There isn't any monetary deflation visible in the data, at least so far.

This is despite the drop in the Consumer Price Index which appears to be driven by quickly weakening aggregate demand, as reflected in the National GDP numbers, in conjunction with a powerful short squeeze in the eurodollar which we have documented earlier that had a dampening effect on key import prices, in particular oil.

Whether a true monetary deflation develops later is another matter. We are still early in this economic downsizing of the financial sector and a massive credit bubble created by lax banking regulation and an over-accommodative Federal Reserve.

Granted there is credit creation outside of the banking system that was and still is significant, particularly with regard to feeding asset bubbles. But the role of the banks has been underplayed in this. The banks, in conjunction with the Fed, were key enablers of this series of credit and asset bubbles we have seen. Fannie and Freddie were bagmen, to borrow an analogy, but the banks were the capos with Greenspan as consigliere.

The growth of credit (indebtedness) is not money supply. It is potential money that feeds into inflationary expectations, most obviously in asset prices and consumption based on debt taken on against inflated assets. Whether my house if valued at $690,000 or $500,000 means little unless one is a speculator, or financing their daily consumption through HELOCs rather than productive growth in the median wage.

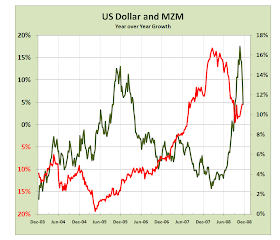

Along the same line of thought, the liquidity being added by the Treasury and the Fed to the banking system, reflected in the spike in the Adjusted Monetary base, is not feeding a monetary inflation yet either, but rather a parabolic bubble in Treasuries, and perhaps the Dollar although this is not yet demonstrable given the many degrees of freedom in the calculation.

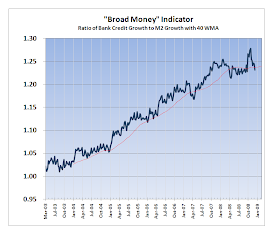

There is an even more sophisticated linkage, with the expected lags, which we will be exploring in future charts and discussions. But if one considers the percentage growth in money supply and credit shown below against the growth in GDP which is now negative the hand of the Fed and Treasury in the economy is pronounced.

As a warning however, there are lags, and we still will expect a contraction in money supply to show up next year, probably coindicent with a trough in financial asset prices as occurred in 2002.

"The more power a government has the more it can act arbitrarily according to the whims and desires of the elite, and the more it will make war on others and murder its foreign and domestic subjects. Power will achieve its murderous potential. It simply waits for an excuse, an event of some sort, an assassination, a massacre in a neighboring country, an attempted coup, a famine, or a natural disaster, to justify the beginning of murder en masse."

R. J. Rummel, Mass Murder and Genocide, 1994