"Even if TARP saved our financial system from driving off a cliff back in 2008, absent meaningful reform, we are still driving on the same winding mountain road, but this time in a faster car."

Neil Barofsky

"The people who designed the [bailout] plans are either in the pocket of the banks or they’re incompetent."

Joseph Stiglitz

“In poor countries, officials receive explicit bribes; in D.C. they get the sophisticated, implicit, unspoken promise to work for large corporations.”

Nassim Taleb, The Bed of Procrustes

"...the biggest risk we can take is to try the same old politics with the same old players and expect a different result."

Barack Obama, Democratic National Convention 2008

"But at some point the Obama Administration should acknowledge that this particular former CEO of Goldman Sachs is still driving the policy bus. If the Republicans are in control of the Congress come next January, maybe they should subpoena [Robert] Rubin to appear periodically. At least then we all can hear directly to the person who is actually making national economic policy."

Chris Whalen, The World According to Robert Rubin

"On Sunday afternoon, facing a revolt by his own party’s senators, Obama dumped Larry [Summers] as likely replacement for Ben Bernanke as Chairman of the Federal Reserve Board.

But the fact that Obama even tried to shove Summers down the planet’s throat tells us more about Obama than Summers—and whom Obama works for. Hint: You aren’t one of them."

Greg Palast, Larry Summers: Goldman Sacked

"After dinner, Larry [Summers] leaned back in his chair and offered me some advice. I had a choice. I could be an insider or I could be an outsider. Outsiders can say whatever they want. But people on the inside don’t listen to them.

Insiders, however, get lots of access and a chance to push their ideas. People — powerful people — listen to what they have to say. But insiders also understand one unbreakable rule: They don’t criticize other insiders."

Elizabeth Warren

Here is my end of an exchange today, with some editing for clarity completeness, between myself and my Samoan attorney, while exchanging some anecdotes about the current climate of corruption within the Beltway and the NYC metropolitan area. He is well informed of the doings in the halls of officialdom.

This gets to the heart of my theory of 'the credibility trap' which you may have seen on my site.

These professional bureaucrats and financiers are so intricately complicit in, and so benefited by, the broken system that we have now that they cannot talk about the real problems. They are very much a part of the problem.

They cannot engage in effective reforms because in doing so they would:

a) indict themselves and their predecessors and colleagues, and impugn their reputation for competency and/or integrity, and

b) would hamper their very lucrative careers in a system that they cannot afford to change or meaningfully reform.

There are very serious consequences for speaking the truth these days. This explains much of our current problems. They are incapable of fixing things without the cover/incentive of a very serious event, either financial or something more exogenous..

Perhaps the slogan for these pampered princes should be 'in for a penny, in for a trillion dollars, because it's all Other People's Money, and I am doing just fine.'

So when I identify various politicians, regulators, and pundits as 'caught in a credibility trap' this is what I mean.

The people are starting to 'get this' even if they cannot describe it eloquently. And they are therefore seeking to use their votes to toss out the insiders and bring in what they hope will be real change.

Here is my more 'formal' definition of the credibility trap.

"A credibility trap is a condition wherein the financial, political and informational functions of a society have been compromised by corruption and fraud, so that the leadership cannot effectively reform, or even honestly address, the problems of that system without impairing and implicating, at least incidentally, a broad swath of the power structure, including themselves.

The status quo tolerates the corruption and the fraud because they have profited at least indirectly from it, and would like to continue to do so. Even the impulse to reform within the power structure is susceptible to various forms of soft blackmail and coercion by the system that maintains and rewards.

And so a failed policy and its support system become self-sustaining, long after it is seen by objective observers to have failed. In its failure it is counterproductive, and an impediment to recovery in the real economy. Admitting failure is not an option for the thought leaders who receive their power from that system.

The continuity of the structural hierarchy must therefore be maintained at all costs, even to the point of becoming a painfully obvious, organized hypocrisy."

Gold and silver rocketed higher today after the ECB pulled out the bazooka loaded with some unconventional weapons, largely designed to benefit the European Banks.

Never have so many suffered so much for such an unworthy few.

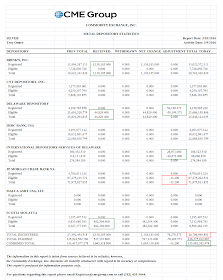

There was little real activity in The Bucket Shop. The scorecards are below.

Now at least we know why the silly whacking of gold was the thing to do the past couple days. They knew it would run when Draghi dropped the hammer, and did not want it to take out key overhead resistance with a lot of momentum.

They 'have to control the price of gold, manage it.' Because otherwise it might tell the truth.

Have a pleasant evening.