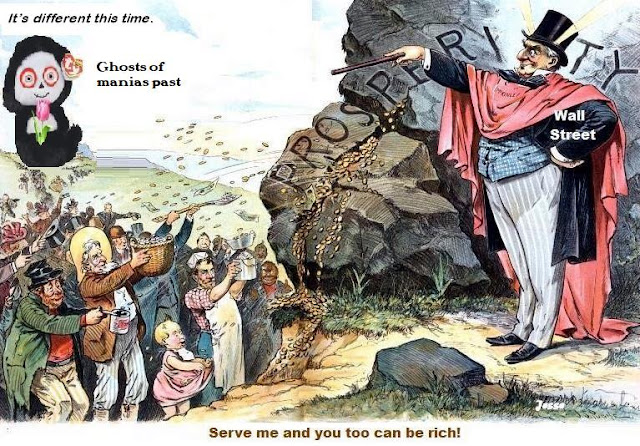

"With a monetary expansion intended to help cure an credit bubble crisis that is not accompanied by significant financial market reform, systemic rebalancing, and government programs to cure and correct past abuses of the productive economy through financial engineering, the hot money given by the Fed and Treasury to the banking system will not flow into the real economy, but instead will seek high beta returns in financial assets.

The monetary stimulus of the Fed and the Treasury to help the economy is similar to relief aid sent to a suffering Third World country. It is intercepted and seized by a despotic regime and allocated to its local warlords [the financial and their Banks], with very little going to help the people.

These injections of monetary stimulus to maintain a false equilibrium is in reality creating an increasingly unsustainable and unstable monetary disequilibrium within the productive economy.

Those who have taken a huge share of the last three bubbles would like to stop the bubble now, keep their gains, and return to a system of fiscal restraint with light taxation on their windfall of assets.

So why does this not just simply happen? Because the political risks become enormous. It is difficult to reduce a population of free men into debt slaves, without risking a significant reaction. Therefore, it seems most likely that the government and the Fed will try to 'muddle through' for the time being, and look for an exogenous event to break the stalemate.

The traditional solution has been a military conflict, which stifles dissent against the government while generating artificial demand sufficient to energize the productive economy. It is a means of exporting your social misery, official corruption, and fiscal irresponsibility to another, weaker people. [war, what is it good for? misdirection and distraction]

As a reminder, in a purely fiat currency regime with an absence of external standards, the question of inflation and deflation is a policy decision. The limiting factor is the latitude with which that policy decision can be made. [a balance between force and fraud]

Jesse, The Speculative Bubble in Equities, 10 October 2009

"Such unsustainable social arrangements are backed by force and fraud. And as the fraud loses its power over time, force must increase, until there is an end in genuine reform, or eventual self-destruction."

Jesse, Credibility Trap, 24 August 2012

"A value-dictated, purely fiat, currency exists through force and fraud. As the fraud grows thin and obvious, the greater and more pervasive the force must become. If imports are needed, wars of aggression will follow to extend and maintain the 'sphere of influence', a euphemism for control. When force finally falters, the currency collapses. A value-dictated, purely fiat currency is not an innovation— it is among the oldest forms of tyranny."

Jesse, Slip Sliding Away, 5 March 2019

"It would be no sin if statesmen learned enough of history to realize that no system which implies control of society by privilege seekers has ever ended in any other way than collapse."

William Dodd, US Ambassador to Germany, 1933

That was some serious wash and rinse dithering we have seen over the last couple of days.

The second lows have been set, with a vengeance.

The spokesmodels were reduced to yammering inanities.

It was pretty much a reversal of everything from yesterday.

Dollar up sharply with VIX, gold and silver lower, and stocks took the gas pipe.

Let's see what the Non-Farm Payrolls report brings.

Have a pleasant evening.