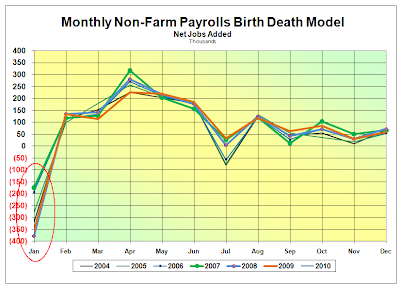

The markets breathlessly await the latest Non-Farm Payrolls Report for the US, which will be released tomorrow morning. January is the month in this report that contains the largest seasonal adjustments by far.

Here is a projection of what tomorrow's numbers may look like, and their historical context. The raw number unadjusted for seasonality may be a loss of around 4,000,000 jobs.

It is no accident that the BLS does the major adjustment to its Birth-Death Model in January. Keep in mind that the Birth-Death adjustment is applied BEFORE seasonal adjustment, that is, to the raw, unadjusted number.

Given that the expected raw number will probably be around 3.5 million jobs lost, and then adjusted to a headline number much closer to zero, adding even 380,000 or so job losses to that does not result in such an enormous adjustment in January.

In other words, the adjustment is largely adjusted away by the seasonality. Nonsense, hardly connected to the real world, but quite clever bureaucratic sleight of hand really.

Saying all this, it seems almost needless to stress that any projection of the headline number is a tough call in January, because the seasonality has such enormous latitude. More in the nature of a SWAG than a proper forecast.

Then there is also the matter of the revisions to the prior two months at least, and the possibility of a revision to the whole series going back two years, which sometimes occurs.

So, we'll look for a 'headline number' closer to zero than not, with a shade to the negative, maybe a loss of 20,000 or so. But we are very prepared to be surprised to the upside to a positive number, and downside to a loss of around 80,000. That speaks less to our inability to forecast, we hope, and more so to the arbitrary nature of the government's willingness and ability to fiddle with the numbers.

With pretty colors, it may look more like a sideways chop than a plunge, especially in light of a greater negative from December which will be adjusted but not higher.

And as for the reaction of US equity markets in anticipation today?

As I have stated before, the banks and their prop trading desks are always and everywhere screwing you, and frontrunning their better insights into the markets, even if only by a few milliseconds.

Watch the sovereign debt situation. This may place a heavy weight on the equity markets. But perhaps not just yet.

skip to main |

skip to sidebar

Potage traditionnel, consommé sophistiqué

mardi et jeudi à la table du propriétaire

aux champignons et pommes frites

aux-bleuets

"The more power a government has the more it can act arbitrarily according to the whims and desires of the elite, and the more it will make war on others and murder its foreign and domestic subjects. Power will achieve its murderous potential. It simply waits for an excuse, an event of some sort, an assassination, a massacre in a neighboring country, an attempted coup, a famine, or a natural disaster, to justify the beginning of murder en masse."

R. J. Rummel, Mass Murder and Genocide, 1994

LE CAFÉ AMÉRICAIN

.

.

.

Our Daily Prayers

Let us pray for those whose hearts are hardened against His grace and loving kindness by greed, fear, and pride, and the seductive illusion and crushing isolation of evil.

We pray that we all may experience the three great gifts of our Lord's suffering and triumph: repentance, forgiveness, and thankfulness. And in so doing, may we obtain abundant life, and with it the peace that surpasses all understanding.

We pray that we all may experience the three great gifts of our Lord's suffering and triumph: repentance, forgiveness, and thankfulness. And in so doing, may we obtain abundant life, and with it the peace that surpasses all understanding.

.

.

Search Le Café Archives

.

.

MÉTAUX PRÉCIEUX QUOTIDIEN

.

.

Translation Service

.

Divertissement Éducatif

.

Archives de Blog

.

.

Soupes, Potages et Bouillons

Potage traditionnel, consommé sophistiqué

Canapés et Apéritifs de la Maison

mardi et jeudi à la table du propriétaire

Salade Niçoise

English Breakfast

Gigot d'Agneau

Légumes rôtis

Coquilles St-Jacques

Tarte aux Tomates

Calamari

Scotch Egg

CÔTE DE BOEUF

aux champignons et pommes frites

Homard

GÂTEAU AU CHOCOLAT FONDANT

GÂTEAU AU FROMAGE

aux-bleuets

Statistiques de Visiteurs depuis 2/2007

Le Propriétaire

Notice of Copyright © Droit d'Auteur

This original work on this site is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 US License

I make every attempt to respect the rights of others. If you feel that something here has infringed your work please let me know and I will correct it immediately. It is not always easy to determine the status of material posted to the Internet with regard to fair use and public domain.

It is available for your use at no cost, but with attribution and a link to the original posting.

I make every attempt to respect the rights of others. If you feel that something here has infringed your work please let me know and I will correct it immediately. It is not always easy to determine the status of material posted to the Internet with regard to fair use and public domain.

Need Little - Want Less - Love More

These are personal observations about the economy and the markets. In providing information, I hope this allows you to make your own decisions in an informed manner, even if it is from learning by my mistakes, which are many. As a standing policy I never provide individual investment advice to anyone. My comments are intended to be reflection on general macro financial and economic events and trends.