"Global megabanks have an incentive to deceive customers, including both individuals and nonfinancial corporations. Their size confers both market power and the political power needed to conceal the extent to which they engage in economic fraud. The lack of transparency in derivatives markets provides them with an opportunity to cheat, but the abuses are much wider – as the Libor scandal demonstrates.

The ripoff is not just of retail investors. Chief financial officers of major corporations should be up in arms. Boards and shareholders of companies that buy services from big banks should be asking much harder questions about all kinds of derivatives transactions – and who exactly is served by the terms of such agreements."

Simon Johnson, Lie More As a Business Model

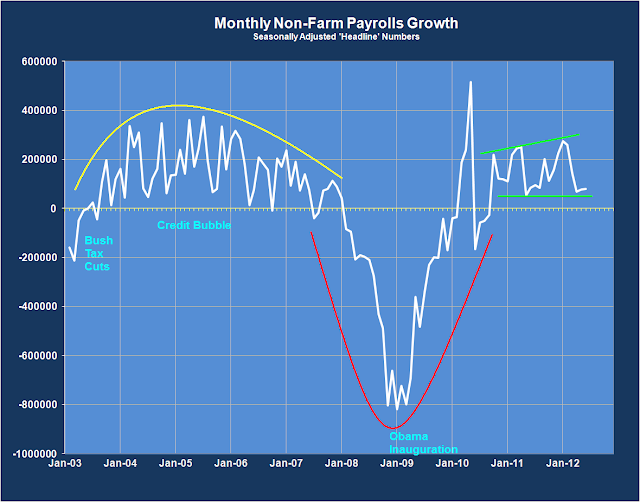

The weak recovery from the depths of the economic slump caused by the credit bubble collapse continues, with 80,000 jobs added.

I did not notice anything unusual in the compilation and adjustments of the numbers.

If anything the number appear to be understated a bit.

The economy is moving from a housing centric focus to something else. But what is that something else to be?

That in large part is the problem.

Manufacturing? The global trade regime still suffers from labor arbitrage and exchange rate 'tinkering' in the mercantilist Asian countries.

Government is not growing but instead remains flat to down from the layoffs in the state and municipal sectors.

Service? The service sector is already outsized in comparison to the rest of the economy, and the jobs added there tend to be lowpaying on average, except for the unusually large salaries in the FIRE sector which is also shrinking as a result of the bubble.

If there was ever a need for a strong national policy to stimulate rebuilding of infrastructure this is it. And this is unlikely to happen because of the political gridlock in Washington, and the continuing power of the financial sector and corporate lobbies over lawmakers.

But as you know from reading this blog, the big drag on policy action and real economic activity is the stubborn corruption at the heart of 'the rotten financial system.'