We like Paul Krugman and enjoy reading his columns. But every so often he writes a column that is so off his normal standards that it makes us wonder if he is on vacation and the task of producing the column has been delegated to a graduate assistant.

Here is one such example.

NY Times

Was the Great Depression a monetary phenomenon?

By Paul Krugman

November 28, 2008, 1:47 pm

Has anyone else noticed that the current crisis sheds light on one of the great controversies of economic history?

A central theme of Keynes’s General Theory was the impotence of monetary policy in depression-type conditions. But Milton Friedman and Anna Schwartz, in their magisterial monetary history of the United States, claimed that the Fed could have prevented the Great Depression — a claim that in later, popular writings, including those of Friedman himself, was transmuted into the claim that the Fed caused the Depression.

Now, what the Fed really controlled was the monetary base — currency plus bank reserves. As the figure shows, the base actually rose during the great slump, which is why it’s hard to make the case that the Fed caused the Depression. But arguably the Depression could have been prevented if the Fed had done more — if it had expanded the monetary base faster and done more to rescue banks in trouble.

So here we are, facing a new crisis reminiscent of the 1930s. And this time the Fed has been spectacularly aggressive about expanding the monetary base:

And guess what — it doesn’t seem to be working.

I think the thesis of the Monetary History has just taken a hit.

We have mixed emotions on this one since we think the monetarist approach is a too one-dimensional to explain what happened then and now, and agree with Keynes that monetary policy alone is incapable of dealing with a complex economic event such as we are now facing. We also do not believe that the Fed 'caused' the Great Depression.

However, to try and make the case that the Fed can "only" control reserves and the currency base, the monetary base, is an old canard trotted out by the likes of Greenspan and his ilk when they wish to make the case that things are happening, like enormous bubbles, that are beyond the Fed's control. This is a Clintonian use of the word 'control' and is always and everywhere rubbish.

The Fed's power, its influence, is profound, and ever moreso in this era of aggressive financial engineering. Krugman uses the narrow argument of literal control to point to the Adjusted Monetary Base as his sole metric and say, "See the monetary base went up in the Depression in his Chart 1, just as it is today in Chart 2. Therefore there was no error from the Fed at that time because it was all that they could do."

Here are two other charts that help to provide a better view of what really happened.

Please note in the above chart that after the British abandoned the gold standard, the Federal Reserve RAISED the discount rate for US banks in the spring of 1931 from 1.5 to 3.5 percent, or 200 basis points.

To emphasize the policy error look at this estimate of real interest rates leading into the bottom of the Great Depression in 1933. Nine out of ten economists might notice that, relative to the price deflation which was obviously occurring, that the increase in Discount Rate was motivated by other than monetary and domestic considerations.

Finally, let's take a look at a broader money supply for the period, M1, against the change in GDP.

Please notice the decline in M1 tracking the changes in GDP.

So, what might the Fed had done differently?

It is obvious that devaluing the dollar was the right thing to do. To that end, the Fed might have cut the discount rate to less than one percent, instead of raising it, which was likely in response to the movement of the British pound and the Bank of England's abandonment of the gold standard. They also might have lent in size to any bank requiring deposits, so that there would be no more bank failures for banks that were in otherwise reasonably good shape, that is, because of depositor runs.

And this is where we do part company with Mr. Friedman and Ms. Schwarz and join Lord Keynes in his observation that it requires fiscal and legislative actions to repair an economic shock such as the country was experiencing in the early 1930's.

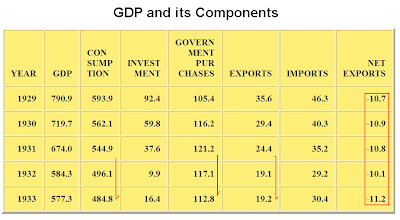

Notice that Government Purchase drop, and rather sharply, into the trough of 1933, along with aggregate demand. This would have been the point where Keynes would have likely observed that supply money was not enough, but was only a first step in stabilizing the system. The 'real cure' was to get people working again, to provide wages and gainful employment, to encourage consumption and economic activity.

As an aside, notice that net exports were negative and remained so throughout the period of 1929 through 1933. Much has been made of the Smoot-Hawley tariff, and indeed exports did nominally decrease. But the proportion of decline to imports makes it clear that protectionism was rampant throughout the rest of the world, and had not been caused by anything the United States was doing per se.

We don't have the chart at hand, and will continue to look for it, but the United States was one of the last of the developed nations to emerge from the Depression with positive GDP growth. We think that this was caused by exactly the phenomenon that Keynes observed, which was a lack of government fiscal and legislative activity to promote economic activity, as well as a relatively open market for imports and a "business first" bias, to the disadvantage of the unemployed working people.

In conclusion we would say that contrary to what Mr. Krugman asserts it is apparent that the Fed made a significant policy error in raising the discount rate in early 1931. It is less clear what latitude they might have had to do more to stem the tide of bank failures because of depositor fears, but they clearly could have done more to react to the contracting money supply. We have heard that they only were able to think in termed of the monetary base and had no statistics beyond that with which to guide their efforts.

We think that this is a weak rationale at best for their failure as bankers to respond to the obviously dire situation of the economy which evident in and of itself. We would not accuse them of lacking imagination, inventiveness, determination, and a spirit of pragmatic activism. In fact, they strike us as 'clubbable men' acting for their club.

We shall see this time perhaps if monetary activism alone is sufficient, especially if the Republicans and corporate banking interests have their way. But it does not appear to be the case since making money available to lend does not solve the problem of helping to create an economic environment in which profits might be made.

Indeed, we can imagine an outcome in which misbegotten monetary policy results in an oligopoly of corporate interests and an economy that is permanently frozen in a series of de facto monopolies based on central planning, not all that dissimilar to the experience of the Soviet Union prior to its dissolution and some countries in which a hundred or so powerful families control the government and its economy in a state of permanent corruption and malaise.