All right I will confess up front, that during the day I have been watching recordings of the Winter Olympics curling matches which were held at Sochi earlier today. The women's match between the US and the Swiss was of particular interest, especially the strategy of the two teams led by their captains, Erika Brown and the legendary Mirjam Ott.

I will not give anything away if you have not yet seen it. I will be watching the curling matches all week. It is one of my few idiosyncrasies. Most Americans have never heard of it.

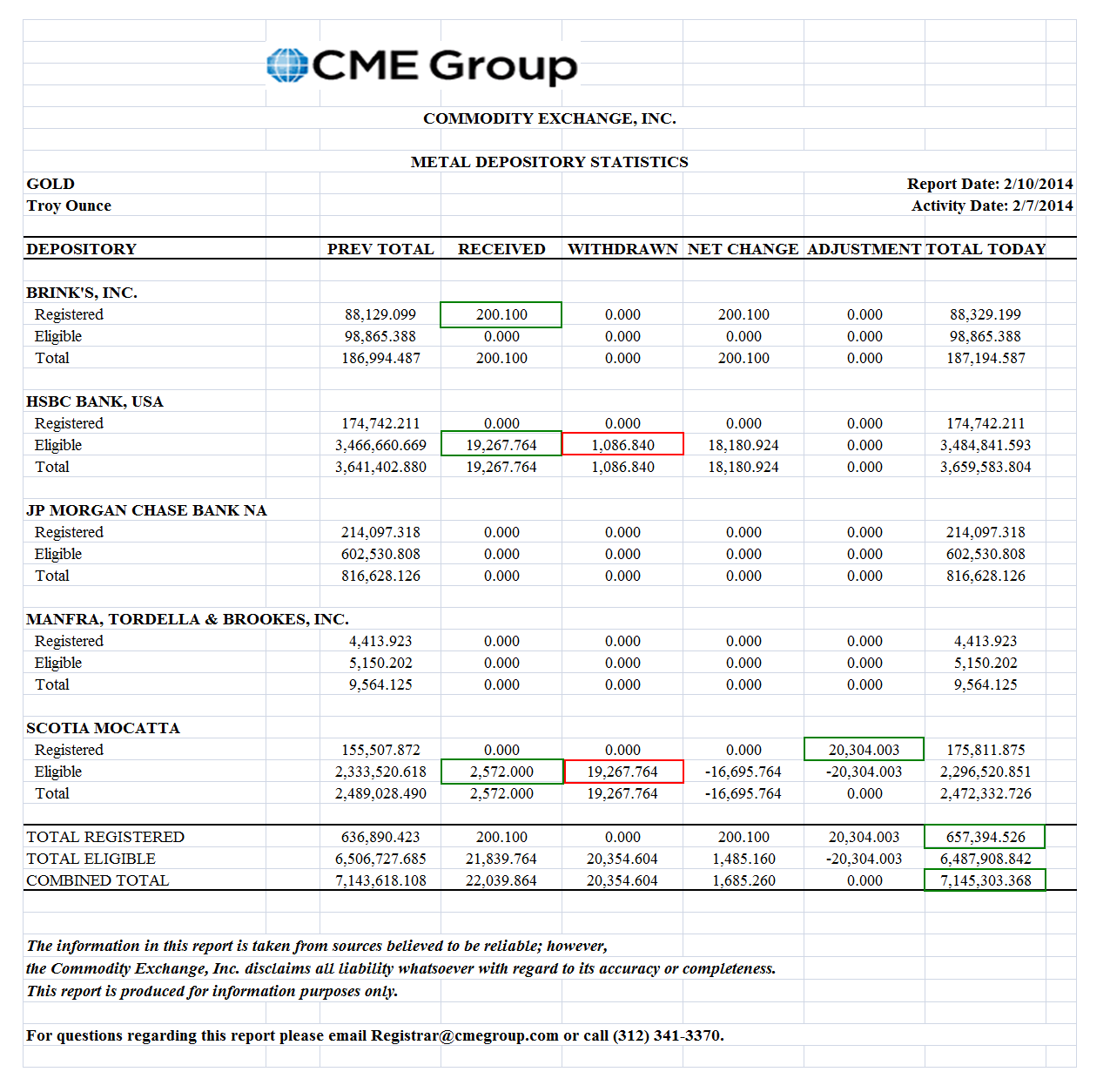

The bit of controversy today is how much gold exactly is flowing from West to East, most specifically to China?

Bloomberg had a piece in print today about the record amount of gold that was imported by China last year through Hong Kong, exceeding 1,000 tonnes for the first time. You may read it here.

What was even more interesting were the gold bullish comments that were made by two guests, one from Pimco and the other by Ed Moy, the chief strategist at Morgan Gold. I include the interview below. He notes that there is concern about a physical gold bullion shortage.

"Quantitative easing has had a distorting effect on the price of gold...Overall when you look at gold, there are two separate pieces here. One is how the West looks at gold, and they have been investing in a lot of electronic derivatives and proxies for gold. Whereas the East has been buying a lot of physical gold. That demand has actually gone up. China looks like it bought 1,000 tonnes in 2013 making them the number one buyer in the worldHow ironic, now that JPM has hammered the paper price of gold down and covered their shorts, and are said by some informed analysts to be sitting net long gold. Classic.

Do you have a concern about a possible gold shortage?

Absolutely!

By the way, Morgan Gold is NOT associated with JP Morgan. I want to make that clear.

Koos Jansen has an even better, more comprehensive article discussing the China gold action through Shanghai. The Shanghai Gold Exchange delivered 2,181 last year. And this may not include official gold purchases by the People's Bank of China. You can read that piece here.

I still think that most of the mainstream media and analysts are still missing the big macro trend change in gold buying by the central banks, and the reasons for it. And you know that I think that many of them do not get it, because they do not wish to get it. It is dangerous to imagine that the status quo may change.

Gold is moving from West to East. And the time is coming when all will be revealed, when the paper gold market freezes up in shock, and the call from the world is made, stand and deliver.