Surprisingly, to some, the economic news continues to show a marked lack of vitality.

In particular, wholesale inventories showed an actual decline, with the prior figure being revised sharply downwards as well. This does not bode well for 4Q GDP.

I have included the particulars in the evening stock markets report.

There are jobs to be had, if you like part time work with few benefits at a poverty level wage. Granted the fortunate few are doing very well. As it has been for quite some time.

The paper asset markets in bonds and stocks are edgy as they think that the Fed will raise next week, without regard to what is happening domestically and in the rest of the world, unless an unavoidable meltdown starts to manifest overseas that cannot be ignored.

At this point, the Fed seems to be so ensnared in the credibility trap that they cannot readily acknowledge the state of the real economy. QE is an unmitigated fiasco, if not a tragic misappropriation of balance sheet flexibility which may be sorely missed in the future.

They must seemingly push on, and raise rates to provide policy room for the cuts to come when their latest paper asset bubble collapses. Meanwhile, the financiers and thought leaders ignore this, burying their heads in the sands of detailed diversions and gettin' paid.

But, alas, belief in The Recovery™ is flagging among the broader public and those who have a mind to think independently as the economic statistics continue to show it to be wishful thinking. People can only suspend belief in what they see with their own eyes for so long, unless of course their perks and paychecks depend on it.

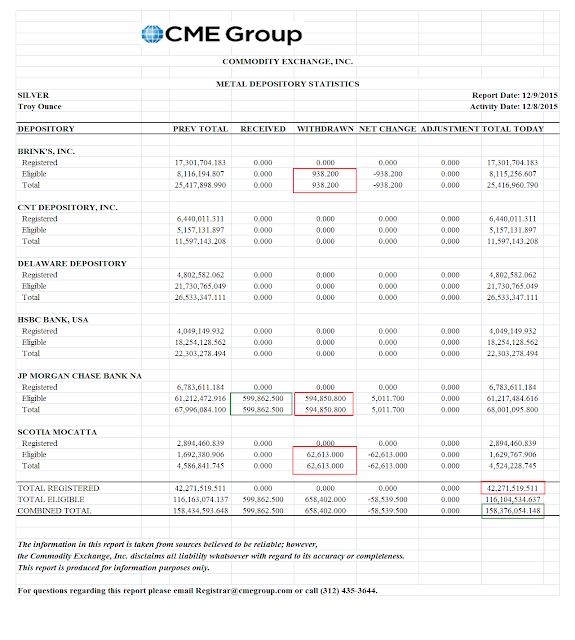

Speaking of ignoring things, the uncurious reaction by some to the odd happenings in the gold market is similarly puzzling.

Is this huge decline in registered gold compared to open interest and total gold in the warehouses nothing new or notable? This has not happened to this degree before that I can find, and certainly not since the turn of the century.

As a reminder, 'eligible' gold is that which has been accepted by a licensed facility as being in a form and purity in accordance with the Nymex rules. That is all that it means. Someone owns it and is storing it in a licensed warehouse facility.

And 'registered' means that a warrant is attached to that gold, which is a prerequisite for a public sale on the exchange, that is, one in which the terms of the sale are fully disclosed and transparent.

The warrant is held in the name of a dealer, and not in the name of the owner or customer. This is to facilitate its transfer in a delivery. I tend to think of it as roughly analogous to a broker holding one's stock in 'street name.' Maybe this is not precise, but it certainly seems to fit.

One might look at the trends in the data and conclude that they suggest that the gold that remains in the licensed facilities in New York is held for the most part in strong hands, who are not inclined to sell it at these prices.

The 'all is well' crowd likes to point to all the gold in the warehouses, including the eligible bullion that is privately held saying, 'see there is plenty of gold, and we are well-supplied.' Except of course that the gold does not belong to the exchange or anyone else except for the owner. And there is a less than usual indication that it is for sale, even to the extent of having a simple warrant for a sale attached to it that is easy to obtain and costs almost nothing.

I am not suggesting that there will be a 'default' in New York. It has already become a nearly virtual trading place for synthetic gold claims, rather than for the exchange of bullion between buyers and sellers.

And the rules on what one might obtain in a crunch are remarkably kind to those who have the greatest influence, positions with the exchange, and the largest teams of lawyers.

But increasingly it is starting to look like a game of musical chairs, of borrowing from Peter to pay Paul. .

And even though the warrants do not expire, and do not compel one to 'sell' I can see why someone would not wish their gold to be held in some other financial organization's name, no matter how convenient that might seem. Maybe that is the reason for this.

I notice that JPM has been accumulating gold again for its house account, and I suspect they will be ready to perform the role of key 'stopper' should there be any large amounts standing for delivery as this active month of December unwinds. They did step in and supply the big demand in the last active month which we had.

Is this sustainable? Is anyone looking closely at this and what is happening on these exchanges?

Have a pleasant evening.