31 December 2013

SP 500 and NDX Futures Daily Charts - The Men Who Sold the World

"Whoever wishes to come with me, let them put aside their own selfish interests, and take up their cross, and follow me.

For whosoever wills to keep their life for themselves shall lose it; but whosoever puts aside their life for My sake, and that of the Gospel, shall save it.

What therefore is the profit in it, if you gain the whole world, but lose your self?"

Mark 8:34-36

Gold and Silver ETF Inventory Changes For 2013 - 942 Tonnes of Western Gold Gone

The drain of gold from the Western ETFs and Funds is apparent. About 942 net tonnes have been removed. This compares to the 856 tonnes that had been removed as of mid-December. That is quite a bit of bullion moving out in just a few weeks.

But even more notably, this is in sharp contrast to silver, which has had about 992 net tonnes added. On a percentage basis silver has had a worse price performance this year compared to gold, so ascribing this to investor preference seems a bit thin.

Category:

Gold ETF Drawdowns

30 December 2013

Gold Daily and Silver Weekly Charts - Year End

Very light volumes and a bit of 'profit taking' although I would tend to say this is painting the short positions up for the year end close.

I include a chart below that shows the 20 biggest stock short positions on the Toronto Stock Exchange. You can see how the miners fit into this picture.

There was no meaningful inventory movement in the Comex warehouses on Friday last.

January is a non-active month, whereas February may once again stress the ability of the Comex to maintain its vestiges of actual precious metals delivery.

This 'feels' like a bottom action here. But in times of 'currency wars' I will tend to wait for confirmation before getting too excited about anything.

But with the fiat meisters of the status quo DeLong and Krugman chirping so loudly, it may not be as good as a fat lady singing, but it might be close.

Have a pleasant evening.

26 December 2013

Gold Daily and Silver Weekly Charts - Tottering Into Year End

"Oh what a tangled web we weave,

When first we practise to deceive!"

Sir Walter Scott, Marmion

“The arrogance and brutality of empire are not repealed when they temporarily get deployed in a just cause.”

Michael Kazin

When governments intervene in markets, other than occasionally and transparently in currency and interest rate markets in pursuit of clear policy, I do not see how they can expect investors to maintain the confidence in their policies and actions.

It is understandable that such actions in commodity markets may be occasionally necessary to help to manage the impact of some exogenous crisis. This is the right and proper role of a government in responding to the needs of their people in the face of natural disasters, wars, and other exceptional events.

But when interventions become a routine and necessary component of central bank policy, there should be no question that the economy is being maintained in an unstable and untenable equilibrium, and that forces of imbalance are being allowed to accumulate that will result eventually in a market dislocation and a further crisis, that often will be worse.

When the temporary becomes permanent, and the discretionary becomes required, then the winds of great change will begin to blow, and what has been hidden, however long, will be revealed.

SP 500 and NDX Futures Daily Charts - VIX - A Warning On the Equity Market

It is the end of year, and the market volume is light, almost as light as the regulatory oversight.

Stocks are drifting higher as the paint is lightly stroked across the tape. VIX is quite low and I have included a Year-To-Date look at it below for you to gauge it more effectively. That is not to say it cannot remain low for a period of time as we have seen in this market during the year.

It is too bad the major VIX ETFs, and short stocks ETFs, are designed to lose money over any extended time period. One will have to find some other way to seek safety or a contrarian event without trying to precisely time the market. What that might turn out to be I can only say what I tend to think about it, having no crystal ball of my own, alas.

As you know I have said it looks like the Fed is blowing an asset bubble in financial assets, for the purposes of a 'trickle down' recovery. Since then some others, more renowned and less easily ignored like Jim Grant, have said the same thing. And I do believe it is absolutely true.

This policy choice, to which the 'scholar-gentry' are trying to accommodate themselves because it feels so good for their own situations, is going to have some consequences. I suspect those consequences are going to start showing up next year.

Confidence, once lost, is hard to regain. Sometimes those in power can be so effective in bullying others to their views, along with their choirs of careerist supporters, that they can take a bad trend much too far beyond the sustainable to a false equilibrium. This is what we have seen in both the tech stock bubble, and the collateralisation of housing related debt bubble. And the reversion from it comes unexpectedly and with some release of energy.

I am fairly persuaded that we will see the same thing again, sometime in the next two years. We will likely see a 'market break' to confirm this first, a small one in the new year and another in spring. This is difficult to time because of the Fed's blatant attempt in support of the markets.

What will precipitate it, what the particular 'trigger event' will be I cannot say, but I am sure that it will be the result of this horrible policy decision fostered by the Federal Reserve and the administration of making the rich richer, in the hopes of making all boats rise, or as Galbraith noted, 'feeding the sparrows with the hay that passes through the horse.'

Have a pleasant evening.

NAV Premiums of Certain Precious Metals Trusts and Funds - Skoyles and Max Do Handbags

A bit of a surprise in the premium on Sprott Silver which is carrying a slightly negative premium and on a par or a bit lower than gold. That is unusual historically except when they are engaging in a secondary offering.

Sentiment is about as low as I have seen it in a long time. It brings out and emboldens the trolls and perma-bears and shills for sure, but even the stalwarts are flagging it seems.

And you know what that can mean.

For those with a long time horizon, I cannot help but reiterate, 'this too shall pass.' As you know I became interested in gold, and a few years later silver, when I began studying asset bubbles and money in the late 1990's. Compared to some periods in gold and silver this is not pleasant, but not all that unusual. It is a fairly stiff correction in what looks to be a bull market based on identifiable fundamentals. If anything concerns me at all it is the 'currency war' aspect of this, and the zealous overstepping of 'very important people' in blind pursuit of their utopian ideologies.

I also include an interview that Max Keiser does with Jan Skoyles. It is a bit light in the seasonal shopping spirit. I particularly enjoyed her premiere interview with Ben Davies. As an aside, when I was in my traveling prime I used to shop frequently at Harrods, and have a suitable veneration for their Food Halls.

However, I have to say that Aldi is a 'budget store' with remarkably good quality, and it does not surprise me that Jan hears that the quality of their mince pie is even better than Harrods. I first encountered them in Germany, and am pleased to see them popping up in the States on the east coast especially. A very workable arrangement for the staples indeed, and the occasional nice surprise from Deutsche Küche brand.

But we tend to 'shop local' whenever feasible, no matter where we might be, from people who actually make and do the things themselves. I have had some great times exploring the local markets around the world with my wife, who is the real subject matter expert on all things shopping and on value in general. It seems as though every good thing I have, or am, has come through her. Together we make a better person than either of us would be alone, looking out and facing the world together. To me this is the essence of a good relationship.

And sometimes there are little overlooked gems to be found, even in your own back yard, if you but take the time to look for them. We search them out, and give them our patronage and attention whenever possible. This applies to both shops, and people.

24 December 2013

Joyeux Noël

“...God is light, and in him there is no darkness at all” (1 Jn 1:5). Yet on the part of the people there are times of both light and darkness, fidelity and infidelity, obedience, and rebellion; times of being a pilgrim people and times of being a people adrift.

In our personal history too, there are both bright and dark moments, lights and shadows. If we love God and our brothers and sisters, we walk in the light; but if our heart is closed, if we are dominated by pride, deceit, self-seeking, then darkness falls within us and around us. “Whoever hates his brother – writes the Apostle John – is in the darkness; he walks in the darkness, and does not know the way to go, because the darkness has blinded his eyes” (1 Jn 2:11).

On this night, like a burst of brilliant light, there rings out the proclamation of the Apostle: “God’s grace has been revealed, and it has made salvation possible for the whole human race” (Tit 2:11).

The grace which was revealed in our world is Jesus, born of the Virgin Mary, true man and true God. He has entered our history; he has shared our journey. He came to free us from darkness and to grant us light. In him was revealed the grace, the mercy, and the tender love of the Father: Jesus is Love incarnate. He is not simply a teacher of wisdom, he is not an ideal for which we strive while knowing that we are hopelessly distant from it. He is the meaning of life and history, who has pitched his tent in our midst.

The shepherds were the first to see this “tent”, to receive the news of Jesus’s birth. They were the first because they were among the last, the outcast. And they were the first because they were awake, keeping watch in the night, guarding their flocks.

Together with them, let us pause before the Child, let us pause in silence. Together with them, let us thank the Lord for having given Jesus to us, and with them let us raise from the depths of our hearts the praises of his fidelity: We bless you, Lord God most high, who lowered yourself for our sake. You are immense, and you made yourself small; you are rich and you made yourself poor; you are all-powerful and you made yourself vulnerable.

On this night let us share the joy of the Gospel: God loves us, he so loves us that he gave us his Son to be our brother, to be light in our darkness.

To us the Lord repeats: “Do not be afraid!” (Lk 2:10). And I too repeat: Do not be afraid! Our Father is patient, he loves us, he gives us Jesus to guide us on the way which leads to the promised land. Jesus is the light who brightens the darkness. He is our peace. Amen.

Francis I, First Christmas Sermon

SP 500 and NDX Futures Daily Charts - Viva La Barracuda

“Hubris calls for nemesis, and in one form or another it's going to get it, not as a punishment from outside, but as the completion of a pattern already started.”

Mary Midgley

"The United States has the best, deepest, widest, most transparent capital markets in the world which give you, the investor, the ability to buy and sell large amounts at very cheap prices. That's a good thing and I wish Paul Volcker understood that."

Jamie Dimon

"'My name is Ozymandias, king of kings:

Look on my works, ye mighty, and despair!'

Nothing beside remains: round the decay

Of that colossal wreck, boundless and bare,

The lone and level sands stretch far away."

Percy Bysshe Shelley, Ozymandias

Bart Chilton Says Goodbye - The Essence of NeoLiberalism and the Sorcerer's Apprentice

"Thus we see how the neoliberal utopia tends to embody itself in the reality of a kind of infernal machine, whose necessity imposes itself even upon the rulers. Like the Marxism of an earlier time, with which, in this regard, it has much in common, this utopia evokes powerful belief - the free trade faith - not only among those who live off it, such as financiers, the owners and managers of large corporations, etc., but also among those, such as high-level government officials and politicians, who derive their justification for existing from it.

For they sanctify the power of markets in the name of economic efficiency, which requires the elimination of administrative or political barriers capable of inconveniencing the owners of capital in their individual quest for the maximisation of individual profit, which has been turned into a model of rationality. They want independent central banks.

And they preach the subordination of nation-states to the requirements of economic freedom for the masters of the economy, with the suppression of any regulation of any market, beginning with the labour market, the prohibition of deficits and inflation, the general privatisation of public services, and the reduction of public and social expenses."

Pierre Bourdieu, L’essence du néolibéralisme

What I find almost remarkable is how deeply neo-liberalism has influenced almost all modern economic thought, even among those who might blanch at that appellation. After all, we become what we hate, because that is where our mind is directed most often.

I was reminded the other day of the critique which Chris Hedges had leveled at the 'new Atheists,' on how in their argument and methods they were almost indistinguishable from the radical religious right.

So too I have been reminded of the intransigence of the so-called liberal establishment economists and their theories, and how similar their response to any debate parallels the response one would obtain from a conservative austerian economist for example. It's all in the dogma, and the discussion seems more religious than intellectual.

Statists, of both the left and the right, pursue power initially in the hopes of establishing a Utopian model that is resisted by reality and the majority of the people, and finally end up pursuing power alone for its own sake to maintain themselves in a status quo. This is, as others through history have observed, the reason why so many revolutions end in failure and repression.

And the more heated the divergence of views becomes the less effective the policy, because it will tolerate no opposition or debate, and almost no discussion except within well defined boundaries of orthodoxy.

The tragedy is when a theory and its models are founded on a fallacy, and from that original misguided assumption a plague of evils are unleashed. This is the sad story of the 'efficient market hypothesis.' And just as bad is the technocratic tendency to make public policy the product of 'objective' economic deliberation, losing sight therein of first principles on which all such discussion are based, whether explicitly or implicitly.

And so as this year ends, I can only reiterate my forecast that stagflation is the outcome which we are starting to see now and will most likely see in the future.

It is due to policy error, and was once believed to be impossible. Then in the aftermath of the oil embargo it was acknowledged as possible, but only in the face of an exogenous shock. And now we will see it as the outcome of a pernicious financial and intellectual corruption.

Hyperinflation remains a possibility, but unlikely in the Dollar as I have said many times. A step wise devaluation is more likely than that, and probably done in coordination with other currencies, but not necessarily real goods.

The central banks will strain to maintain an equilibrium until it eventually shatters, or is shattered by those who defer from participation in their schemes. Such utopianism can tolerate no opposition, because it is an act of will, that must extend to all it touches.

It would take some human decisions of substantially misdirected proportion to create such a condition as a genuine hyperinflation in a major world currency. I have trouble conceiving of it, but I know it is possible. But it is not probable as far as I can determine. And some will take comfort in that, saying as a quack doctor might say, 'We have not yet killed the patient, so we must be doing something right.' Even though the patient is suffering and debilitated from their misguided treatment.

The reason for the stagflation is the continuing policy error of the Federal Reserve and the government in their pursuit of 'trickle down' recovery solutions without reforming the system on the domestic front. This stagflation will take its toll, even as they seek to mask the reality of what they have caused through the fashion of the day, accounting gimmickry.

I suggest one might keep an eye on the real median wage and the labor participation rate to obtain a reading of how things are going. They are not perfect, but better than the usual suspects.

This will end of course, but messily I am afraid. We may all regret the weakness of our political leaders and the lack of a genuine progressive voice amongst our established 'thought leaders.'

And I have to wonder if on the broader international stage that the great currency resets are even closer than I had imagined. The hysteria that occasionally breaks to the surface from the financial 'control room' makes me a bit concerned.

Given the highly unstable underpinnings of the markets, and the propensity for the financial engineers to stubbornly return again to their asset bubbles like a dog to its vomit, gives me little hope for the innovative thinking that must and will arise, either from debate or despair.

Have a pleasant evening.

"As we long suspected, Wall Street continues to use every trick in its playbook to do whatever it can to eviscerate numerous post-financial-crisis rules. The arsenal includes high-powered lobbyists who outnumber lawmakers 10-to-1; $1,000-an-hour letter-writing lawyers who gain strength from negotiating over arcana; and the occasional hoodwinking of a president whose knowledge of the ways of finance are close to nil.

The lesson for me is: The financial sector is so powerful that they will roll things back over time. The Wall Street firms have tremendous influence, and they can impact policy to a greater degree than any one regulator or a small group of regulators can.

[Financial-industry executives contribute more money] in every election, than any other sector, and they have made more profits in every single quarter since the fall of 2008 when many of them helped crash the economy. So while the rest of the nation is suffering still, and trying to get a leg up to get out of the ditch, the financial sector didn’t miss a beat.”

William D. Cohan, Angry Bart Takes His Parting Shot

"As the dominant discourse would have it, the economic world is a pure and perfect order, implacably unrolling the logic of its predictable consequences, and prompt to repress all violations by the sanctions that it inflicts, either automatically or —more unusually — through the intermediary of its armed extensions, the International Monetary Fund (IMF) and the Organization for Economic Cooperation and Development (OECD) and the policies they impose: reducing labour costs, reducing public expenditures and making work more flexible. Is the dominant discourse right? What if, in reality, this economic order were no more than the implementation of a utopia - the utopia of neoliberalism - thus converted into a political problem? One that, with the aid of the economic theory that it proclaims, succeeds in conceiving of itself as the scientific description of reality?

This tutelary theory is a pure mathematical fiction. From the start it has been founded on a formidable abstraction. For, in the name of a narrow and strict conception of rationality as individual rationality, it brackets the economic and social conditions of rational orientations and the economic and social structures that are the condition of their application...

In this way, a Darwinian world emerges - it is the struggle of all against all at all levels of the hierarchy, which finds support through everyone clinging to their job and organisation under conditions of insecurity, suffering, and stress. Without a doubt, the practical establishment of this world of struggle would not succeed so completely without the complicity of all of the precarious arrangements that produce insecurity and of the existence of a reserve army of employees rendered docile by these social processes that make their situations precarious, as well as by the permanent threat of unemployment. This reserve army exists at all levels of the hierarchy, even at the higher levels, especially among managers. The ultimate foundation of this entire economic order placed under the sign of freedom is in effect the structural violence of unemployment, of the insecurity of job tenure and the menace of layoff that it implies. The condition of the "harmonious" functioning of the individualist micro-economic model is a mass phenomenon, the existence of a reserve army of the unemployed.

This structural violence also weighs on what is called the labour contract (wisely rationalised and rendered unreal by the "theory of contracts"). Organisational discourse has never talked as much of trust, co-operation, loyalty, and organisational culture as in an era when adherence to the organisation is obtained at each moment by eliminating all temporal guarantees of employment (three-quarters of hires are for fixed duration, the proportion of temporary employees keeps rising, employment "at will" and the right to fire an individual tend to be freed from any restriction).

Thus we see how the neoliberal utopia tends to embody itself in the reality of a kind of infernal machine, whose necessity imposes itself even upon the rulers. Like the Marxism of an earlier time, with which, in this regard, it has much in common, this utopia evokes powerful belief - the free trade faith - not only among those who live off it, such as financiers, the owners and managers of large corporations, etc., but also among those, such as high-level government officials and politicians, who derive their justification for existing from it. For they sanctify the power of markets in the name of economic efficiency, which requires the elimination of administrative or political barriers capable of inconveniencing the owners of capital in their individual quest for the maximisation of individual profit, which has been turned into a model of rationality. They want independent central banks. And they preach the subordination of nation-states to the requirements of economic freedom for the masters of the economy, with the suppression of any regulation of any market, beginning with the labour market, the prohibition of deficits and inflation, the general privatisation of public services, and the reduction of public and social expenses.

Economists may not necessarily share the economic and social interests of the true believers and may have a variety of individual psychic states regarding the economic and social effects of the utopia which they cloak with mathematical reason. Nevertheless, they have enough specific interests in the field of economic science to contribute decisively to the production and reproduction of belief in the neoliberal utopia. Separated from the realities of the economic and social world by their existence and above all by their intellectual formation, which is most frequently purely abstract, bookish, and theoretical, they are particularly inclined to confuse the things of logic with the logic of things.

These economists trust models that they almost never have occasion to submit to the test of experimental verification and are led to look down upon the results of the other historical sciences, in which they do not recognise the purity and crystalline transparency of their mathematical games, whose true necessity and profound complexity they are often incapable of understanding. They participate and collaborate in a formidable economic and social change. Even if some of its consequences horrify them (they can join the socialist party and give learned counsel to its representatives in the power structure), it cannot displease them because, at the risk of a few failures, imputable to what they sometimes call "speculative bubbles", it tends to give reality to the ultra-logical utopia (ultra-logical like certain forms of insanity) to which they consecrate their lives.

And yet the world is there, with the immediately visible effects of the implementation of the great neoliberal utopia: not only the poverty of an increasingly large segment of the most economically advanced societies, the extraordinary growth in income differences, the progressive disappearance of autonomous universes of cultural production, such as film, publishing, etc. through the intrusive imposition of commercial values, but also and above all two major trends. First is the destruction of all the collective institutions capable of counteracting the effects of the infernal machine, primarily those of the state, repository of all of the universal values associated with the idea of the public realm. Second is the imposition everywhere, in the upper spheres of the economy and the state as at the heart of corporations, of that sort of moral Darwinism that, with the cult of the winner, schooled in higher mathematics and bungee jumping, institutes the struggle of all against all and cynicism as the norm of all action and behaviour."

Pierre Bourdieu, Utopia of Endless Exploitation: The Essence of NeoLiberalism, 1998

Bourdieu's essay in the original French

"The pretended rights of these theorists are all extremes; and in proportion as they are metaphysically true, they are morally and politically false. The rights of men are in a sort of middle, incapable of definition, but not impossible to be discerned. The rights of men in governments are their advantages; and these are often in balances between differences of good, in compromises sometimes between good and evil, and sometimes between evil and evil."

Edmund Burke, Reflections on the Revolution In France

23 December 2013

Gold Daily and Silver Weekly Charts - Muddling Through the End of December Delivery

"The gold and silver money which circulates in any country may very properly be compared to a highway, which, while it circulates and carries to market all the grass and corn of the country, produces itself not a single pile of either.

The judicious operations of banking, by providing, if I may be allowed so violent a metaphor, a sort of waggon-way through the air, enable the country to convert, as it were, a great part of its highways into good pastures, and corn fields, and thereby to increase, very considerably, the annual produce of its land and labour.

The commerce and industry of the country, however, it must be acknowledged, though they may be somewhat augmented, cannot be altogether so secure, when they are thus, as it were, suspended upon the Daedalian wings of paper money, as when they travel about upon the solid ground of gold and silver."

Adam Smith, Wealth of Nations

There was intraday commentary related to gold and silver here and here.

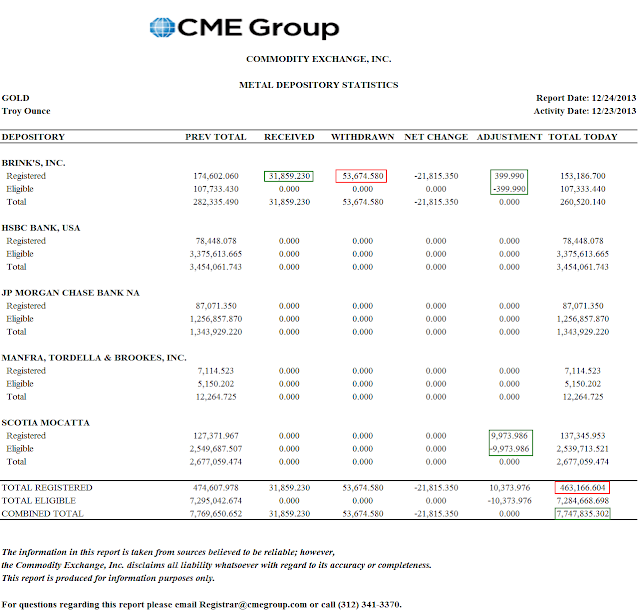

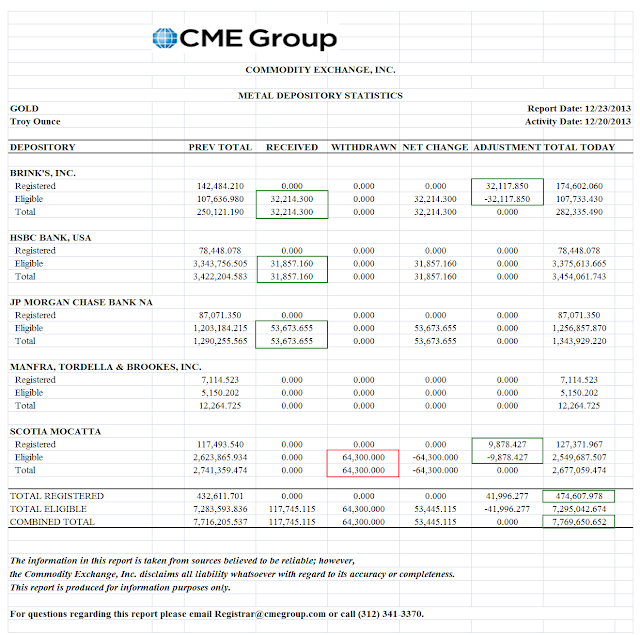

If you look at the CME precious metal inventory report below you can see that there *should* be more than enough gold to deliver into the remaining longs that are standing. And January is an inactive month for delivery, so all should be well until February.

Again, and I cannot stress this enough, I am not looking for a default on the Comex in the metals. I think that if there is a market break it will occur in some physical market overseas, and spread in a more domino fashion to the paper markets, including the exchanges and ETFs that may be mispricing the risk of leverage.

There is nothing wrong with the inventory situation at the CME that could not be cured, at least in the short term, by higher prices. That does not seem to be forthcoming, so we will have to see what happens.

I don't suppose it would help to remind our financial sophisticates of the old saying, 'when you find yourself in a hole, stop digging.'

Paul Krugman Does Some Injustice to the Thoughts of Adam Smith On Money, Gold, and Silver

Paul Krugman, in making his argument about gold, bitcoins, and paper money, 'quotes' Adam Smith, although somewhat circuitously, as seemingly to deride gold and silver in favor of paper money.

I discuss that column of his here. And here is Mr. Krugman's quote from Adam Smith.

"I suspect, however, that Adam Smith would have been dismayed. Smith is often treated as a conservative patron saint, and he did indeed make the original case for free markets. It’s less often mentioned, however, that he also argued strongly for bank regulation — and that he offered a classic paean to the virtues of paper currency.I looked up quite a few of the references to 'dead stock' in Adam Smith's Wealth of Nations since Paul K does not provide an actual quote, and found plenty of references to 'money' as 'dead stock,' but nothing in particular to gold and silver per se.

Money, he understood, was a way to facilitate commerce, not a source of national prosperity — and paper money, he argued, allowed commerce to proceed without tying up much of a nation’s wealth in a “dead stock” of silver and gold."

I doubt that Adam Smith thought of them as barbarous relics as Paul seems to imply. I could be wrong and would be interested in seeing a quote that says what Mr. Krugman implies that Adam Smith says. Perhaps he can consult his notes and provide an actual quote in context.

Smith goes to great pains to show that 'money' is a medium of exchange, and the wealth of a nation is properly increased by the employment of money in productive ways. Duh. I wish the Federal Reserve understood that in their trickle down approach to economic recovery and regulation and the support of the financialisation of the economy that produces no wealth, but instead transfers it from the many to the few.

Smith recognizes that gold and silver are a store of wealth that could be needed moreso at certain times, and should be increased during bountiful periods, but he is adamant that 'money' is not the means of increasing wealth. Wealth is the action of people on resources creating products. Money is a 'highway' to help to facilitate the transactions.

But this in no way implies that he views gold and silver themselves as inherently 'dead stock' and that paper money is to be preferred in and of itself. At least not in the areas in which I had read.

He does not specifically condemn 'paper money' either except in passing with regard to risk.

I struggled with the supposed quote given by Mr. Krugman, given that Smith would have been so familiar in the sad case of John Law and his paper money experiment, for example.

I believe that Smith is talking about those domestic instruments that energize a monetary system in transactions. In other words, commercial paper and so forth. Smith argues that money is best used as it is being gainfully employed in the actual production of things, and not hoarded. Again, who can argue with that?

Here is what I would daresay is the 'money quote' from Adam Smith on paper, gold and silver:

"The gold and silver money which circulates in any country may very properly be compared to a highway, which, while it circulates and carries to market all the grass and corn of the country, produces itself not a single pile of either.As you may recall Daedalus was the father of Icarus. He fashioned the wings of wax and feathers on which Icarus soared, but in his hubris flew too high, and close to the sun on his artificial devices, alas, and plummeted quite dramatically back to earth.

The judicious operations of banking, by providing, if I may be allowed so violent a metaphor, a sort of waggon-way through the air, enable the country to convert, as it were, a great part of its highways into good pastures, and corn fields, and thereby to increase, very considerably, the annual produce of its land and labour.

The commerce and industry of the country, however, it must be acknowledged,though they may be somewhat augmented, cannot be altogether so secure, when they are thus, as it were, suspended upon the Daedalian wings of paper money, as when they travel about upon the solid ground of gold and silver.

Over and above the accidents to which they are exposed from the unskilfulness of the conductors of this paper money, they are liable to several others, from which no prudence or skill of those conductors can guard them."

Adam Smith, Wealth of Nations, p. 262

I thought Adam Smith's statement on 'paper money' is particularly well formed and well advised in this regard. And extrapolating what he said and what he thought to somehow craft an endorsement of the current monetary system in all its malformed and highly unproductive serial fraud is a bit of a stretch to say the very least.

Rather than be dismayed, if a moral philosopher like Adam Smith were to come back and look at what passes for a financial system and the regulation and encouragement of commerce in our world today, I doubt he would be able to stop throwing up.

Category:

Adam Smith,

modern monetary theory

Subscribe to:

Comments (Atom)