In 1991, Blythe Masters read in economics (presumably with a heavy influence from H.P. Lovecraft and Stephen King) at Trintity College, Cambridge. In 1997, Blythe headed a small team of economists at J.P. Morgan bank in New York which developed the concept of the Credit Default Swaps as a means of insuring loans. This has led to Masters being described by The Guardian newspaper as "the woman who invented financial weapons of mass destruction." Regrettably, the quote from the Bhagavad-Gita about Shiva, destroyer of worlds, had already been taken by J. Robert Oppenheimer.

In April 2010 Masters told the Economic and Monetary Affairs Committee of the European Parliament that "there are definitely lessons that have to be learnt. I for one feel that I have learnt from that experience and there are things I may like to have seen done differently." There is nothing better than on-the-job training when manipulating the world's economy, as Ben Bernanke can attest. Theory is all well and good, but there is something to be said for the good old trial and error method.

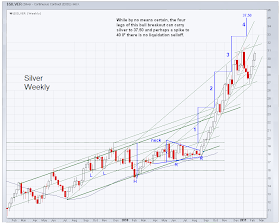

Blythe has been the head of Morgan's commodity trading since 2006, and was reponsible for notably heavy losses in the firm's portfolio last year. JPM does not specifically disclose its own market positions, but is rumoured to be short a multiple of the solar system's estimated reserves in the silver market. The positions are said to be 'almost as volatile as Lindsay Lohan's personal life' and 'about as far underwater as the Titanic.'

"It is crudely general to suggest collective responsibility for the German populace. It is, however, fair to suggest that those who continued to defend the idea of Germanhood publicly as the war went on—when this had become synonymous with barbarity—were in fact renouncing their humanity for the sake of individual survival and peace of mind."

Panayiotis Demopoulos, Götterdämmerung: Suicide Music