"What was scattered gathers.

What was gathered blows away.”

Heraclitus

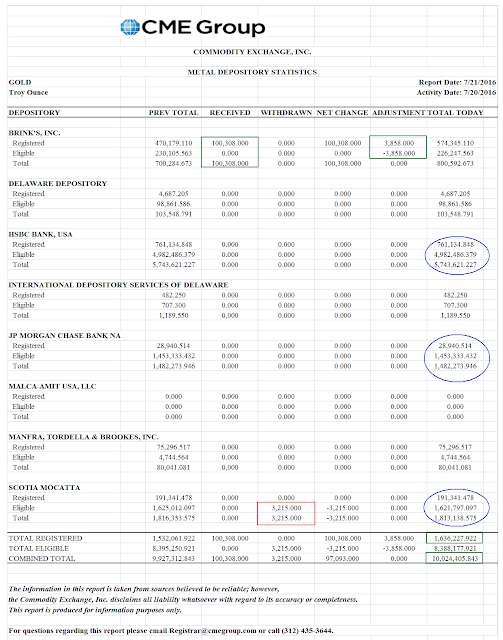

And so we did a bungee jump over the past two days, a trading phenomenon colloquially known hereabouts as 'shenanigans.'

These jokers are so obvious and tiresome since the regulators have been put to bed. At least they are not too lazy to steal.

Intraday there was a simple performance comparison of the two gold funds OUNZ and PHYS.

Next week could be a bit of a challenge for the precious metals, as we have not only a relatively important expiration on the Comex on Tuesday the 26th, but on the next day on Wednesday the 27th the FOMC will be revealing their decision on interest rates.

I am not going to speculate on which way I think the punters and wiseguys will take the markets, but it is likely to be an up and down, or a down and up, or perhaps even a down and down with the up to follow later on. Or as I suspect we will be seeing sometime this year, just an 'up, up, and away.'

I do not wish to encourage anyone to trade any of these jiggered markets on the short term, even those who at least theoretically prefer their markets on the wild and underregulated side, with a charming trust in the natural goodness and rationality of some of the worst moral actors you will ever find.

And if you are determined to trade these markets short term, then just put your big boy pants on and have at it, as you certainly do not need any help from me.

Longer term, dull reality intrudes. even on the half-fevered monetary dreamstates of statists and thieves.

And after many a summer, dies the swan.

Have a pleasant evening.