"And remember, where you have a concentration of power in a few hands, all too frequently men with the mentality of gangsters get control."

Lord Acton

Investors do not need a ratings agency to tell them what to think about the US sovereign debt status. The Treasury market is broad and deep, and the facts about the US financial situation are reasonably available, although sometimes hard to retrieve through the fog of rhetoric and deception.

Specialist agencies like S&P are needed to rate more obscure financial instruments and entities without a wide following or deep and liquid markets. And the US ratings agencies have shown themselves perfectly willing to produce 'ratings on demand for pay' over the last ten years for their large financial customers. And nothing appears to have changed.

So today we saw Treasuries rally sharply even on the longer end of the curve where the downgrade occurred. How about that! But it was perfectly understandable.

Why? Because the message was not about the quality of the Treasuries, which the market already knows much better than the bureaucratic paper pushers at S&P. Rather, the implications were about the outlook for the US economy. And that outlook is becoming increasingly dire. So Treasuries and gold were bought for safe haven status, and stocks and assets dependent on economic growth were sold off sharply in search of liquidity.

The reasons for this weakening economy should be obvious by now, and it is not because of the long term debt situation. Here is a review of some of the changes in the past twelve years that have taken the US from surplus to disaster.

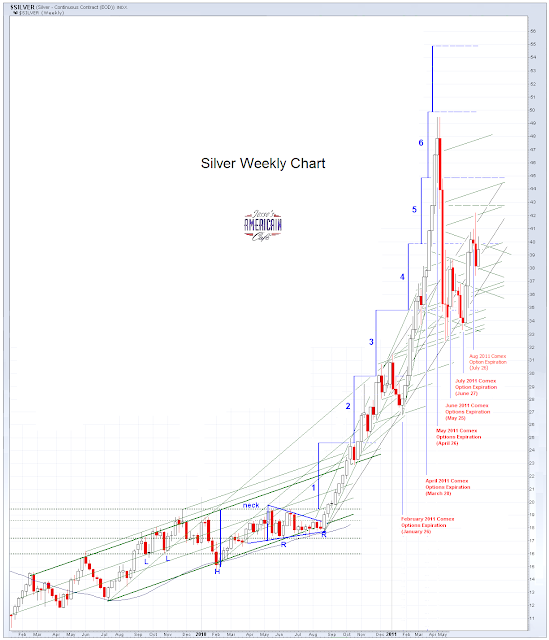

We saw a remarkable flight to the safety of gold, but much less in the more industrially popular silver, and a serious sell off in the commodities. That was the clear sign that this market action was a comment on the economy, with its slack demand and stagnant wages, the dire condition of the average American family, and the dysfunctional nature of the economy.

And for the first time in a while, there was a feeling that the US government has lost its bearings and its ability to respond effectively even in the face of a common cause and emergency, and it was expressed dramatically.

Obama came on television to speak. And after he said his piece, the losses in the equity markets doubled. Why is this?

Because the President may be many good things, and have many good qualities, but he is most surely not a leader, and does not seem to possess an overweening moral principle or vision which he can communicate and achieve, even in the face of opposition and adversity. What does he stand for, and who or what does he really support with any passion, not because it is convenient, not as a means to some other end, but because it is the right thing to do? The best way to be thrown under the bus is to be one of his supporters and constituents, who is not a major lobbyist and campaign contributor. He is hardly a radical and he is certainly no reformer; he is a chameleon, who goes along to get along.

He is the very profile of a modern corporate manager, heavily laced with the moral timidity of a professional bureaucrat. He could not carry Franklin Roosevelt's leg braces. I would not hold him to this higher standard if he had not chosen to pursue the leadership of the Presidency in times of crisis. But he did. And he sold out faster than a hooker when the fleet comes in. He pandered to the monied interests with his key appointments and choices of advisors from the very first days of his administration.

The President's response to this latest crisis is familiar, to have the Congress choose yet another bipartisan commission, similar to the ones that have failed to reach any practical consensus so far, and delegate the problem to them, hoping for the best.

And what makes this situation even worse is that as bad as this President may be, his opposition are largely created from the same mold, the same lobbyist infested cesspool, and are unprincipled servants to power, beholden to creeps, crooks, and sociopaths who pay them and reward them with power, to the detriment of the American republic.

There are wide expectations that the Fed will 'do something' tomorrow. I doubt they will do anything, but they may say something. This is what Wall Street wants. If they do not get it, and the markets begin to move downward with some momentum, look for yet another hastily tossed together crisis response to come out later in the week. Hostage-taking pays in this unprincipled environment.

The downgrade was a vote of no confidence in the leadership of the US, across the board: Democrats and Republicans, the Banks and Wall Street, the Regulators and the Fed, and their partners in the corporations, the mainstream media, the economists, and big business. The power elite, the best and the brightest, the fortunate sons, whatever one wishes to call the governance of the country, have utterly lost their moral bearings. Confidence in the government is at shocking lows, with some polls showing confidence in the Congress is down to 18%. Why Are Banks Getting Off Scot Free? - Greenwald.

In a parliamentary government, the leadership of the US would have fallen this week. This is what the market is saying.

And governments are beginning to fall around the world, as the tide of history advances. The pampered princes and princesses of privilege are blind to what is happening.

The pity will be if the Fed does announce QE3, and the market rallies, and it is quickly forgotten, business as usual. For then it is just a reckoning delayed.

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery.