Today we got something a little unexpected. I have to admit it caught me by surprise, and brought back at least a little twinge of seller's regret.

Russia's new draft law permitting them to seize foreign assets and to offer compensation for their nationals who suffer from the Western sanctions shook up the markets a bit, starting with some tremors in the Dax, but achieving their full blossom in US equities. The popular indices were down about 1.5 to 2 percent.

Some pointed to the very low durable goods number this morning, which is fashionably dumb. Durable goods is notoriously volatile because of airplane sales. If you back those out of this morning's figures, then the number was not notable.

And AAPL has reported some problems with their new iPhone6. The cases are bendably thin, and they are having some software problems.

Our market are this fragile? It was more likely geopolitical jitters triggering profit taking from the tech bubble fostered by debubbling in AAPL and BABA.

And these sorts of big moves are characteristic of the narrow market we are in, as shown by the NDX/RUT and SPX/RUT ratios.

The same line of dumb thinking says that if we get a revision to 2Q GDP tomorrow it might be over 5 percent, and that would prompt the Fed to tighten more quickly next year, due to our remarkable recovery.

A revised 2Q GDP with no supporting trend, a stagnant median wage, and a recovery that is so selective that it is almost embarrassing if you don't spend all your time talking to the 'right class of people.' Are you kidding me? I cannot believe the level of groupthink that possesses the financially aloof and their spokesmodels on financial television. It's pathetic.

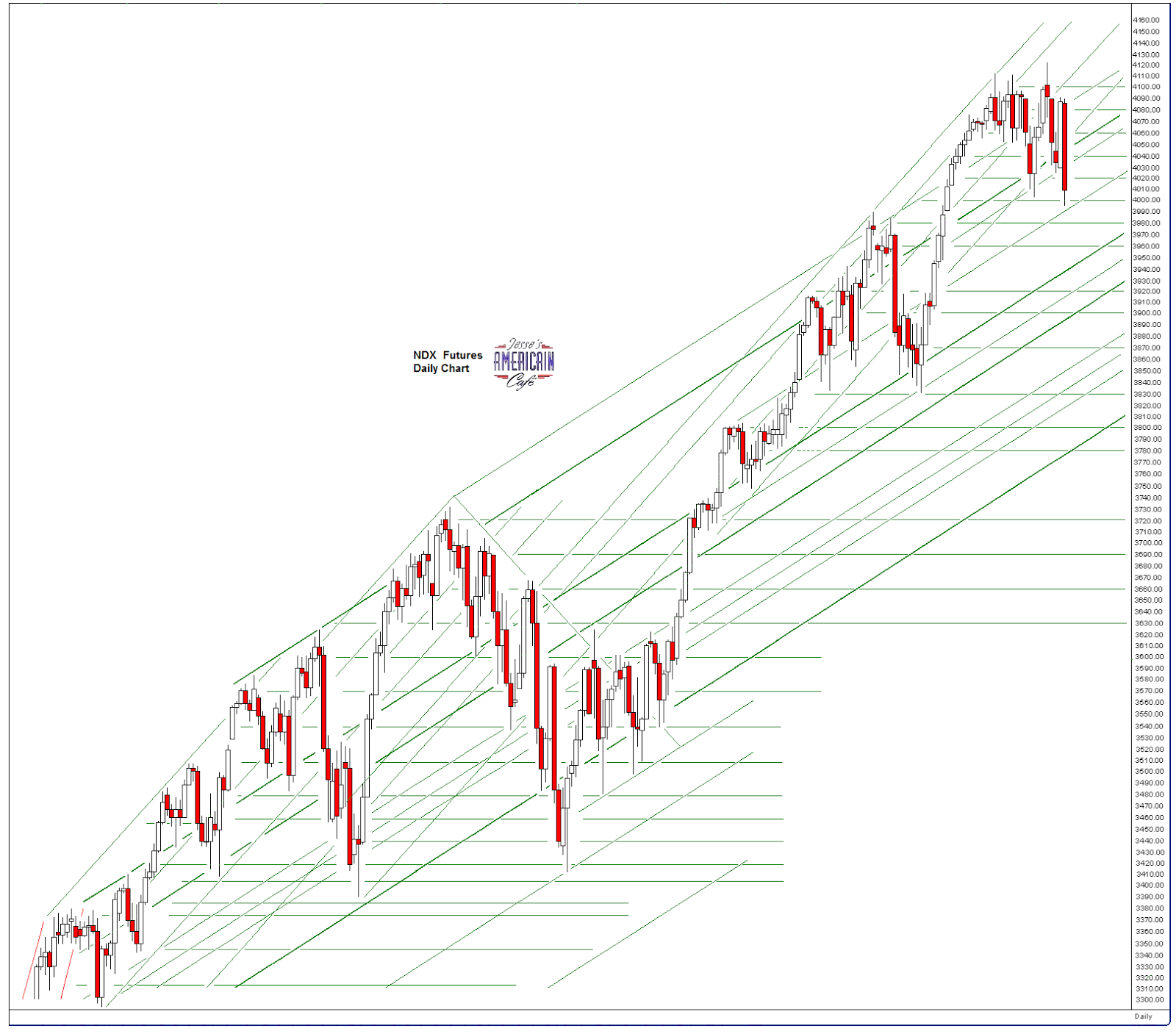

The next move of the markets may be lower, and the support levels are obvious. We are still in a formation that looks like a large inverse head and shoulders consolidation. So we would be looking for any market moves that either negate or activate that formation.

So the markets remain risky, but the volumes and market action is 'narrow,' driven significantly by professional trading that is algorithmically driven. So are we in the long managed rally as we saw in the early 2000's or the kind of reckless bubble making we have seen so often since 1987? Probably both since they are children of the same policy errors.

Have a pleasant evening.