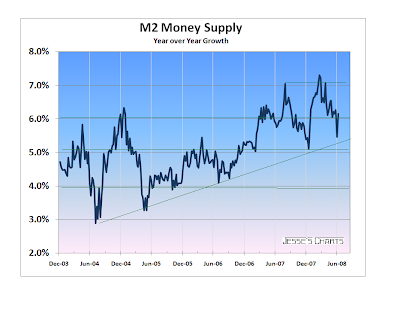

There is certainly a contraction in the growth of bank credit and the money supply.

Please note that these are reductions in growth, and from some recently lofty heights.

Before this is over, we ought to see some contraction in the overall supply of money. This is what we had seen in 2002 as the market approached bottom.

One question rarely considered by non-monetary economists is "What is the equilibrium rate of monetary growth, and is it always the same?"

If the economic population is not increasing, and the growth of real GDP is zero, should the money supply be increasing? If the economic population and real GDP are decreasing, would the correct level of monetary growth be a decrease to maintain stable prices? And then there is the matter of the velocity of money, and the notion of a virtual or derivative money supply. All good questions worthy of serious thought.

"They defended him, verbally and physically, every time he committed one of his criminal acts. They went blithely on past the suffering of all the bombing victims, the prisoners in the concentration camps, and the religious persecutors, because a different regime would have meant the end of their power. 'You made this monster, and as long as things were going well you gave him whatever he wanted. You turned Germany over to this arch-criminal.'”

Friedrich Reck-Malleczewen, 1947