"It has been the longest bull market in modern history, enabled by massive Central Bank intervention. But with trade wars raging, Brexit, Presidential impeachment over something, etc., there remains a significant risk of a recession over the next 12 months.

If we look at the normalized change in the 10Y-3M curve minus normalized change in 10Y yields, we can see a heightened recession risk. Lower yields and steeper curves are not a good recipe. And then we have the decline in S&P 500 earnings estimates. Recession coming?"

Anthony Sanders, Confounded Interest

"Day by day the money-masters of America become more aware of their danger, they draw together, they grow more class-conscious, more aggressive. The [first world] war has taught them the possibilities of propaganda; it has accustomed them to the idea of enormous campaigns which sway the minds of millions and make them pliable to any purpose.

American political corruption was the buying up of legislatures and assemblies to keep them from doing the people's will and protecting the people's interests; it was the exploiter entrenching himself in power, it was financial autocracy undermining and destroying political democracy. By the blindness and greed of ruling classes the people have been plunged into infinite misery."

Upton Sinclair, The Brass Check

Stocks slumped again today on renewed concerns about global trade.

December 15th may be a date of interest, tariff-wise.

As you can see from the charts, the major stock indices managed to crawl back up to a reasonable level of trend support.

The rest of the week into the Non-Farm Payrolls Report should tell us the story.

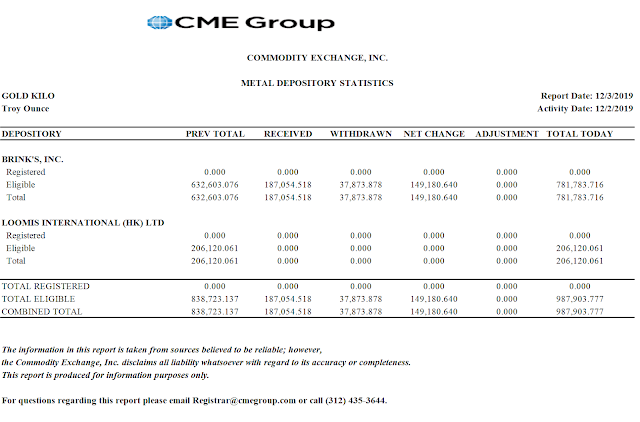

Gold and silver had a nice rally higher after a long coiling process.

But we are still well within the short term declining (coiling?) patterns on the chart. So no breakout yet.

The underpinnings of the market are vulnerable to exogenous shocks. So I would proceed with caution.

The equity and high yield bond markets are leaning heavily on the Fed's balance sheet. And that may not be a longer term sustainable arrangement, and certainly not any formula for sustainable economic recovery.

What would I do? Reform. It's obvious. The system is bent, and consciously so, to sweep the wealth up to a few 'at the top.' It's a racket.

But the credibility trap will not allow the powers that be and their enablers and politicians to consider it as an option, or even to cite systemic imbalance and corruption as a problem. Those that do are ignored, smeared, and villified by those that thrive on the existing imbalance.

The banks must be restrained, and balance restored to the economy, and the dark money power limited from its manipulation of policy, politics, and public discourse, before there can be any sustainable recovery.

Have a pleasant evening.