US equities came in roaring this morning, with punters buying the dip with abandon.

Alas, it was not to be.

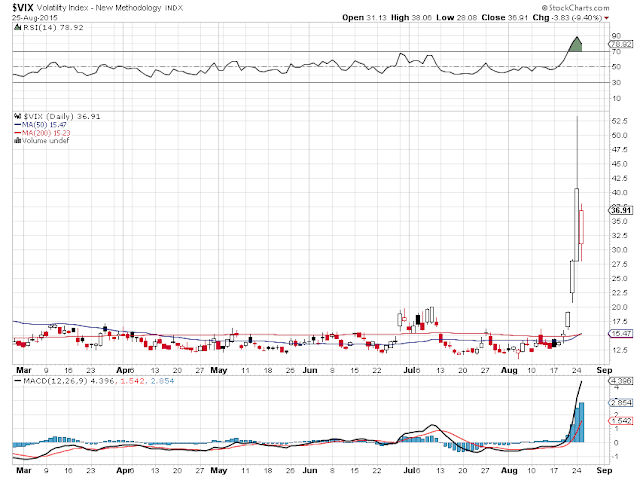

The rally faded badly into the afternoon, and the equity futures ended up in a classic whiplash reversal of an attempted 'dead cat bounce.'

So what next.

One thing is that the Fed is probably, if they are wise, taking any idea of a September rate increase off the table.

Not that a 25 basis point increase would make much difference. The Fed has distorted the real economy badly, and created a formidable asset bubble in paper, and a systemically dangerous financial sector through policy errors and malign regulation .

No they won't do it if the markets are still wobbly because they do not want to do anything visible that could be pointed at later when the search for a scapegoat begins, like the last time, with furious words and much fake anger by the wise men of Capitol Hill.

Today's action was not encouraging since almost everything went lower. We might have to spend a little time at these levels, allowing things to consolidate, before the bulls and their pals in the banking sector begin to attempt to reinflate this pig.

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery.

When the suffering becomes visible and the reaction strong and widespread enough, perhaps change will come.

Have a pleasant evening.