The initial reaction we had was that RBS was doing some 'reverse jawboning' on Monsieur Trichet of the ECB with regard to interest rate increases. We don't follow Europe closely but we think increases by the US Federal Reserve are strong dollar fantasies for all the reasons which we've outlined in previous discussions.

The initial reaction we had was that RBS was doing some 'reverse jawboning' on Monsieur Trichet of the ECB with regard to interest rate increases. We don't follow Europe closely but we think increases by the US Federal Reserve are strong dollar fantasies for all the reasons which we've outlined in previous discussions.

Still, its rare to read such a specific prediction of a 300 point decline in the SP within three months from a 'name' banking institution which ought to be in a position to render an informed opinion.

But it does fit with our bias here to be prepared for the worst, and if it does not come, then so much the better for us all. Our outdoor activities have blossomed into a case of Lyme disease, so we'll be working lighter hours for at least the next month or so while time and the proper medicines do their work. Too bad such an effective remedy is not in the medical kit of Dr. Bernanke. Or is it?

RBS issues global stock and credit crash alert

By Ambrose Evans-Pritchard

11:44pm BST 17/06/2008

UK Telegraph

The Royal Bank of Scotland has advised clients to brace for a full-fledged crash in global stock and credit markets over the next three months as inflation paralyses the major central banks.

"A very nasty period is soon to be upon us - be prepared," said Bob Janjuah, the bank's credit strategist.

A report by the bank's research team warns that the S&P 500 index of Wall Street equities is likely to fall by more than 300 points to around 1050 by September as "all the chickens come home to roost" from the excesses of the global boom, with contagion spreading across Europe and emerging markets.

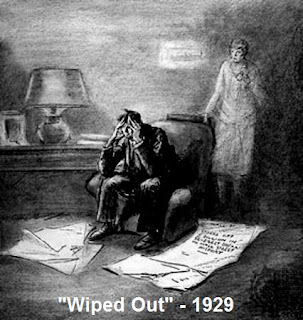

Such a slide on world bourses would amount to one of the worst bear markets over the last century.

RBS said the iTraxx index of high-grade corporate bonds could soar to 130/150 while the "Crossover" index of lower grade corporate bonds could reach 650/700 in a renewed bout of panic on the debt markets.

"I do not think I can be much blunter. If you have to be in credit, focus on quality, short durations, non-cyclical defensive names."

"Cash is the key safe haven. This is about not losing your money, and not losing your job," said Mr Janjuah, who became a City star after his grim warnings last year about the credit crisis proved all too accurate.

RBS expects Wall Street to rally a little further into early July before short-lived momentum from America's fiscal boost begins to fizzle out, and the delayed effects of the oil spike inflict their damage.

"Globalisation was always going to risk putting G7 bankers into a dangerous corner at some point. We have got to that point," he said.

US Federal Reserve and the European Central Bank both face a Hobson's choice as workers start to lose their jobs in earnest and lenders cut off credit.

The authorities cannot respond with easy money because oil and food costs continue to push headline inflation to levels that are unsettling the markets. "The ugly spoiler is that we may need to see much lower global growth in order to get lower inflation," he said.

"The Fed is in panic mode. The massive credibility chasms down which the Fed and maybe even the ECB will plummet when they fail to hike rates in the face of higher inflation will combine to give us a big sell-off in risky assets," he said.

Kit Jukes, RBS's head of debt markets, said Europe would not be immune. "Economic weakness is spreading and the latest data on consumer demand and confidence are dire. The ECB is hell-bent on raising rates."

"The political fall-out could be substantial as finance ministers from the weaker economies rail at the ECB. Wider spreads between the German Bunds and peripheral markets seem assured," he said.

Ultimately, the bank expects the oil price spike to subside as the more powerful force of debt deflation takes hold next year.

"All the world marveled at this, and gave their allegiance to the Beast. And they worshiped the serpent, for giving such power to him, as they also worshiped the Beast. 'Who is as great as the Beast?' they exclaimed. 'And who is able to resist him?' And the Beast was allowed to commit great blasphemies against God."

Revelation 13:3-5