Here's what Grok has to say about my December 16th post on X warning of a bubble in market valuations which is pictured on the right:

Market Sentiment: The post indicates a cautious view on the current market conditions, suggesting that the market might be overvalued ("toppy") but expects some manipulation or positive portrayal ("paint the tape") towards the year's end. This reflects a common practice in financial markets where end-of-year performance might be artificially boosted.

Cultural Reference: The image used in the post references the character "The Mask" from the movie of the same name, known for his chaotic and exaggerated behavior, symbolizing the unpredictable and possibly reckless nature of market movements at this time.

Economic Context: The mention of market manipulation or artificial market support can be linked to historical practices like those seen during the Wall Street crash of 1929, where market manipulation was part of the broader economic events leading up to the Great Depression.

These AI things are mostly obvious plagiarists, but they do draw nice pictures sometimes. But people tend to give it some credibility. Maybe you will listen to it.

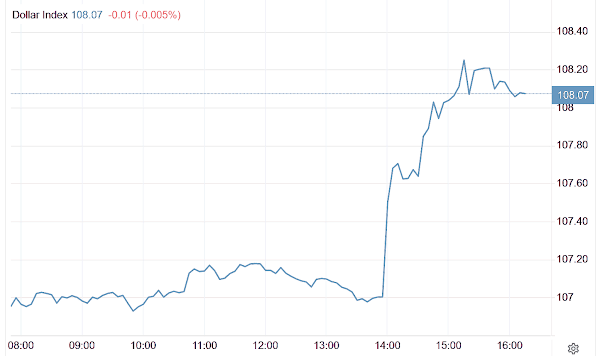

Here in the second picture on the right is what I posted earlier today before the FOMC meeting. I was getting ready for a surprise. I wasn't sure how big a surprise because I did not know the extent of the 'trigger event.'

I suspect that today is going to be more of a standalone event, with perhaps a day or two of aftermath that eventually finds a footing.

Once the wiseguys have their portfolios squared up they can go back to building something reportable for their year end results.

Why did stocks fall so sharply? The valuations were so stretched that it took very little to set off the correction.

What the Fed did and said today was utterly obvious to anyone watching what is going on, and thinking for themselves.

They did their 25 basis point cut, and affirmed their firmer stance on future cuts because of persistent inflation.

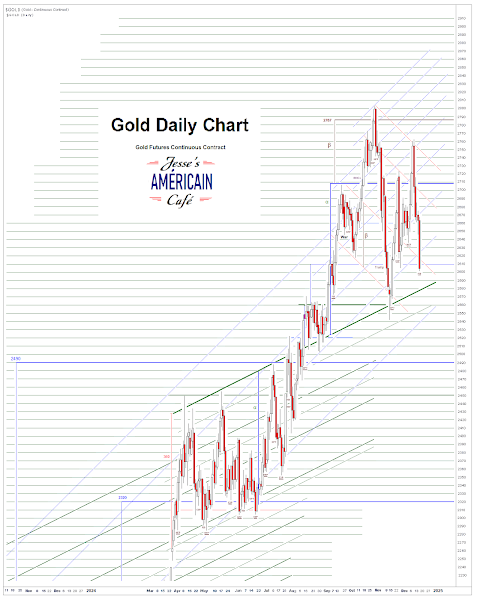

I had some significant short positions built up in the equity assets over the past two days, and I made some money. My PM related longs were on the slimmed down, but what there was got thoroughly toasted. According to plan I added some of the usual suspects in the afternoon today. There were some fire sale items of interest for the longer term. There will be time to add more. Slowly goes it. And hedged.

A geopolitical event will make some obvious Fed related temper tantrum look pale by comparison.

More gold left the Hong Kong warehouses yesterday. Gold is flowing from West to East.

As a reminder there will be a stock market option expiration on Friday. This was most likely a wash and rinse for year end.

Things do eventually make sense. It's just that the liars and those who fall for their lies can be ardent and persuasive, and very, very loud.

But if there is a message in this, it is that these financial things mean relatively little compared to the bigger traps and lies that are being told about theft, wholesale murder and wars of aggression. It's almost astonishing, and it could be getting worse before it gets better.

“Just as it was in the days of Noah, so will it be with the coming of the Son of Man. People were eating, drinking, marrying and being given away in marriage, up until the very day that Noah entered the ark. Then the flood came, and swept them all away. And they said to him, 'Where will this happen, Lord?' And He said to them, 'Where death is, there will be a gathering of vultures.'”Things can be replaced. Your soul can't.

Luke 17:26-27, 37

Have a pleasant evening.