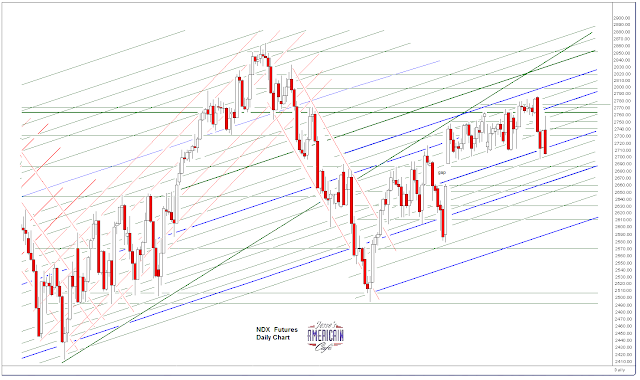

This was the worst daily sell off in US equities since last November.

The spokesmodels were blaming this on 'The Three B's: Berlusconi, Bernanke, and Boehner.'

That is of course a thin film to cover what really happened today, which is that the bubble rally of the past two months or so, led by the relentless buying of the SP futures and the market manipulation of the big funds, let some air out today as big cap earnings drew to a close.

As it turns out Mr. Boehner had absolutely nothing new to say, except to repeat the same rhetoric about no more tax revenues including the closing of loopholes. He took a hard line on any tax increases. Eric Cantor echoed the same thing.

And Bernanke will say very little tomorrow, unless he makes a serious policy statement mistake.

But the surprise that Berlusconi garnered more votes than expected, by appealing to the anti-austerity forces, cautioned many that their optimism of a new anschluss in Europe may not happen quite so easily and broadly. It does not matter that Berlusconi is a star of the opera buffa genre of Italian politics. And it certainly did not justify this volatile of a sell off, except that stocks had run quite too far and therefore the underpinnings of the markets were inherently unstable.

Let's see if the bubble in financial assets will take a bigger pause, is done, or is merely taking profits in advance of another leg up. Keep an eye on Europe.