"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K."

Edward 'Eddie' George, Governor Bank of England 1993-2003

Yesterday I said,

"The capping in the metals is obvious.

There is no economic news or theory that is needed otherwise to explain it.

The question is how long it can last."

Someone asked 'why then is it happening?" I am sorry I had thought it was also obvious based on any number of recent posts.

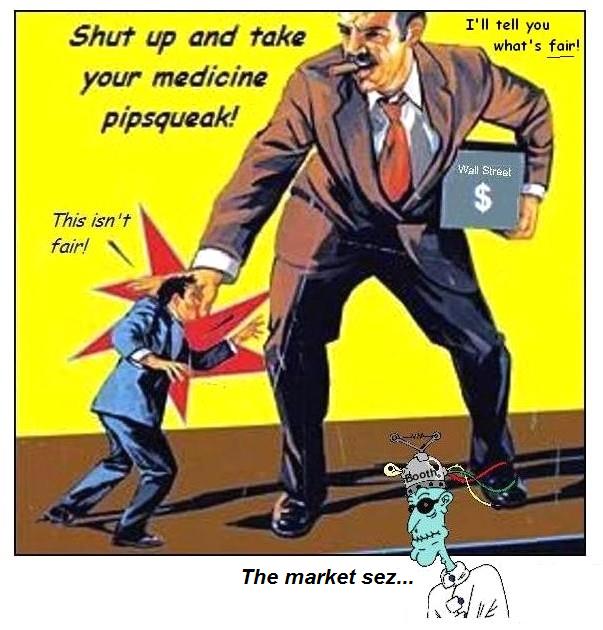

The Anglo-American Gold Pool, and their coterie of client Banks, have made a policy decision to hold the price of gold and silver below 1300 and 20.

Why those particular levels? Because any lower, and the miners would start going out of business, and the flow of physical bullion to the East might become unmanageable. They are nice round numbers, with the obvious appeal to the bureaucratic mind. Anything higher, or rather, with a more aggressive rate of ascent, and some of the natives might become restless, and the positions of some Banks might become untenable.

Their reasons are of course theirs, but I would imagine it is something along the lines of ZIRP, the TARP, selective justice, and the rigging of LIBOR and any other number of markets.

The preservation of the status quo becomes paramount to those caught in a credibility trap, and especially among those who have risen to great wealth and power through 'extraordinary means.'

L'etat, c'est moi.

Have a pleasant evening.