquette to take our silver, she is really a femme fatale to longer term wealth.