“You levy a straw tax on the poor

and impose a further tax on their grain.

Therefore, though you have built stone mansions,

you will not live in them;

though you have planted lush vineyards,

you will not drink their wine.

For I know how many are your offenses

and how great your sins.

There are those who oppress the innocent and take bribes

and deprive the poor of justice in the courts.

Seek good, not evil,

that you may live.

Then the Lord God Almighty will be with you,

just as you say he is...

But let justice roll on like a river, righteousness like an ever-flowing stream.”

Amos 5:11-15, 24

"The state of slavery is of such a nature that it is incapable of being introduced on any reasons, moral or political, but only by positive law, which preserves its force long after the reasons, occasions, and time itself from whence it was created, is erased from memory. It is so odious, that nothing can be suffered to support it, but positive law. Whatever inconveniences, therefore, may follow from the decision, I cannot say this case is allowed or approved by the law of England..." Fiat justitia ruat caelum.

Somerset v. Stewart, Court of King's Bench, 1772

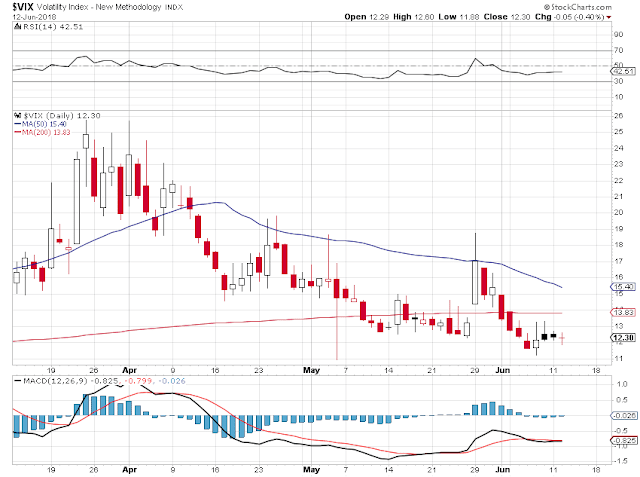

Some markets caught a bid today, compliments of a cleverly dovish Monsieur Draghi of the ECB.

The ECB head has announced the beginning of the end for their quantitative easing program. But then he very dovishly added that he does not see interest rates increasing until some time after the middle of next year.

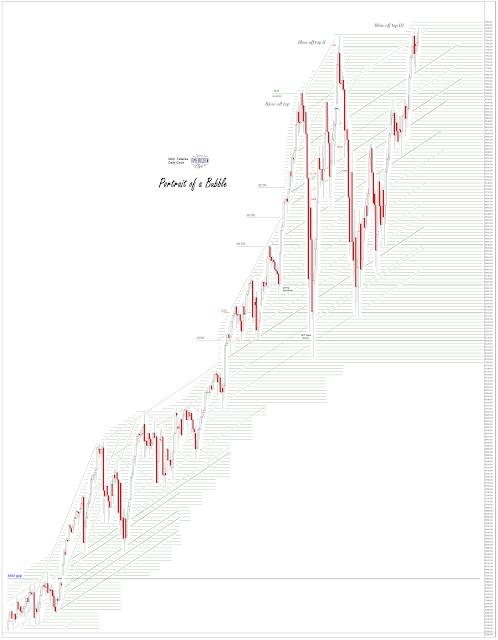

Equities were led higher by big cap tech. Apparently the Street is cheered by the valuations which, although they are high in the mid 20's range, are not as high as they were at the peak of the tech bubble at the latest turn of the century.

Gold and silver were up despite a sharply higher Dollar. Merci, Monsieur.

The available for delivery supply of physical gold seems to be getting a bit thin again.

There will be a stock options expiration tomorrow.

If only the markets were the real economy. Then they could make everything just fine.

As it is, despite all the good news and our fearless leaders birthday, I have a really bad feeling about how this is all going to end.

Need little, want less, love more. For they who abide in love abide in God, and God in them.

Have a pleasant evening.